Reasons to Add OGE Energy (OGE) to Your Portfolio Right Now

OGE Energy Corporation’s OGE continuous investment is expected to aid infrastructure development and provide seamless services to its customers. The company’s solid renewable portfolio is likely to boost its future performance. Given its growth opportunities and dividend history, OGE makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment.

Earnings Growth, Long-term Growth & Surprise History

The Zacks Consensus Estimate for OGE Energy’s second-quarter 2023 earnings is pinned at 65 cents per share, indicating year-over-year growth of 80.6%.

OGE Energy’s long-term (three- to five-year) earnings growth rate is 17.89%. It delivered an average earnings surprise of 19.92% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, OGE Energy’s ROE is 9.71%, higher than the industry’s average of 4.92%. This indicates that the company has been utilizing its funds more constructively than its peers in the electric power utility industry.

Debt Position

In the past 12 months, OGE’s total debt to capital was 53.3% compared with the industry’s average of 58.6%.

The time to interest earned ratio at the end of the first quarter was 3.8. The figure, being greater than one, reflects OGE Energy’s ability to meet future debt obligations without difficulties.

Dividend History

The utility company has been consistently paying dividends to its shareholders. Currently, OGE’s quarterly dividend is 41.41 cents per share, which represents an annualized dividend of $1.6564 per share.

OGE Energy expects to continue increasing its dividends in the next five years. It targets a dividend payout ratio of 65-70%. In order to achieve this target, the company expects earnings per share (EPS) growth to exceed the dividend growth rate over the next several years. Its current dividend yield is 4.54%, better than the Zacks S&P 500 Composite’s 1.48%.

Systematic Investments

OGE plans to spend $4.75 billion between 2023 and 2027. For 2023, the company has allocated $950 million, which includes $720 million for strengthening its transmission, distribution and grid expansion operations.

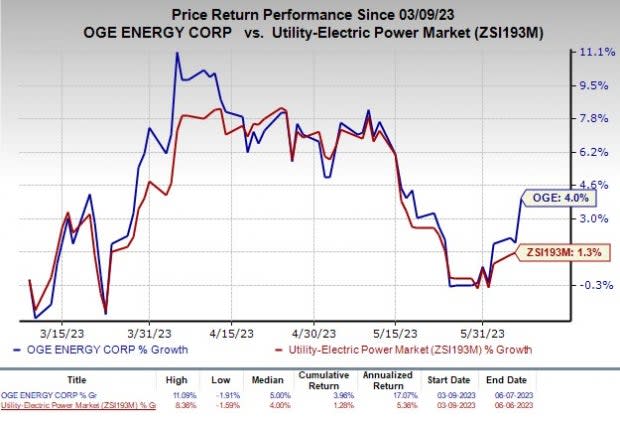

Price Performance

In the past three months, OGE’s shares have risen 4% compared with the industry’s average growth of 1.3%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Southern Company SO, Consolidated Edison ED and NiSource Inc. NI, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Southern Company’s long-term earnings growth rate is 4%. The Zacks Consensus Estimate for the company’s 2023 EPS is pinned at $3.61, indicating a year-over-year increase of 0.3%.

Consolidated Edison’s long-term earnings growth rate is 2%. The Zacks Consensus Estimate for the company’s 2023 EPS is pegged at $4.86, implying a 6.81% improvement from the previous year’s figure.

NiSource’s long-term earnings growth rate is 6.9%. The Zacks Consensus Estimate for the company’s 2023 EPS is pinned at $1.57, implying year-over-year growth of 6.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company (The) (SO) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

OGE Energy Corporation (OGE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance