The Real Reason SINA Is Struggling This Year

Wall Street hasn't taken a kind view of SINA (NASDAQ: SINA) this year, thanks mainly to the trade showdown between China and the U.S. As of this writing, the stock is down 16% in 2018. The market has overlooked the Chinese internet specialist's massive growth and attractive valuation, probably fearing that a full-blown trade war could hurt SINA's business.

But SINA doesn't sell a physical commodity that's traded between the two nations. It gets most of its revenue from Weibo (NASDAQ: WB), a Twitter-like service in China that was a part of SINA before it was spun off in 2014. The company's business is concentrated within China, so it remains insulated from a potential trade war.

So why has SINA failed to carry its terrific momentum from last year into 2018? Let's find out.

Image source: Getty Images.

Is fintech going to fizzle out?

Weibo's fantastic growth has rubbed off positively on SINA, but trouble in other parts of the business could give investors pause. For instance, the fintech business (technology used to support the financial sector) that SINA was betting big on has gotten into hot water.

The company launched a $500 million fund last year to make investments in Chinese fintech companies, believing that it could harness data from Weibo and the online portal business to benefit from this space in the next three to five years. But regulatory pressures have kept it from taking off.

SINA conceded last quarter that it has racked up losses in the microloans business thanks to bad loans, while revenue fell sequentially due to a tough regulatory environment. The company didn't call for an outright recovery in the fintech segment, either, as CEO Charles Chao said in May that the company is "going to see probably more tightened policy in the regulatory areas for the fintech business ..."

Beijing has been aggressively clamping down on the internet finance space in China, telling local regulators to stop granting new licenses in a bid to keep a handle on scams and frauds. The arbitrary and ambiguous nature of the regulations is proving to be another roadblock for fintech companies, forcing many of them to close up shop.

Fintech is supposed to give SINA an opportunity to diversify the company and reduce its reliance on Weibo, which currently supplies nearly 80% of its revenue. The developments in China, however, suggest that it will have to rely on Weibofor growth, but there's a problem in that area as well.

More red flags

Weibo reported terrific growth in the latest quarter. Its revenue shot up 76% year over year to $350 million, and this was critical to SINA's year-over-year revenue growth of 59%. (SINA owns about 46% of Weibo.) But this terrific top-line growth is coming at a price.

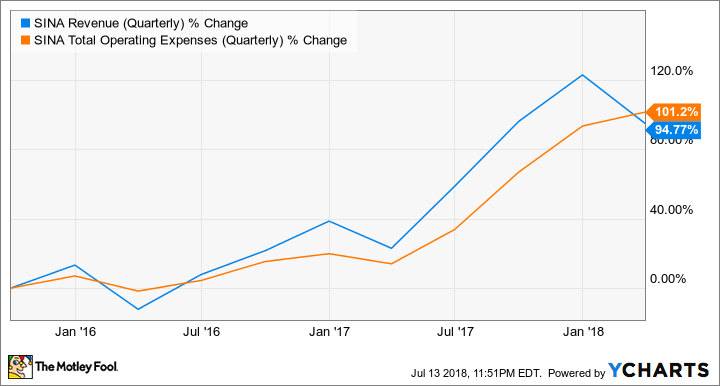

SINA's operating expenses ballooned from $127.4 million in the prior-year period to $237.4 million on a non-GAAP basis this time, an increase of over 86%. This means that SINA's expenses grew at a faster pace than the top line. SINA's operating expenses had been closely tracking the increase in its sales for the past year before surpassing them in the latest quarter.

SINA Revenue (Quarterly) data by YCharts.

Looking ahead, SINA will have to keep spending at a high clip thanks to the stiff competition it faces from well-heeled players such as Tencent (NASDAQOTH: TCEHY), which has created an entire social ecosystem that Weibo is having difficulty matching. Tencent's WeChat platform currently has over a billion active users across the globe, easily exceeding Weibo, which had close to 400 million at the end of last year.

In addition, 29% of time spent on mobile apps in China last April was spent on WeChat and Weibo was lagging far behind. Weibo and WeChat are different types of services. The former is simply a micro-blogging platform, but the latter allows users to do a variety of things, ranging from instant messaging to booking doctor appointments to hailing cabs.

This is why WeChat has been able to capture more attention of internet users in China, leaving Weibo with no option but to spend a big amount of money to stay competitive, thereby compromising the bottom line. SINA's trailing price-to-earnings ratio of nearly 43 is well above the industry median of 33 and it seems investors are unwilling to pay such a premium given the challenges that the company is facing.

More From The Motley Fool

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Tencent Holdings and Twitter. The Motley Fool recommends Sina and Weibo. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance