Real estate investment sales holding up despite property curbs

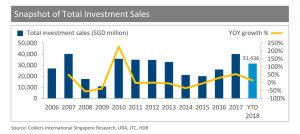

Total property investment sales in Singapore contracted substantially in Q3 2018 and kept real estate investors at bay as fresh property cooling measures weighed on the residential property sector. According to Colliers International’s latest research report, overall investment sales slipped 30% year-on-year (YOY) to SGD8 billion in the three months to September 30, 2018. Cumulatively, total investment sales in Singapore reached SGD31.4 billion in the first nine months of 2018 – up 14% YOY.

Residential

Residential investment sales slumped 57.9% quarter-on-quarter (QOQ) in Q3 to SGD3.46 billion, the lowest volume since Q1 2017. On a YOY basis, residential investment sales fell 38% in Q3 2018.

The decline was largely due to the muted collective sale market, following July’s cooling measures which raise taxes for real estate investors and developers.

Screengrab: Colliers International

Data tracked by Colliers International’s Research found that the value and volume of residential collective sales plunged in Q3 to SGD370 million from three deals, compared with SGD3.9 billion over 16 transactions in Q2. As a result, collective sales accounted for just 11% of total residential investment sales in Q3 down from 47% in the previous quarter.

Ms Tricia Song, Head of Research for Singapore at Colliers International, said, “The private sector took a back seat in Q3. We anticipate residential property purchases could remain subdued as developers focus on monetising their inventory and recalibrating their strategies for the rest of 2018 and through the first half of 2019. Sentiment, however, could pick up by the second half of next year. In the meanwhile, investors will continue to channel their interest to the recovering commercial and industrial assets which have less policy risks.”

Government land sales made up the bulk (47%) of total residential investment sales in Q3 at SGD1.63 billion, even as bidding turnouts for residential sites eased noticeably after the new cooling measures – reflecting developers’ cautious approach towards land acquisition. Five public residential land tenders were awarded in Q3: Hillview Rise; Jalan Jurong Kechil; Dairy Farm Road; Canberra Link (Executive Condo); and Anchorvale Crescent (EC).

The Good Class Bungalow (GCB) segment also posted robust growth, with sales soaring by 109% QOQ and 188% YOY to SGD354 million in Q3 2018. This is the highest sales volume since Q2 2012 when 18 GCBs valued at SGD364 million were sold. The largest GCB transacted during the quarter was the estate of the late Lim Kim San in Dalvey Road, which fetched SGD93.9 million or SGD1,804 per square foot on land.

Commercial (Office and Retail)

The commercial sector continued building on its growth momentum, as total commercial investment sales rose 47.4% QOQ to SGD2.2 billion in Q3, driven mainly by a few big-ticket transactions. However, sales volume declined by 23.4% YOY due to a high base in the corresponding quarter in 2017, which saw the sale of Asia Square Tower 2 for an eye-watering SGD2.1 billion.

Institutional real estate investors and REITs have been active sellers and buyers, and were the key players for all major commercial deals in Q3.

Two of the deals brokered in Q3 became the largest transactions year-to-date in their respective property sectors: OUE Commercial REIT’s acquisition of the office component of OUE Downtown from its sponsor OUE for SGD908 million; and CapitaLand Mall Trust’s purchase of the retail component in Westgate for SGD789.6 million from CapitaLand.

Meanwhile, Frasers Commercial Trust divested 55 Market Street, an office and retail development, to a US-based global institutional real estate investor for SGD217 million in early July, reflecting a 45% premium to its book value and an annualised Net Property Income yield of 1.7%.

Ms Song added, “There is ample liquidity in the market searching for yield and chasing attractive trophy assets. We expect more major deals to close in Q4 2018 and in 2019. In the longer term, commercial properties should continue to remain attractive to investors, supported by steady rental recovery in the leasing office market in the next three years and demand for steady income yields in a safe haven.”

Industrial

Apart from the commercial sector, the industrial property sector also helped to prop up overall investment sales in Q3, as sales value jumped 52.3% QOQ to SGD1.2 billion. However, on a YOY basis, total volume was 57.9% lower as Q3 2017 saw the record high level of industrial investment sales, boosted by ExxonMobil’s acquisition of a petrochemical plant for SGD2.0 billion.

Industrial REITs continued to reconstitute their portfolios through selective acquisitions and divestments in Q3 2018. In the largest industrial transaction year-to-date, Mapletree Logistics Trust acquired five modern ramp-up warehouses in the West Region from Hong Kong-listed CWT International for a total of SGD730 million, translating to an average price of SGD259 per sq ft on net lettable area. Another major en bloc transaction was Ascendas-Singbridge Group’s acquisition of Geo-Tele Centre, a data centre in the Tai Seng area, from Sabana REIT for SGD99.6 million.

“We expect demand for industrial properties to grow as they can offer attractive yields to qualified (real estate investors) and rents appear to be stabilising. Interest will noticeably come from REITs’ demand for investible industrial assets in higher-end sectors such as data centres, high-spec facilities and modern ramp-up logistics properties,” noted Ms. Song.

Other sectors

Mixed-use: Public mixed-use land sites remained popular. In Q3 2018, mixed-use investment sales stood at SGD778 million, comprising a single public land sale of a commercial and residential site at Sengkang Central. Total mixed-use investment sales in the first nine months of 2018 reached SGD2.7 billion, the highest level witnessed for the same period since 2013, according to Colliers International’s Research.

Hospitality: With recovering hotel revenue per available room (RevPAR) on the back of tightening net new supply and buoyant visitor arrivals, interest for hotel assets has picked up. The total hospitality investment sales value in Q3 2018 jumped to SGD145 million from none in Q2 2018 and Q3 2017. This brought total hospitality sales volume in the first nine months of 2018 to SGD428 million, surpassing even full-year hospitality investment sales in 2015-2017.

Shophouses: These properties – which are hybrids of residential, commercial and hospitality sectors – continue to see healthy interest from real estate investors amid new cooling measures in the residential sector. Based on Colliers International’s Research, shophouse transactions with value of SGD5 million and above declined 35.1% QOQ but grew 40.7% YOY to SGD199 million in Q3 2018. Total shophouse transactions in the first nine months of 2018 amounted to SGD983 million – already higher than full-year shophouse investment volume in all previous years with Q4 2018 still to go.

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, real estate investors and property agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!

The post Real estate investment sales holding up despite property curbs appeared first on iCompareLoan Resources.

Yahoo Finance

Yahoo Finance