How ready is Southeast Asia for online payments?

Co-authored by Peter Nguyen. Both Hoang and Peter are analysts at Solidiance, the Asia-focused growth strategy and B2B marketing consultancy firm of which sectoral expertise focuses on technology/ICT, industrial application, healthcare, and green technology.

Updated: Graphs were edited to correct some errors.

Philippines leads Southeast Asia in mobile payment adoption.

Rapid economic expansion, a young population, and low-cost smartphones and tablets are creating tech-savvy generations across Southeast Asia.

Major e-commerce players such as Groupon, eBay, Rocket Internet, and LivingSocial have ventured into Southeast Asia, making significant investments into these markets. With increasing penetration of e-commerce into Southeast Asia, global payment companies such as PayPal are investing in the region.

But as they do, stiff competition is being demonstrated from a number of local players such as MOL (Malaysia) and 2C2P (Thailand). MOL is now one of the biggest payment companies in Southeast Asia, with 60 million annual transactions, and yearly revenues over $300 million. 2C2P is a Thailand-based e-payment company with a smaller scale but already having expanded offices and operations to over seven other markets in the region.

While the industry’s potential is obvious, technology investors and global payment providers should be wary of rushing into these markets without understanding the cultural and regulatory differences of each country, which affect how merchants and consumers behave.

For example, Philippines has a stronger acceptance of mobile payments while Malaysians prefer internet payment.

A tailored strategy then, which considers the unique stages of each market’s development, factoring in technology, infrastructure, consumer preferences, and regulatory environment, is far superior to a regionalized blueprint approach.

Internet, mobile network and banking

Three key underlying infrastructure drivers needed to facilitate online payment are ease of internet access, mobile usage, and banking penetration.

Ease of Internet access

* The Internet Penetration Rate corresponds to the percentage of the total population of a given country or region that uses the Internet. Source: Internet WorldStats, 2012

** ID: Indonesia, MY: Malaysia, PH: the Philippines, SG: Singapore, TH: Thailand, VN: Vietnam

Internet access is instrumental to boosting online payment. In total, the six largest economies in Southeast Asia are home to an online population in excess of 160 million, representing internet penetration of 28 percent. Singapore leads the region with an internet penetration of 75 percent, while Indonesia has the lowest internet penetration at 22 percent.

Across all the markets considered, urban populations have higher penetration rates than rural areas. For example, internet penetration in Vietnam’s two biggest cities is over 50 percent while the nationwide rate is 34 percent.

Mobile usage

Important to expanding online payment options and seen as the future of the industry, mobile phones are widely used across the region. In addition to excellent mobile network coverage, mobile phone subscriptions often exceed 100 subscriptions per 100 inhabitants, indicating wide prevalence of dual-SIM and multiple device users. Only Myanmar has less – 11 subscriptions per 100. The rate peaks with Singapore at 153 subscriptions per 100.

Banking penetration

* The banking penetration rate represents the percentage of respondents (age 15+) with an account at a formal financial institution

**The credit card penetration rate represents the percentage of respondents (age 15+) with a credit card

Source: World Bank, 2011

High banking penetration, especially online banking, can significantly speed up the acceptance of online payment. Though online payment is possible without a bank account, the use of debit and credit cards, as well as online banking to fund e-wallets, makes the online payment platform significantly more accessible.

Most local banks now facilitate online banking and act as secure platforms to connect customers, suppliers and merchants for online transactions. Banking penetration varies across the region.

While almost all Singaporeans have accounts at formal financial institutions, only 20 out of 100 Indonesian have them. Credit cards are also limited in usage across the region, with the exception of Singapore where credit card penetration rate is 38 percent and Malaysia with 12 percent while none of the other countries have percentages exceeding 5 percent.

When considering rural areas across all markets, the percentages drop to nearly zero as banking and other formal financial institutions have little to no presence.

Consumer readiness

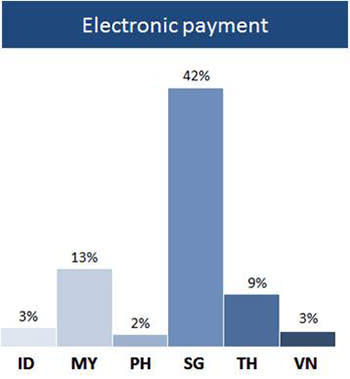

* Electronic payment represents the percentage of respondents (% age 15+) who used electronic payments (payments that one makes or that are made automatically including wire transfers or payments made online)in the past 12 months to make payments on bills or to buy things using money from their accounts. Source: World Bank, 2011

Consumer readiness measures how familiar and willing consumers are to using online payment. Even with the most sufficient infrastructure, online payment will not prosper without high levels of consumer readiness.

The percentage of electronic payments is a proxy indicator for the country’s readiness for online payment. Countries with higher electronic payment percentages are more likely to adopt newer and more innovative online payment services. Singapore leads the rest of Southeast Asia by a wide margin.

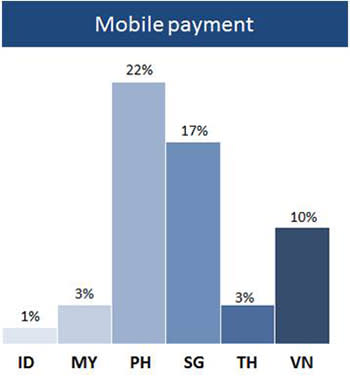

Since banking penetration rates will require some time to gain traction in Southeast Asia, the growth of online payments will more heavily rely on mobile payment usage. Mobile payments allow consumers to transfer money using mobile devices, deducting from mobile accounts rather than bank accounts.

* Mobile payment represents the percentage of respondents who report using a mobile phone to pay bills, receive and send money in the past 12 months. Source: World Bank, 2011

Philippines leads the region in mobile phone payments, surpassing even Singapore and far exceeding the rest of Southeast Asia. The country hosts two of the earliest pioneers in mobile money—Smart’s Smart Money launched in 2001 and Globe’s GCash launched in 2004. Since the launch of Smart Money and GCash, Filipino consumers have shown rapid uptake of the services used for a range of transactions, from remittances to bill payment.

Vietnam ranks third in the region for mobile payment usage and Vietnamese consumers demonstrate high familiarity and willingness to adopt this channel. But limited support from the government and telecom companies has hampered innovation of the channel within the country.

Consumers in Indonesia are not yet persuaded of the value of mobile payments. On measures of readiness with mobile payments, willingness to use them, and current usage, Indonesia lags behind its peer countries.

Regulatory environment

* The Regulatory environment index measures variables related to legal and regulatory structures of a country including effectiveness of law-making bodies, law relating to ICTs, efficiency of legal framework in settling disputes, intellectual property protection, number of procedures to enforce a contract,… Source: Global Information Technology Report 2013

With so many interconnected parties involved in online payment, an effective legal and regulatory system is vital to promote the partnerships that are critical to the success of the service.

A report from World Economic Forum (WEF) notes that Singapore leads the world in political and regulatory environment for information and communication technology (ICT) development. The extreme efficiency and business friendliness of its institutional framework as well as strong intellectual property protection lead to a business environment supportive of the ICT industry.

The Philippines ranks the lowest among the six major Southeast Asian countries because of the burden of government regulation on businesses and lack of well-developed laws for ICT. For example, the country’s Cybercrime Prevention Act of 2012, which aimed at criminalizing offenses conducted online, caused huge uproar among internet users for allegedly controlling rather than safeguarding them. The law was suspended one week after issuance.

Each country is in different phase of readiness and thus needs a customized approach:

Singapore

Singapore is leading the region for readiness of transition to a cashless society. High banking and internet penetration, consumer readiness of cashless payment and fully-fledged legal system create opportunities for the development of online payment in this country.

Malaysia

Malaysia follows Singapore’s trajectory but its consumers are slower to adopt mobile phone as a payment channel. High mobile coverage will facilitate the adoption of mobile payment if companies employ good marketing and customer education programs.

Philippines

The Philippines is faster than other countries in mobile payment adoption, a channel often popular where ICT infrastructure is lacking. But the country’s regulatory environment is less developed leading to a lack of ICT development overall. Along with helping the government to foster regulations, companies can take advantage of consumer readiness to provide additional payment services.

Vietnam and Thailand

Vietnam and Thailand are both “in-the-middle” for online payment readiness when compared to neighbors. Stronger opportunities to expand mobile payment services to non-bank users exist in Vietnam because of higher mobile payment readiness. But in Thailand, consumers have not shown as much of a readiness to accept mobile payment, and companies will need to primarily focus on marketing to bank users instead.

Indonesia

Indonesia ranks the lowest for online payment readiness, receiving relatively low scores for all three indicators – ease of internet access, mobile usage, and online banking penetration. Companies investing into Indonesia will need to employ technology and marketing focused on groups of early adopters. Such a strategy may prove highly successful in the long run.

(Editing by Terence Lee, image via Nicolas Raymond)

The post How ready is Southeast Asia for online payments? appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance