Raymond James (RJF) Q1 Earnings Miss, Revenues Increase Y/Y

Raymond James RJF reported first-quarter fiscal 2020 (ended Dec 31) earnings of $1.89 per share, missing the Zacks Consensus Estimate by a penny. However, on a year-over-year basis, the bottom line increased 11.8%.

Results benefited from increase in revenues and decent assets growth. Moreover, the company’s balance sheet position was strong in the quarter. However, higher operating expenses acted as an undermining factor.

Net income (GAAP basis) was $268 million, up 7.6% from the prior-year quarter.

Revenues Up & Costs Rise

Net revenues amounted to $2 billion, growing 4% year over year. The rise was largely driven by increase in asset management and related administrative fees.

Segment wise, in the reported quarter, RJ Bank registered an increase of 6.4% in net revenues. Capital Markets witnessed a rise of 5.9% in the top line, and Private Client Group recorded 4.3% growth. Further, Asset Management witnessed a 5.8% jump. However, Others recorded negative net revenues of $8 million.

Non-interest expenses were up 3.2% year over year to $1.7 billion. The increase was due to rise in almost all cost components.

As of Dec 31, 2019, client assets under administration grew 23.5% from the prior-year quarter to $896 billion. Further, financial assets under management were $151.7 billion, up 19.9% from the prior-year quarter.

Strong Balance Sheet & Capital Ratios

As of Dec 31, 2019, Raymond James reported total assets of $40.2 billion, up 3.4% sequentially. Total equity increased 4% from the prior quarter to $6.8 billion.

Book value per share was $49.26, up from $43.69 as of Dec 31, 2018.

As of Dec 31, 2019, total capital ratio came in at 25.7%, increasing from 24.7% on Dec 31, 2018. Also, Tier 1 capital ratio was 24.8% compared with 23.6% as of December 2018 end.

Return on equity (annualized basis) was 16.0% at the end of the reported quarter compared with 15.9% in the prior-year quarter.

Share Repurchase Update

During the fiscal first quarter, Raymond James repurchased 126,000 shares for a total value of $11.3 million.

Our Take

Raymond James’ efforts to expand through acquisitions are likely to support top-line expansion. However, mounting expenses are likely to further hurt bottom-line growth.

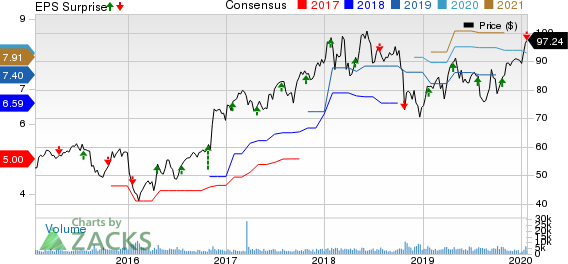

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Zacks Rank

Currently, the company has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earrings Release Dates of Other Investment Brokerage Firms

Charles Schwab’s SCHW fourth-quarter 2019 adjusted earnings of 63 cents per share lagged the Zacks Consensus Estimate by a penny. Also, the bottom line decreased 3% from the prior-year quarter. Results for the reported quarter excluded $25 million (1 cent per share) expenses relating to two pending acquisitions.

Interactive Brokers Group IBKR recorded fourth-quarter 2019 adjusted earnings per share of 58 cents. The figure matched the prior-year quarter’s earnings.

LPL Financial Holdings Inc. LPLA is scheduled to report fourth-quarter 2019 results on Jan 30.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance