RAOUL PAL: History shows there's a 100% chance of a recession for Trump

Closely-followed former global macro fund manager Raoul Pal is forecasting a 100% chance of a recession for president-elect Donald J. Trump.

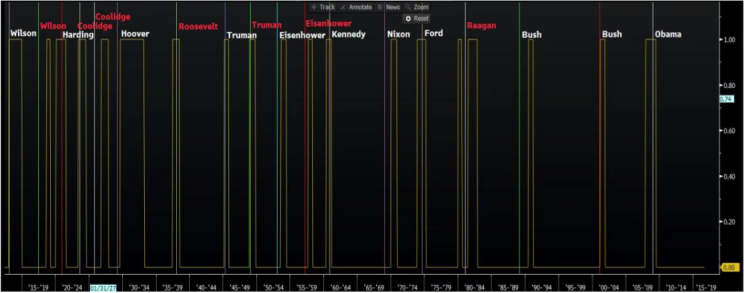

Pal authors The Global Macro Investor, a research letter read by some of the most prolific hedge fund managers. He recently spent time looking at US recessions in general. What he found was that every single one in the last one-hundred years occurred during or right after an election. Specifically, when there’s a two-term incumbent change.

“I recently noted that since 1910, the US economy is either in recession or enters a recession within twelve months in every single instance at the end of a two-term presidency… effecting a 100% chance of recession for the new President,” he wrote in a copy of GMI posted below.

He noted that the only recession in the last century that did not occur around an election was 1979.

“In the last 100 years, the recession of 1979 is the only recession not to occur around an election date (again, Carter came into office after Ford who did not undergo the election cycle). Just mull that over…” Pal wrote.

He added: “Every single US recession bar one (with explainable circumstances) occurred around an election. Only two Presidents in history did not see a recession and they were inaugurated after single-term Presidents.”

For some time now, Pal has been expecting the stock market to peak out and he’s been looking for a topping out of the economy. He views the economy through the lens of the business cycle. In this latest GMI, he noted that the political cycle is a driver of recessions.

“It is difficult to believe it is primarily the country’s economic well-being that the politicians care about when this cycle is so evident.”

For now, history suggests the odds of a recession for Trump are 100%. And while that probability may change, it’s still going to be “extremely high”, according to Pal.

For now, the stock market been rallying since Trump won, while money has been fleeing the bond market.

“Should you really be betting on growth and inflation for 2017? I very much doubt it. I think that the current euphoria for equities and hatred for bonds is going to be exactly the wrong trade for 2017,” Pal wrote.

Pal, a Goldman Sachs alum, previously co-managed GLG’s global macro fund, one of the largest in the world. He retired in 2004 at age 36. In addition to authoring GMI, he’s also co-founder of RealVision Television, an online subscription financial-news service.

Read Pal’s full argument in the copy of GMI posted below:

GMINovember2016Update by Julia on Scribd

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

SCARAMUCCI: The government’s new rule will hurt investors

Trump’s win is a ‘grand slam’ for Wall Street banks

GRANT WILLIAMS: Trump appears doomed to inherit the next recession

Yahoo Finance

Yahoo Finance