Ralph Lauren Stock Rises 64.1% in a Year: Time to Buy, Sell or Hold?

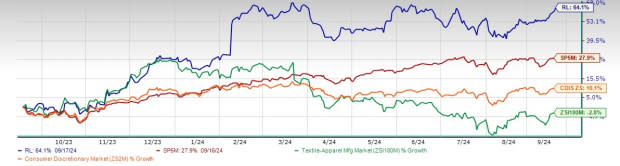

Ralph Lauren Corporation RL stock has been trending up the charts in the past year, recording growth of 64.1% against the broader Consumer Discretionary sector’s return of 10.1% and the Zacks Textile - Apparel industry‘s 2.8% decline. RL’s shares also surpassed the S&P 500 index’s appreciation of 27.9% in a year.

Currently priced at $181.44, Ralph Lauren stock is trading at 5.5% to its 52-week high of $192.03, reached on March 21, 2024. However, it is trading at a 67.1% premium to its 52-week low mark.

RL’s Strategies Drive Growth

Ralph Lauren’s stock performance is due to its progress on ‘Next Great Chapter: Accelerate Plan’ and digital efforts. As part of the plan, the company is focused on elevating its lifestyle brand, expanding core and other businesses and strengthening its presence in key cities. It is enhancing its global lifestyle brands by offering premium products that align with evolving consumer preferences. Its strategy, which includes product elevation, personalized promotions, disciplined inventory management and a favorable channel and geographic mix, is proving effective.

This approach supports Ralph Lauren’s financial goals. Management forecasted mid-to-high-single-digit compounded annual revenue growth in constant currency during the fiscal 2022-2025 period. Operating profit growth is expected to outpace revenue growth, with the operating margin projected to reach at least 15% by fiscal 2025 in constant currency. Modest gross margin improvements and controlled expenses will support operating margin expansion. Capital expenditures are expected to remain in the band of 4-5% of revenues annually and the company plans to return $2 billion to shareholders via dividends and share repurchases by fiscal 2025.

RL continues to invest in key priorities like marketing, digital growth and ecosystem expansion in major cities. Its direct-to-consumer (DTC) channels, including stores and digital commerce, are performing well, with significant progress in mobile, omnichannel and fulfillment investments. In the latest quarter, RL added 1.3 million new consumers through its DTC business, with digital sales increasing 14% in Europe and 21% in Asia.

RL's Price Performance

Image Source: Zacks Investment Research

RL’s Earnings Estimate Revisions

Given the positive sentiments regarding the stock, the Zacks Consensus Estimate for fiscal 2025 and 2026 has been northbound. In the past 60 days, the consensus estimate for earnings per share (EPS) for the current fiscal year has been revised 1.5% to $11.24 for fiscal 2025 and 0.2% to $12.56 for fiscal 2026. This implies year-over-year earnings growth of 9% and 11.8%, respectively, for fiscal 2025 and 2026.

Image Source: Zacks Investment Research

Hurdles in RL’s Growth Path

Ralph Lauren, like other lifestyle brands, faces macroeconomic challenges such as inflation, supply-chain issues and shifting consumer behavior. Management expressed caution about the global economic and consumer outlook. Also, unfavorable foreign currency impacts are expected to affect gross margins by 40 basis points and operating margins by 50 basis points in the upcoming quarter.

Softness in its wholesale channel in North America is another setback for the company. Higher promotions and an unfavorable wholesale timing shift have been affecting the segment. The North America wholesale business reported a 13% decline in revenues in first-quarter fiscal 2025, due to receipt timing shifts and lower product sales to the off-price wholesale division. This resulted in the North America segment reporting a 4% year-over-year decline in revenues, with 4% fall in digital revenues.

Management anticipates wholesale declines to moderate through the remainder of fiscal 2025, with the potential of a restock in well-performing core products.

RL Stock’s Valuation

Ralph Lauren stock is trading at a premium valuation relative to the industry. Going by the price/earnings ratio, RL stock is currently trading at 15.31 on a forward 12-month basis, higher than 12.38 of the industry. Also, it is trading higher than its median of 14.48.

Image Source: Zacks Investment Research

How to Play the RL Stock?

Ralph Lauren’s robust strategies, including the Next Chapter Plan and digital endeavors, position it well for long-term growth. However, macroeconomic uncertainties and soft North America performance are likely to be headwinds in the near term.

The company's steady uptrend with a pricey valuation signals a cautious approach for investors willing to enter at these levels. For existing investors, retaining the stock seems to be a prudent choice, considering the company’s long-term growth potential. The company’s Zacks Rank #3 (Hold) supports our thesis.

Stocks to Consider

We have highlighted three better-ranked stocks, namely, G-III Apparel Group GIII, Crocs CROX and Royal Caribbean RCL.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has a trailing four-quarter earnings surprise of 118.2%, on average. The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales indicates growth of 3.3% from the year-ago figure.

Crocs develops and manufactures lifestyle footwear and accessories. It currently has a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and EPS implies an improvement of 4% and 6.8%, respectively, from the prior-year actuals.

Royal Caribbean carries a Zacks Rank of 2 at present. RCL has a trailing four-quarter earnings surprise of 18.5%, on average.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates an increase of 18.1% and 71.1%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report