Radian Group (RDN) Q3 Earnings Beat, Revenues Decrease Y/Y

Radian Group Inc. RDN reported third-quarter 2022 adjusted operating income of $1.31 per share, which beat the Zacks Consensus Estimate by 54.1%. The bottom line increased 95.5% year over year.

The results reflected higher monthly premium policy insurance in force, higher investment income and lower expenses, offset by lower premiums earned.

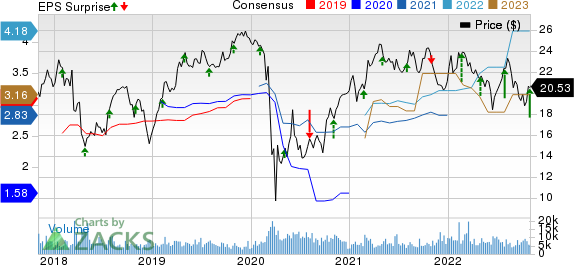

Radian Group Inc. Price, Consensus and EPS Surprise

Radian Group Inc. price-consensus-eps-surprise-chart | Radian Group Inc. Quote

Quarter in Details

Operating revenues decreased 3.5% year over year to $312.4 million on lower net premiums earned, services revenues and other income.

Net premiums earned were $240.2 million, down 3.6% year over year. Net investment income increased 42.9% year over year to $51.4 million. MI New Insurance Written decreased 33.7% year over year to $17.6 billion.

Primary mortgage insurance in force was $259.1 billion as of Sep 30, 2022, up 7.3% year over year. The increase reflects an 11.8% increase in monthly premium policy insurance in force and a 13.2% decline in single premium policy insurance in force.

Persistency — the percentage of mortgage insurance in force that remains in the company’s books after a 12-month period — was 75.9% as of Sep 30, 2022, up 1510 basis points (bps) year over year.

Primary delinquent loans were 21,077 as of Sep 30, 2022, compared with 33,795 in the year-ago quarter.

Total expenses decreased 75.2% year over year to $40.7 million on account of lower policy acquisition costs and cost of services. The expense ratio was 26.1, down 250 bps from the year-ago quarter.

Segmental Update

The Mortgage segment reported a year-over-year increase of 2.3% in total revenues to $281 million. Net premiums earned by the segment were $235.2 million, down 0.7% year over year. Claims paid were $4.5 million, down 55.9% year over year. The loss ratio was (41.5) against 7.1 in the year-ago quarter.

The homegenius segment’s revenues of $25.1 million decreased 44.3% year over year. Adjusted pre-tax operating loss was $25.5 million, wider than the prior-year quarter’s loss of $5.6 million.

Financial Update

As of Sep 30, 2022, Radian Group had a solid cash balance of $54.7 million, down 63.8% from the 2021-end level. The debt-to-capital ratio deteriorated 250 bps to 27.4 from the 2021-end level.

Book value per share, a measure of net worth, climbed 1.4% year over year to $23.80 as of Sep 30, 2022. Adjusted net operating return on equity was 22.5%, compared with 11.8% in the year-ago quarter.

The risk-to-capital ratio of Radian Guaranty as of third-quarter end was 11.1:1, unchanged from the 2021-end level. Excess available resources to support PMIERs of $5.4 billion were 44% higher than Radian Guaranty's minimum required assets.

Share Repurchase and Dividend Update

Radian bought back 9.5 million shares worth $194.1 million in the third quarter of 2022. This represented 5.7% in aggregate of total shares outstanding as of the end of the second quarter.

In October 2022, Radian purchased an additional share for nearly $1 million. At present, no purchase authority is available under the most recent repurchase authorization.

On Aug 10, 2022, Radian Group’s board of directors authorized a regular quarterly dividend of 20 cents per share and the dividend was paid out on Sep 1, 2022.

Zacks Rank

Radian currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Multi-Line Insurers

Of the insurance industry players that have reported third-quarter results so far, The Hartford Financial Services Group, Inc. HIG and Assurant, Inc. AIZ beat the respective Zacks Consensus Estimate for earnings, while Prudential Financial, Inc. PRU missed the mark.

The Hartford Financial Services reported third-quarter 2022 adjusted operating earnings of $1.44 per share, which outpaced the Zacks Consensus Estimate by 11.6%. The bottom line climbed 14% year over year. Operating revenues of HIG amounted to $3,830 million, which rose 3.6% year over year in the quarter under review.

The top line also beat the consensus mark by 1.8%. Hartford Financial’s total earned premiums improved 7.6% year over year to $4,910 million, which surpassed the Zacks Consensus Estimate of $4,811 million and our estimate of $4,808.2 million. Net investment income of $487 million dropped 25.1% year over year in the third quarter due to a decline in income from limited partnerships and other alternative investments.

Assurant reported third-quarter 2022 net operating income of $1.01 per share, which beat the Zacks Consensus Estimate by 1% but missed our estimate of $2.36. The bottom line decreased 40.2% from the year-ago quarter.

Assurant’s total revenues increased 1.9% year over year to $2.6 billion due to higher net earned premiums and net investment income. The top line, however, missed the Zacks Consensus Estimate by 1.8%. The figure was lower than our estimate of $2.7 billion. Net investment income was up 9.9% year over year to $83.5 million. The figure was higher than our estimate of $81.8 million.

Prudential Financial’s third-quarter 2022 operating net income of $2.13 per share missed the Zacks Consensus Estimate by 3.6%. The bottom line decreased 43.6% year over year. Total revenues of $21.6 billion increased 10% year over year on higher premiums. The top line beat the Zacks Consensus Estimate by 69.4%. The figure was higher than our estimate of $12.8 billion.

Prudential Financial’s total benefits and expenses of $20.6 billion were up 15.5% year over year for the quarter. The increase in expenses was mainly attributable to higher insurance and annuity benefits and interest expenses. The figure was higher than our estimate of $11.6 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance