PSEG (PEG) Q4 Earnings Beat Estimates, Revenues Rise Y/Y

Public Service Enterprise Group Incorporated PEG, or PSEG, reported fourth-quarter 2022 adjusted operating earnings of 64 cents per share, which beat the Zacks Consensus Estimate of 63 cents by 1.6%.

The company reported quarterly GAAP earnings per share (EPS) of $1.58 in the fourth quarter of 2022 compared to earnings of 88 cents generated in the fourth quarter of 2021.

For the full-year 2022, PEG’s adjusted operating earnings of $3.47 per share compared with $3.65 in the previous year’s quarter. Earnings beat the Zacks Consensus Estimate of $3.46 per share by 0.3%.

Total Revenues

Operating revenues came in at $3,139 million in the fourth quarter, which beat the Zacks Consensus Estimate of $2,179.4 million by 44%. The top line also increased by 2.7% from the year-ago quarter’s $3,056 million.

For the full-year 2022, PSEG reported operating revenues of $9.80 billion compared with $9.72 billion in the year-ago period. Operating revenues beat the Zacks Consensus Estimate of $8.84 billion by 10.9%.

In the quarter, electric sales volumes were 9,254 million kilowatt-hours, while gas sales volumes were 988 million therms.

Under electric sales, Residential sales volumes were 2,659 million kilowatt-hours, down 5% from the prior-year quarter figure. Its commercial and industrial sales volumes accounted for 6,498 million kilowatt-hours, registering growth of 4% from the same period last year.

Other sales were 97 million kilowatt-hours, down 2% from the year-ago quarter figure.

Total gas sales volumes witnessed an increase of 18% in firm sales volumes and a decrease of 9% in the non-firm sales volumes of gas from the year-ago quarter figure.

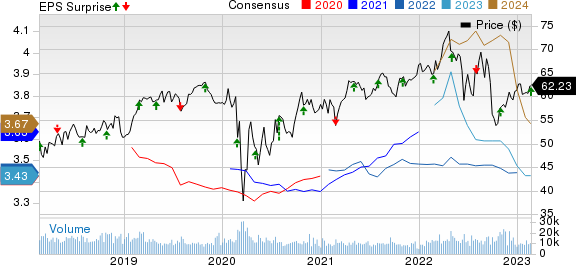

Public Service Enterprise Group Incorporated Price, Consensus and EPS Surprise

Public Service Enterprise Group Incorporated price-consensus-eps-surprise-chart | Public Service Enterprise Group Incorporated Quote

Highlights of the Release

In the fourth quarter of 2022, the operating income came in at $964 million compared with $902 million in the year-ago quarter.

Total operating expenses were $2,175 million, up 0.9% from the year-ago quarter.

Segment Performance

PSE&G: Net income was $352 million, up from $271 million in the prior-year quarter.

Carbon-Free Infrastructure/Other: The adjusted operating loss was $34 million compared to operating earnings of $81 million in the prior-year quarter.

Financial Update

The long-term debt (including the current portion of the long-term debt) as of Dec 31, 2022 was $18,070 million, down from the 2021-end level of $19,438 million.

PSEG generated $1,503 million in cash from operations during the 12 months ended Dec 31, 2022 compared with the $1,736 million generated in the prior-year period.

2023 Guidance

The company updated its 2023 guidance. PEG now expects its adjusted operating earnings in the range of $1,700-$1,750 million and adjusted EPS in the range of $3.40-$3.50 compared with the prior range of operating earnings of $1,675-$1,775 million and EPS in the range of $3.35-$3.55. The Zacks Consensus Estimate for earnings is currently pegged at $3.43 per share, lower than the midpoint of the company’s guided range.

The company now expects its PSE&G adjusted operating earnings in the range of $1,500-$1,525 million compared with the prior range of $1,490-$1,540 million for 2023. It now anticipates Carbon-Free, Infrastructure & Other adjusted operating earnings in the range of $200-$225 million compared with the earlier guidance in the band of $185-$235 million.

Zacks Rank

PSEG currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

Hawaiian Electric Industries, Inc. HE reported an EPS of 52 cents in the fourth quarter of 2022. The bottom line improved 4% from 50 cents per share in the prior-year quarter.

Hawaiian Electric’s total revenues of $1,019.1 million in the fourth quarter improved 32.3% from the prior-year quarter’s $770.3 million. The rise in revenues can be attributed to increased contributions from the Electric Utility, Bank and other segments.

Duke Energy Corporation DUK reported fourth-quarter 2022 adjusted earnings of $1.11 per share, which surpassed the Zacks Consensus Estimate of $1.06 by 4.7%. The bottom line also improved 26.1% year over year.

Total operating revenues came in at $7,351 million, which improved 20.2% from $6,117 million in the year-ago period. The reported top line also surpassed the Zacks Consensus Estimate of $6,608 million by 11.2%.

CMS Energy Corporation CMS reported a fourth-quarter 2022 adjusted EPS of 60 cents from continuing operations, which came in line with the Zacks Consensus Estimate. The reported figure improved 27.7% on a year-over-year basis.

For the quarter under review, CMS Energy’s operating revenues were $2,278 million, which exceeded the Zacks Consensus Estimate of $2,185.3 million by 4.2%. The top line improved 12.1% on a year-over-year basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Hawaiian Electric Industries, Inc. (HE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance