Provention (PRVB) Gets FDA Nod for Drug That Delays T1D Onset

Shares of Provention Bio PRVB were up 9.2% in after-market trading on Nov 17 after management announced that the FDA approved its anti-CD3-directed antibody teplizumab. The drug, to be marketed under the brand name Tzield, will be administered intravenously to delay the onset of stage 3 type 1 diabetes (T1D) in adults and pediatric patients aged eight years and older having stage 2 T1D.

Following the FDA’s approval, Tzield became the first and is currently the only immunomodulatory treatment that can delay the onset of stage 3 T1D.

Patients suffering from stage 3 T1D eventually require constant monitoring and insulin injections for life. The stage 3 T1D indication carries significant health risks, including diabetic ketoacidosis, which can be life-threatening. Insulin therapy and glucose monitoring are the standard of care for treating stage 3 T1D. Treatment with Tzield will allow patients to delay this threatening disease.

The FDA’s decision is based on data from a clinical study which showed over a median follow-up of 51 months, 45% of patients who received Tzield were later diagnosed with stage 3 T1D, compared to 72% of patients who were administered a placebo. Per the FDA, this represents a statistically significant delay of stage 3 T1D.

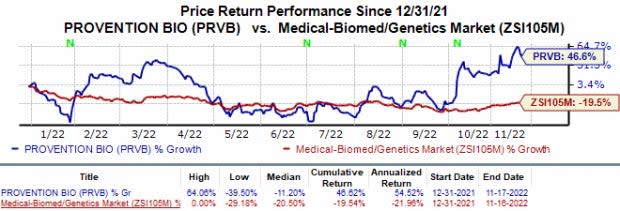

Shares of Provention Bio have gained 46.6% in the year against the industry’s 19.5% fall.

Image Source: Zacks Investment Research

Last month, management signed a co-promotion deal for the drug with Sanofi SNY to launch Tzield in the United States. Per the terms of the agreement, Sanofi will commit commercial resources for Tzield in the United States. Provention Bio will reimburse field force-related expenses that Sanofi will incur in connection with commercializing Tzield under the agreement. Sanofi also agreed to make an equity investment of $35 million in PRVB’s common shares.

Provention also received $20 million as a non-refundable payment from Sanofi, which grants the latter exclusive right of the first negotiation to in-license teplizumab globally for T1D.

Teplizumab was originally developed by MacroGenics MGNX. The drug was acquired by Provention Bio from MacroGenics pursuant to an asset purchase agreement in 2018. Per the terms of agreement, MacroGenics is eligible to receive $60 million following the approval of teplizumab.

MacroGenics is also eligible to receive milestone payments of up to $225 million on achievement of sales-related milestones and single-digit royalty payments on net sales of the product.

Provention Bio, Inc. Price

Provention Bio, Inc. price | Provention Bio, Inc. Quote

Zacks Rank & Stocks to Consider

Provention Bio currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Angion Biomedica ANGN, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Angion Biomedica’s 2022 loss per share have narrowed from $1.64 to $1.53. During the same period, the loss estimates per share for 2023 have narrowed from $1.54 to $1.43. Shares of Angion Biomedica have plunged 70.3% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

MacroGenics, Inc. (MGNX) : Free Stock Analysis Report

Provention Bio, Inc. (PRVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance