Properties that will be positively impacted by Cross Island Line Phase 1

Waterway Point which is part of an integrated development near Punggol MRT Station. (Picture: Albert Chua/EdgeProp Singapore)

The whole Cross Island Line (CRL) will be constructed in three phases. Construction for the first phase has started and is expected to end in 2030. Construction for the second phase will start next year and is expected to finish in 2032. No announcement has been made by the government for the third phase.

We discussed the potential impact of Phase 2 of the Cross Island Line (CRL2) on property prices in an earlier article and will examine the impact of the first phase in this article.

There are 15 stations under Phase 1 of the Cross Island Line (CRL1). Out of these, six of them are interchange stations — Pasir Ris (East-West Line), Riveria (LRT), Punggol (North-East Line), Hougang (North-East Line), Ang Mo Kio (North-South Line) and Bright Hill (Thomson-East Coast Line). We grouped the stations into six clusters according to their location before examining the potential impact of the CRL1 on each cluster area and analyse ways that buyers can capitalise on this knowledge.

Ang Mo Kio cluster: Bright Hill to Tavistock

The Ang Mo Kio cluster comprises four stations with two of them; namely Bright Hill and Ang Mo Kio MRT Stations being interchange stations.

There are 15 condominiums with 3,779 units within a 1km radius of Bright Hill MRT Station but there are only two condominiums with 908 units within the same distance from Ang Mo Kio MRT Station.

Residential developments near to Ang Mo Kio MRT Station are mostly HDB flats. There are 221 blocks with 28,109 HDB flats within a 1km radius of the MRT station. In contrast, there are only 61 blocks with 5,468 HDB flats within a 1km radius of Bright Hill MRT Station. (Find HDB flats for rent or sale with our Singapore HDB directory)

There are eight condominiums with 2,250 units within a 500m radius of Bright Hill MRT Station. The Gardens at Bishan and Faber Garden Condominium are located just beside Bright Hill MRT Station and so have the most to gain after the MRT station becomes an interchange station. The Gardens at Bishan (756 units) is also the largest development within a 1km radius of Bright Hill MRT Station.

Interestingly, Faber Garden Condominium ($1,673 psf) is 22.7% more expensive than The Gardens at Bishan ($1,363 psf) despite The Gardens at Bishan (TOP 2004) being much younger than Faber Garden Condominium (TOP 1984). This could be because Faber Garden Condominium is a freehold development while The Gardens at Bishan is a 99-year leasehold development.

The lower price point for The Gardens at Bishan makes it a worthwhile consideration especially for parents who wish to place their child in the nearby Ai Tong School. A drawback will be the leasehold tenure of the condominium. Additionally The Gardens at Bishan (756 units) has three times the number of units compared to Faber Garden Condominium (233 units), thus giving buyers more choices. The Gardens at Bishan also has more facilities which would be a boon to families.

Serangoon and Hougang cluster: Serangoon North and Hougang

Two stations on CRL1 will serve the Serangoon and Hougang cluster. The new Serangoon North MRT Station is likely to have a greater impact because there is no MRT station within a 1km radius while Hougang MRT Station is an existing station on the North-East Line.

A total of 16 condominiums with 3,510 units are within a 1km radius of Serangoon North MRT Station while there are nine condominiums with 4,490 units within the same radius of Hougang MRT Station.

Uncompleted Affinity @ Serangoon is the largest development (1,012 condominium units and 40 landed units) within a 1km radius of Serangoon North MRT Station. Based on caveats lodged with URA at the time of writing, the leasehold development has only two landed units and six condominium units available for sale so keen buyers have to hurry. The current average price for Affinity @ Serangoon is $1,578 psf.

Kensington Park Condominium is the only condominium that is within 500m of Serangoon North MRT so the development has the most to gain from the opening of the MRT station. Kensington Park Condominium’s average price of $1,448 psf is also lower than Affinity @ Serangoon despite its 999-year leasehold tenure and proximity to the upcoming MRT station. The 316-unit development was put up for en-bloc tender in May with a guide price of $1.28 billion and was just relaunched at the same guide price.

Tampines cluster: Defu and Tampines North

The upcoming Defu MRT Station is near Defu Industrial Estate which will bring much convenience to the workers as the nearest MRT station — Hougang — is more than 1km away. Three uncompleted HDB estates (Tampines Greenglades, Tampines Greenglen and Tampines Greencrest) are near the upcoming Tampines North MRT Station.

Tampines North MRT Station is near the 616-unit Tenet which is an executive condominium that is expected to launch later this year. The site was awarded to Qianjian Realty and Santarli Pte Ltd for $422 million ($659 psf ppr) in August 2021 which was a record high bid for an executive condominium site at the time of the award.

Tampines North MRT Station is also near two Government Land Sales (GLS) sites. Tampines Street 62 (Parcel B) is another executive condominium site located just beside Tenet. The plot is under the Reserve List in the GLS list for 2H 2022. The site might be triggered for tender if Tenet performs well during launch.

The other GLS site is a commercial and residential site along Tampines Avenue 11. It is on the GLS Confirmed List for 2H 2022 and will be launched for tender in December. The land parcel is expected to attract strong bids because of its proximity to the upcoming Tampines North MRT station. The lack of nearby integrated developments and condominiums might encourage more developers to submit a bid. Additionally, the commercial element is an opportunity for the successful bidder to develop a mixed development which has proven to be popular with buyers, especially owner-occupiers.

Pasir Ris cluster: Pasir Ris to Elias

Of the three stations in this cluster, only Pasir Ris MRT Station is an interchange station. It is located in a bustling area with White Sands as its immediate neighbour.

An awarded GLS site is also beside Pasir Ris MRT Station. The white site was awarded in March 2019 to Allgreen Properties and Kerry Properties for $700 million ($685 psf ppr). The upcompleted development — Pasir Ris 8 — is expected to have a direct link to the MRT station, a two-storey mall and 487 condominium units when completed in 2025. During the launch weekend, 85% of the units were sold. According to caveats lodged with URA, 458 units of Pasir Ris 8 are sold (take-up rate of 94%) at an average price of $1,820 psf.

Buyers who like Pasir Ris but want a home in a less bustling area may want to consider the developments surrounding the upcoming Pasir Ris East MRT Station which is a stop away from Pasir Ris MRT Station.

The Esparis is the condominium nearest to the upcoming Pasir Ris East MRT Station. The 274-unit executive condominium obtained TOP in 2005 i.e. it is privatised. The leasehold development is also walking distance to Loyang Point.

There are three other executive condominiums with 1,223 units within a 1km radius of The Esparis; namely Sea Horizon, Eastvale and Watercolours. The four executive condominiums are also within a 2km radius of the upcoming Pasir Ris East MRT. The Esparis ($798 psf) is the cheapest executive condominium while Sea Horizon ($1,057 psf) is the most expensive. The higher price point for Sea Horizon could be because it is the newest (TOP in 2016).

The affordable price point and walking distance to connectivity and convenience makes The Esparis a worthwhile consideration for families looking for a home in the east.

Punggol cluster: Rivieria and Punggol

Punggol and Rivieria MRT Stations are both interchange stations which will increase travel routes for nearby residents.

There are three large condominium developments within a 500m radius of Punggol MRT Station; namely Watertown (992 units), A Treasure Trove (882 units) and Parc Centros (618 units). Watertown ($1,489 psf) is the most expensive, followed by Parc Centros ($1,317 psf) and A Treasure Trove ($1,218 psf).

The slight price difference between the three leasehold development could be due to age. Watertown is the youngest having obtained TOP in 2017. Parc Centros obtained TOP a year earlier in 2016 while A Treasure Trove obtained TOP in 2015.

Despite being the most expensive, it might be worthwhile to consider Watertown over the other developments because it is an integrated development with direct linkage to Punggol MRT Station and Waterway Point.

Buyers with more modest budget could consider A Treasure Trove which is the most affordable of the trio. Buyers should note that the latest Master Plan indicates the empty land across the road from A Treasure Trove is designated as a reserve site with no indications to its future use.

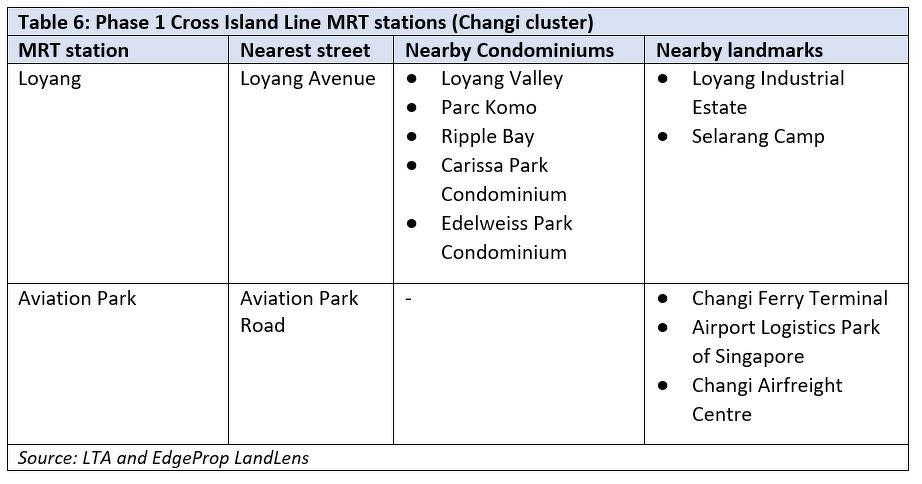

Changi cluster: Loyang and Aviation

There are no condominiums near Aviation Park MRT Station at the moment but the upcoming MRT station will definitely benefit those working at the Airport Logistics Park or the Changi Airfreight Centre.

The sole condominium within a 1km radius of the upcoming Loyang MRT Station is Loyang Valley. The 362-unit condominium is an older leasehold development that obtained TOP in 1985. Its age, bite-size site and proximity to a future MRT station makes the development ripe for en-bloc. (See potential condos with en bloc calculator)

There are 35 developments with 8,819 units near Loyang MRT Station if the radius is expanded to 2 km. One of them is the uncompleted 276-unit Parc Komo which is fully sold with an average price of $1,628 psf.

Check out the latest listings near Kensington Park Condo, Tenet, Pasir Ris 8, Watertown, Affinity @ Serangoon, The Gardens at Bishan, Faber Garden Condominium, Tenet, The Esparis, Sea Horizon, Eastvale, Watercolours, A Treasure Trove, Parc Centros, Loyang Valley, Parc Komo, Ang Mo Kio MRT Station, Bright Hill MRT Station, Serangoon North MRT Station, Hougang MRT Station, Defu MRT Station, Tampines North MRT Station, Pasir Ris MRT Station, Pasir Ris East MRT Station, Rivieria MRT Station, Punggol MRT Station, Loyang MRT Station

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Cross Island Line Phase 2 to boost surrounding property prices

More willing to pay for connectivity and convenience: Survey

Kensington Park Condo collective sale: Beyond a $1.28 bil punt

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance