Progressive (PGR) Q1 Earnings Lag Estimates, Revenues Rise Y/Y

The Progressive Corporation’s PGR first-quarter 2020 earnings per share of $1.17 missed the Zacks Consensus Estimate by 19.3%. The bottom line deteriorated 36% year over year.

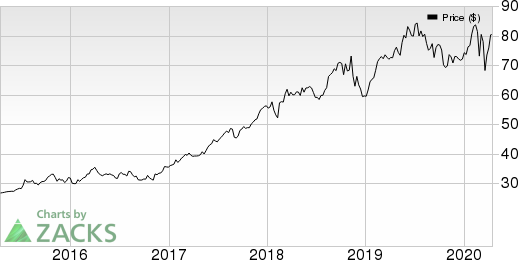

The Progressive Corporation Price, Consensus and EPS Surprise

The Progressive Corporation price-consensus-eps-surprise-chart | The Progressive Corporation Quote

Behind the Headlines

Net premiums written were $9.9 billion in the quarter under review, up 7% from the year-ago period. Net premiums earned grew 11% year over year to $9.4 billion.

Net realized loss on securities was $553.6 million against the year-ago gain of $414.5 million.

Operating revenues were $9.9 billion, up 11.1% year over year. The improvement was owing to an 11% increase in premiums and 18% growth in fees and other revenues as well as 21% increase in service revenues. The top line however missed the Zacks Consensus Estimate by 0.5%.

Total expenses increased 9% year over year to $8.4 billion driven by 7% rise in losses and loss adjustment expenses, 10% increase in policy acquisition costs, 20% higher other underwriting expenses and 25% increase in service expenses.

Combined ratio — percentage of premiums paid out as claims and expenses — improved 190 basis points (bps) from the prior-year quarter’s level to 86.9%.

March Results

In March, policies in force were impressive at the Personal Auto segment, having improved 10% from the year-ago month to 15.3 million. Special Lines improved 4% from the prior-year month’s figure to 4.6 million.

In Progressive’s Personal Auto segment, Direct Auto grew 11% year over year to 8.1 million while Agency Auto improved 8% year over year to 7.2 million.

Progressive’s Commercial Auto segment rose 7% year over year to 0.7 million. The Property business had about 2.3 million policies in force in the reported month, up 13% year over year.

Financial Update

Progressive’s book value per share was $23.68 as of Mar 31, 2020, up 19% year over yar.

Return-on-equity for March 2020 was 28.5%, having contracted 190 bps year over year. Debt-to-total capital ratio deteriorated 60 bps year over year to 27.3% as of Mar 31, 2020.

Zacks Rank

Progressive currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

RLI Corp. RLI is slated to announce first-quarter earnings on Apr 21.

The Travelers Companies, Inc. TRV is scheduled to release first-quarter earnings on Apr 21.

Brown and Brown Inc. BRO is set to report first-quarter earnings on Apr 27.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance