Progress Software (PRGS) Q1 Earnings Beat, Revenues Rise Y/Y

Progress Software PRGS reported first-quarter fiscal 2021 non-GAAP earnings of 95 cents per share that beat the Zacks Consensus Estimate by 26.7%. The figure increased 25% from the year-ago quarter.

Non-GAAP revenues of $131.8 million also surpassed the consensus mark by 8.2%.

Quarter Details

Software license GAAP revenues were $33.3 million, up 8.8% year over year. Maintenance and service GAAP revenues were $88 million, up 11.3% from the year-ago quarter.

GAAP sales and marketing expenses, as a percentage of revenues, expanded 220 basis points (bps) from the year-ago quarter to 24.3%.

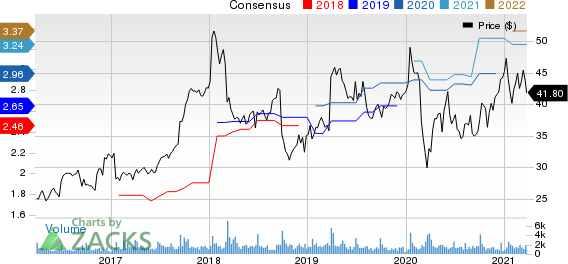

Progress Software Corporation Price and Consensus

Progress Software Corporation price-consensus-chart | Progress Software Corporation Quote

GAAP product development expenses, as a percentage of revenues, expanded 50 bps from the year-ago quarter to 20.2%.

However, GAAP general and administration expenses, as a percentage of revenues, declined 60 bps from the year-ago quarter to 11.1%.

Progress Software reported adjusted operating margin of 43%, which expanded 80 bps from the year-ago quarter.

Balance Sheet

As of Feb 28, 2021, cash and cash equivalents (and short-term investments) were $114.4 million compared with $106 million as of Nov 30, 2020.

Progress Software generated $44.7 million in cash from operations compared with $33 million reported in the year-ago quarter and $42.8 million in the previous quarter.

Progress Software repurchased 0.4 million shares for $15 million during first-quarter fiscal 2021. As of Feb 28, 2021, $175 million remained under this authorization.

The company declared a quarterly cash dividend of $0.175 per share to be paid out on Jun 15, 2021.

Guidance

For the second quarter of fiscal 2021, Progress Software expects non-GAAP revenues between $119 million and $123 million. The Zacks Consensus Estimate for revenues is currently pegged at $122 million, indicating growth of 7.1% from the year-ago quarter’s reported figure.

The company expects non-GAAP earnings to be in the range of 72-74 cents per share. The consensus mark is currently pegged at 75 cents per share, indicating decline of 1.3% from the year-ago quarter’s reported figure.

For 2021, non-GAAP revenues are projected between $519 and $527 million. Adjusted operating margin is expected to be 37%. Non-GAAP earnings are projected between $3.38 and $3.42 per share.

The Zacks Consensus Estimate for 2021 revenues and earnings are currently pegged at $516.3 million and $3.24 per share, respectively.

Zacks Rank & Stocks to Consider

Progress Software currently has a Zacks Rank #3 (Hold).

Amkor Technology AMKR, Apple AAPL and Arrow Electronics ARW are better-ranked stocks in the broader computer and technology sector. While Amkor sports a Zacks Rank #1 (Strong Buy), both Apple and Arrow Electronics carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Amkor Technology is likely to report its quarterly results on Apr 26. Both Apple and Arrow are likely to report the same on Apr 29.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Progress Software Corporation (PRGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance