PriceSmart (PMST) Q3 Earnings Beat, Comparable Sales Up 7.8%

PriceSmart, Inc. PSMT reported better-than-expected third-quarter fiscal 2024 results. The operator of U.S.-style membership shopping warehouse clubs delivered adjusted earnings of $1.08 per share, which significantly surpassed the Zacks Consensus Estimate of 98 cents per share. Additionally, the bottom line showed an improvement from adjusted earnings of $1.04 per share reported in the year-ago period.

Total revenues of $1.23 billion increased significantly by 12.1% from the prior year quarter. The company’s net merchandise sales of $1.19 billion climbed 11.6% from the year-ago period. On a constant currency basis, the metric rose 9.1%. Notably, foreign currency exchange fluctuations positively impacted sales by $27.3 million or 2.5%. Membership income of $19.3 million rose 15.2% from the year-ago period.

PriceSmart reported a notable 7.8% increase in comparable net merchandise sales for the 13-week period ending Jun 2, 2024, compared with the same period the previous year. On a constant currency basis, the metric rose 5.6%. Foreign currency exchange fluctuations contributed to a 2.2% increase in comparable net merchandise sales growth during the period.

As of May 31, 2024, the company operated 54 warehouse clubs, compared to 51 warehouse clubs as of May 31, 2023.

Total operating expenses of $1.18 billion increased 11.9% year over year. Adjusted EBITDA for the third quarter of fiscal 2024 was $71 million, marking an increase of 11.1% from $63.9 million reported in the same period last year. Adjusted EBITDA margin remained flat at 5.8% in the third quarter of fiscal 2024.

PriceSmart, Inc. Price, Consensus and EPS Surprise

PriceSmart, Inc. price-consensus-eps-surprise-chart | PriceSmart, Inc. Quote

Other Financial Aspects

PSMT ended the fiscal third quarter with cash and cash equivalents of $128.3 million, long-term debt of $36.7 million, and stockholders’ equity of $1,10 billion.

Wrapping Up

PriceSmart's strategic initiatives, including investing in remodeling existing clubs, expanding into new locations, and opening distribution centers, can indeed bolster its market presence and operational efficiency. Focusing on increasing membership value, both for retail and business members and leveraging online and digital platforms can drive sales and strengthen customer engagement in the competitive retail landscape.

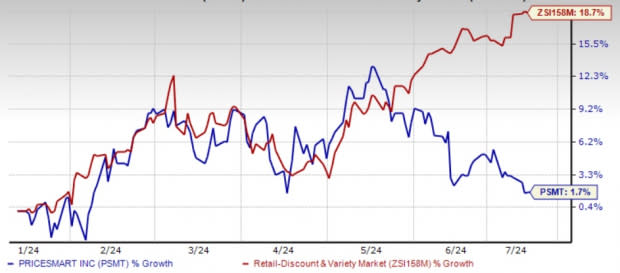

That being said, the above-mentioned strategies align well with enhancing overall customer experience and operational effectiveness. This Zacks Rank #3 (Hold) company’s shares have gained 1.7% in the past six months compared with the industry’s growth of 18.7%.

Image Source: Zacks Investment Research

3 Picks You Can’t Miss

We have highlighted three better-ranked stocks, namely, Walmart WMT, Burlington Stores BURL and Ollie's Bargain Outlet OLLI.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 4.2% and 9.4%, respectively, from the year-ago period’s reported numbers. WMT has a trailing four-quarter earnings surprise of 8.3%, on average.

Burlington Stores, a nationally recognized off-price retailer, currently carries a Zacks Rank #2 (Buy). BURL has a trailing four-quarter earnings surprise of 21.7%, on average.

The Zacks Consensus Estimate for Burlington Stores’ current financial-year sales and earnings suggests growth of around 9.5% and 25.4%, respectively, from year-ago reported numbers.

Ollie's Bargain, the extreme-value retailer of brand-name merchandise, currently carries a Zacks Rank #2. OLLI has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings indicates a rise of around 7.9% and 12.0%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

PriceSmart, Inc. (PSMT) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report