Price & Time: Topping Pattern in EUR/JPY?

DailyFX.com -

Talking Points

EUR/JPY rally from key retracement area stalls

EUR/USD fails to convincingly break important pivot

GBP/USD struggling for direction

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

ChartPrepared by Kristian Kerr

EUR/USD failed to gain traction yesterday below 1.0820 and rallied sharply in response

Our near-term trend bias is still lower in the euro while below 1.0980

A daily close below the May low around 1.0820 is needed to kick off a more important decline

A minor turn window is seen early next week

A close over 1.0980 would turn us positive on EUR/USD

EUR/USD Strategy: Like the short side while below 1.0980.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.0820 | 1.0920 | 1.0940 | *1.0980 | 1.1040 |

Price & Time Analysis: GBP/USD

ChartPrepared by Kristian Kerr

GBP/USD continues to consolidate below the 61.8% retracement of the June - July decline at 1.5700

Our near-term trend bias is lower in cable while below 1.5700

A move back under 1.5525 is needed to re-instill downside momentum into the exchange rate

A very minor turn window is eyed tomorrow

A daily close above 1.5700 would turn us positive on the pound

GBP/USD Strategy: Like the short side while below 1.5700

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

GBP/USD | 1.5450 | *1.5525 | 1.5615 | *1.5700 | 1.5755 |

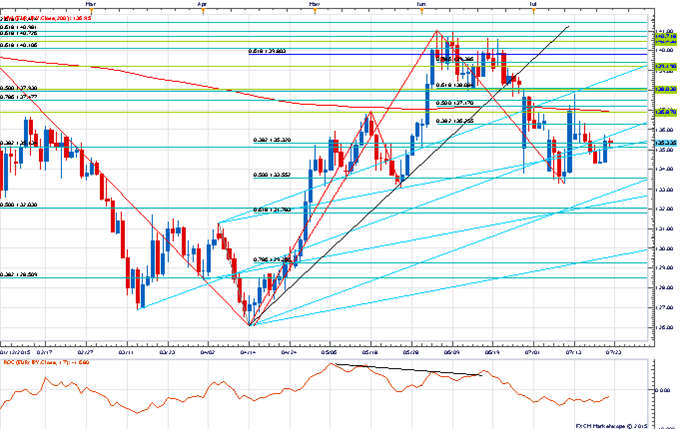

Focus Chart of the Day: EUR/JPY

Yesterday we wrote about USD/JPY and our concern that the low volume rally in the exchange rate could lead to some sort of secondary high. Naturally this concern extends to the yen crosses as well. One of the more interesting charts at the moment is that of EUR/JPY. After finding support earlier this month at the 50% retracement of the April – June advance around 133.50 the cross has drifted below the 200-day moving average. This has set up a fairly clear potential head & shoulders topping pattern on the daily chart. Weakness under 133.50 would confirm a top of some magnitude and set the stage for a more important run lower. A move back over 138.00 in the cross is needed to invalidate the potential topping pattern and signal a resumption of the medium-term uptrend.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance