PPG Industries (PPG) Tops Q4 Earnings and Revenue Estimates

PPG Industries Inc. PPG logged net income from continuing operations of $267 million or $1.12 per share in fourth-quarter 2021, down from the year-ago quarter’s profit of $272 million or $1.14 per share.

Barring one-time items, adjusted earnings were $1.26 per share in the reported quarter, down from $1.69 logged in the year-ago quarter. However, the figure topped the Zacks Consensus Estimate of $1.19.

Net sales rose roughly 11.5% year over year to $4,190 million. The figure beat the Zacks Consensus Estimate of $4,030.5 million.

The company benefited from higher year-over-year sales in the Industrial Coatings segment in the quarter, led by selling price increases. It also witnessed strength in the Performance Coatings business. However, it faced headwinds from raw material cost inflation and supply-chain disruptions in the quarter.

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. price-consensus-eps-surprise-chart | PPG Industries, Inc. Quote

Segment Highlights

Performance Coatings: Net sales in the segment were around $2.5 billion in the fourth quarter, up around 16% year over year, driven by acquisitions and higher prices. Sales volume in the segment inched down around 2%. Selling prices rose 8% year over year.

Segment income declined roughly 19% year over year to $243 million. The downside was caused by raw material and logistics cost inflation, higher manufacturing costs and lower sales volumes, partly offset by increased selling prices along with restructuring cost savings.

Industrial Coatings: Sales in the segment totaled around $1.7 billion, up around 6% from the prior-year quarter’s figure of $1.6 billion. Sales volumes declined 8% year over year and selling prices were up 9% year over year.

Net income in the segment totaled $105 million, down around 63% year over year. It was lower than the previous year’s levels primarily due to raw material cost inflation and higher operating costs due to intermittent manufacturing outages as well as reduced sales volumes. The downside was partly offset by higher selling prices, restructuring cost savings and acquisition-related earnings.

FY21 Results

Adjusted earnings for full-year 2021 were $6.77 per share compared with earnings of $6.12 per share a year ago. Net sales increased 21% year over year to $16,802 million.

Financials

PPG Industries ended the fourth quarter with cash and cash equivalents of $1,005 million, down roughly 45% year over year. The long-term debt rose around 27.1% year over year to $6,572 million.

Outlook

While the company expects demand to remain strong, it apprehends supply and pandemic-related disruptions in the fourth quarter to continue in first-quarter 2022, affecting its ability to manufacture and deliver products. It also expects raw material cost inflation to persist along with higher logistics and labor costs. PPG Industries is undertaking measures to increase selling prices to offset the incremental inflation.

PPG Industries projects earnings per share (EPS) between 84 cents and$1.02 for first-quarter 2022. Adjusted EPS are expected in the range of $1.02-$1.20, excluding amortization expenses of 14 cents and costs related to earlier approved and communicated business restructuring of 4 cents.

The company expects aggregate net sales volumes to be down a mid-single-digit percentage on a year-over-year basis for first-quarter 2022. The corporate expenses are projected to be around $70 million. The first quarter is typically higher than other quarters. Net interest expenses are forecast to be around $25 million.

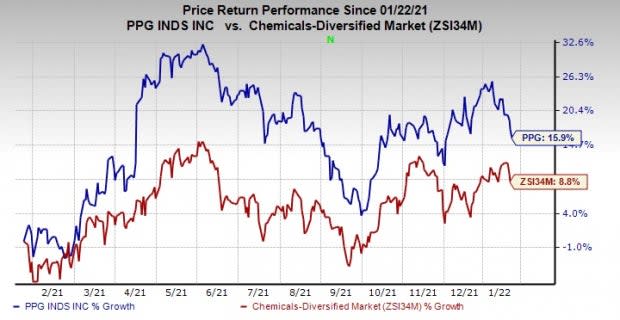

Price Performance

Shares of PPG Industries have rallied 15.9% in the past year compared with a 8.8% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

PPG Industries currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Albemarle Corporation ALB, Nutrien Ltd. NTR and AdvanSix Inc. ASIX.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 51.3% for the current year. The Zacks Consensus Estimate for ALB's earnings for the current year has been revised 5.4% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with the average being 22.1%. ALB has rallied around 25% over a year.

Nutrien, sporting a Zacks Rank #1, has a projected earnings growth rate of 51.4% for the current year. The Zacks Consensus Estimate for NTR's current year earnings has been revised 15.1% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 73.5%, on average. NTR has rallied around 33% in a year.

AdvanSix has a projected earnings growth rate of 3.9% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised 2% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with the average being 46.9%. ASIX has surged 85.1% over a year. ASIX sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance