US, European stocks hit in worsening Brexit selloff

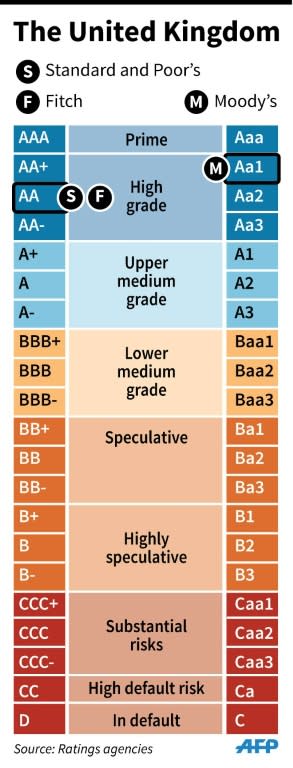

US and European stocks tumbled again Monday, while the pound fell to a three-decade low against the dollar as global markets reeled from Britain's vote to leave the European Union. Asian markets had steadied after Britain's surprise June 23 vote to abandon the European Union wiped $2.1 trillion off international equity values Friday. But investors embarked on a new wave of selling in European trade followed by a heavy sell-off on Wall Street, as they grappled with the financial consequences of the Brexit referendum. London's FTSE 100 index fell 2.5 percent at closing, masking steeper falls in key sectors likely to be affected by Brexit. Frankfurt's DAX 30 index and the CAC 40 in Paris both shed 3.0 percent, while the broad-based S&P 500 in the US dropped 1.8 percent. The two-day losses in the S&P 500 were $974.2 billion, the third worst back-to-back stretch in history, according to S&P Dow Jones Indices. "At this point, we know the implications of Brexit are negative for global markets, but absent a full understanding of what the exit will look like, markets are embracing a risk-off mentality and you're seeing that play out across the globe," said David Levy, portfolio manager at Republic Wealth Advisors. The dollar gained on both the euro and the pound, while oil prices retreated. - Britain downgraded - Before European markets had opened, Britain's finance minister, George Osborne, had sought to reassure Britain and its international partners that the country "is ready to confront what the future holds for us from a position of strength". Britain's economy is "as strong as could be," he said. Standard & Poor's stripped Britain of its coveted 'AAA' top rating, lowering it by two notches, and Fitch downgraded it a notch to 'AA'. Both credit rating agencies citing the Brexit vote as a game-changer. "The Brexit result could lead to a deterioration of the UK's economic performance, including its large financial services sector, which is a major contributor to employment," S&P said. The agency also noted risks to Britain's "constitutional and economic integrity" due to the possibility of a future referendum on Scottish independence. The pound skidded to $1.3121, its lowest level against the dollar since September 1985, before rebounding somewhat. Around 2100 GMT, the pound was at $1.3228. Nomura predicted a drop in the British currency below $1.25 or $1.30 was "very likely" in light of the questions over the British economic outlook. "The uncertainty generated from a lack of a functioning government in the UK, the lack of a roadmap of a new deal for the UK after its exit from the EU and the lack of clarity around the continuation of the British Union likely will weigh on investment into the UK," Nomura said. Banking shares were especially weak, with British giants Barclays and Royal Bank of Scotland plummeting a respective 17.4 percent and 15.1 percent. Banks on the continent tumbled on expectations of more low and negative interest rates. BNP Paribas and Deutsche Bank each lost more than 6.0 percent. Bank of America sank 6.3 percent and JPMorgan Chase 3.3 percent. The Brexit is expected to force large US banks to make costly changes to their European operations, which have been headquartered in London. British budget airline EasyJet, which warned of a Brexit hit to sales, plunged more than 22 percent. US travel-related shares were also in retreat. Priceline fell 3.7 percent, American Airlines 6.6 percent and Marriott International 4.2 percent, with analysts pointing to potential hits to corporate travel due to uncertainty over business investment in Europe. - Key figures around 2100 GMT - New York - DOW: DOWN 1.5 percent at 17,140.24 (close) New York - S&P 500: DOWN 1.8 percent at 2,000.54 (close) New York - Nasdaq: DOWN 2.4 percent at 4,594.44 (close) London - FTSE 100: DOWN 2.6 percent at 5,982.20 (close) Paris - CAC 40: DOWN 3.0 percent at 3,984.72 (close) Frankfurt - DAX 30: DOWN 3.0 percent at 9,268.66 (close) Hong Kong - Hang Seng: DOWN 0.1 percent at 20,227.30 (close) Tokyo - Nikkei 225: UP 2.4 percent at 15,309.21 (close) Shanghai - Composite: UP 1.5 percent at 2,895.70 (close) Sterling: DOWN at $1.3228 from $1.3670 on Friday Euro/dollar: DOWN at $1.1022 from $1.1112 Dollar/yen: DOWN at 101.99 yen from 102.21 yen

Yahoo Finance

Yahoo Finance