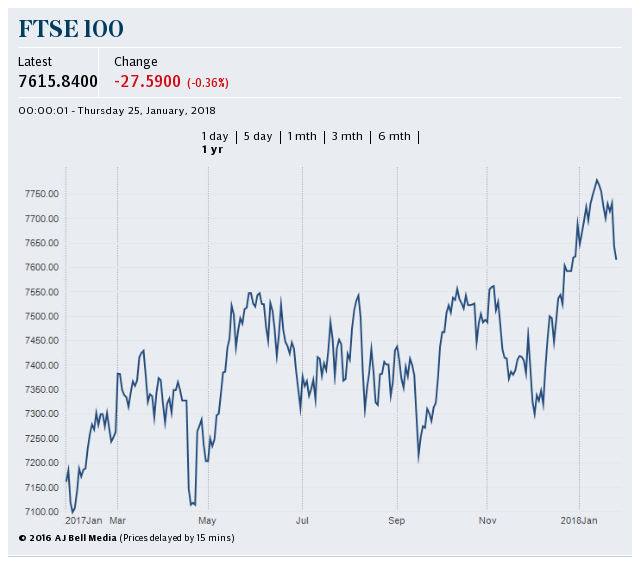

Pound shrugs off IMF cut to UK GDP growth forecast; FTSE 100 suffers heavy losses

The IMF has lowered its GDP growth forecast for the UK from 2pc to 1.7pc on "weaker-than-expected activity"

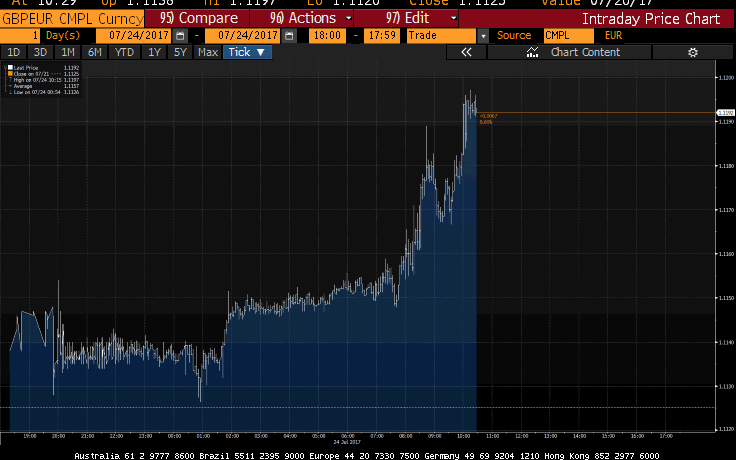

The pound has shrugged off the prediction, rising against the euro and dollar early on before consolidating its position in the afternoon

FTSE 100 slips 1pc with a stronger pound, the IMF downgrade, fluctuating oil prices and Ryanair's pessimistic outlook all hitting shares this afternoon

Markets wrap: Perfect storm causes FTSE 100 to slip 1pc

A stronger pound, the IMF cutting its UK GDP growth forecast and a number of sector-specific warning bells (most notably in the oil and aviation industries) combined today to knock investor sentiment in London. The FTSE 100 slipped 1pc to finish 75.18 points down to 7377.73, its third worst session in 2017.

Next dived 3.1pc after RBC Capital Markets warned clients that the retailer could be feeling the effects of the tough consumer backdrop until the second quarter of next year. EasyJet fell 2.8pc on rival Ryanair predicting a tough outlook for the second half of the year and Reckitt Benckiser slumped 3.3pc after it told shareholders that June's cyber attack had affected its results.

Other European markets closed mixed as the euro came off last week's Mario Draghi-inspired highs with the German car sector suffering most on the DAX.

Despite the IMF downgrade, sterling rebounded from last week's lows to advance 0.35pc on the dollar and 0.6pc on the euro, the latter slipping on disappointing PMI figures from this morning.

Joshua Mahony, market analyst at IG, commented on today's play:

"The FTSE has maintained and extended its early losses, as traders continue to move their assets into safe havens such as gold and the yen.

"Despite the euro and dollar largely consolidating today, the gains we have seen over recent months no doubt contribute to the underperformance seen in European equities in comparison to their US counterparts.

"As we move deeper into earnings season, the influence of a strong or weak currency will become increasingly apparent."

The long and winding road of electric car adoption

With Volvo announcing that it will go all electric from 2019 and Elon Musk's Tesla Model 3 coming to market earlier this month, Serla Rusli has put together a guide on current health of the electric car industry.

Drinks giant Campari makes largest ever disposal with $165m Irish drinks sale to US rival

America’s largest independent spirits company Heaven Hills Brands has snapped up the Carolans and Irish Mist brands from rival Campari in the seller’s largest ever disposal.

Both Carolans Irish Cream and Irish Mist will transfer to Kentucky-based Heaven Hills as part of the deal, which is based on an enterprise value (including debt and equity) of $165m (£126.5m).

The two whiskey liqueur brands, which will change ownership in August, registered total net sales of €34m in 2016, equivalent to just 2pc of turnover for Campari.

The drinks’ core market is the US, accounting for 70pc of sales. Carolans is the second-largest selling Irish cream whiskey drink worldwide.

As part of the transaction, Campari will continue to distribute the drinks outside the US but Heaven Hills, which was founded in 1935 by the Shapira family, will take control of production.

Read Bradley Gerrard's full report here

US PMI reading fails to alter momentum on the currency markets

The encouraging PMI figures out of the US has failed to move the dollar much this afternoon.

Sterling has stabilised around the $1.3030 mark against the greenback and is trading 0.6pc higher at €1.1194 against the euro, which has come off Friday's highs due to its own slightly disappointing PMI figures released this morning.

US markets

The Dow Jones has started the week "in fairly sleepy fashion", according to Spreadex analyst Connor Campbell. The Nasdaq is flat while the Dow Jones and S&P 500 have nudged down early on.

He added on today's play in the US:

"There wasn’t a great amount of change this afternoon, the Dow Jones starting the week in fairly sleepy fashion. A pair of decent PMIs – the manufacturing reading outperformed estimates at 53.2, while the services figure slightly disappointed at 54.2 – made little difference to the Dow Jones or dollar this Monday.

"That’s arguably because both have bigger things to worry about this week. The Dow is staring at a very busy earnings calendar, the highlight being tonight’s second quarter report from Google-parent Alphabet. As for the greenback, Wednesday sees the month’s Federal Reserve meeting, with the currency on the lookout for any hawkish hints to help rescue it from a sour summer."

Seven reasons why home working is the future

Sophie Christie has put together a list of all the reasons why working from home could be the future. And yes, commuting and trains feature heavily.

Sharpest US private sector output expansion in six months, according to IHS Markit

The US private sector's output experienced its sharpest expansion in six months in July, IHS Markit has revealed this afternoon.

The flash US Composite PMI Output Index came in at 54.2 in July, up from 53.9 in June. IHS Markit said that a pickup in business activity growth, driven by a steep increase in manufacturing production, aided the expansion.

Its chief business economist Chris Williamson commented:

“The July PMI surveys show an economy gaining growth momentum at the start of the third quarter, enjoying the strongest monthly improvement in business activity since January.

“The overall rate of expansion remains modest rather than impressive. The surveys are historically consistent with annualized GDP growth of approximately 2%, but the signs are that growth could accelerate further in coming months."

He added that the main weakness in the economy continues to be exports with a slight drop in foreign goods orders.

McColl's retenders £2bn Nisa supply deal in blow to planned Sainsbury's takeover

Convenience chain McColl’s has confirmed it is retendering its £2bn supply deal with retailer Nisa, in a potential blow to Sainsbury’s planned £130m takeover of Nisa.

McColl’s has emerged as the unlikely kingmaker in Sainsbury’s swoop on Nisa, as the 1,300-store group provides almost two fifths of Nisa’s revenues through a five-year supply deal set to expire next year.

Industry insiders have questioned whether Sainsbury's will still want Nisa if it loses the contract.

The Sunday Telegraph first reported that McColl’s was considering severing its links with Nisa and was understood to have met with Sainsbury’s executives to discuss potential sweeteners to the deal.

Analysts believe McColl’s could itself be a takeover target, as the major grocers jockey to grab a share of the fast-growing convenience market, with Tesco also trying to buy Londis and Budgens-owner Booker for £3.7bn.

Read Iain Withers' full report here

FTSE 100 on course for third worst session this year

The FTSE 100 is on course for its third worst session this year as a deluge of factors weighs on stocks. The blue-chip index is being hit generally by the IMF growth downgrade and the pound's modest gains but a host of sector-specific factors are also impacting equities.

Ryanair's pessimistic outlook for the second half of the year has hit the big airliners in London while a fluctuating oil price today due to the OPEC meeting in St Petersburg has hurt BP and Shell.

Overall the index is nearly 1pc down, dropping 73.60 points to 7379.31.

Earnings season to be main focus this week; US PMI data due soon

A five-year high in earnings and revenue beats for the S&P 500 in Q2https://t.co/fEzGXh5MZG

via BAML pic.twitter.com/fmdCeKz0e5— Downtown Josh Brown (@ReformedBroker) July 24, 2017

US stocks will follow their European counterparts and open weakly this afternoon, according to Craig Erlam, senior analyst at OANDA.

He said on this week's action over in the US:

"Earnings season is likely to be the main focus this week, with 189 S&P 500 companies scheduled to report, as well as plenty more from across the pond.

"With indices in the US trading at record highs and central banks favouring a less accommodative stance, earnings will become increasingly important in maintaining or expanding on these levels, particularly in the continued absence of the growth policies that won Donald Trump the US election last November."

There is a bit more economics data for traders to digest this week with US PMI figures due this afternoon at 2.45pm (BST).

This morning's Eurozone PMI figures showed a slight softening in the main composite reading but analysts maintained that the slight drop was a blip rather than the start of a downward trend on the continent.

Earnings season preview

While the big US companies have been reporting its latest quarterly figures for the past few weeks now, here in UK the corporate calendar only gets in full swing again this week.

Results from ITV, GlaxoSmithKline, Sky, Shell, Lloyds, Astrazeneca, BT and Barclays are all due later this week with Google's holding company Alphabet in the US due to report this evening.

Thus far in the US, earnings season has brought mixed results but banking stocks in the UK have been boosted by results across the pond.

CMC market analyst Michael Hewson believes, however, that weak investment banking revenues could weigh on Barclays' results:

" One of the more notable takeaways from the recent US bank trading updates was how investment banking profits had improved in the aftermath of the election of Donald Trump as US President last November.

"This reflation premium certainly helped Barclays at the end of last year and in the first quarter of this year, however this premium has disappeared in the last three months, so much so we saw that Goldman Sachs saw a 40% decline in its FICC division revenues, as turnover declined and the yield curve flattened.

"With M&A activity also muted it seems likely that there we could see revenue undershoot here as well. As far as Barclays is concerned it is quite likely that we’ll see a similar effect play out, which means its UK business will need to take up the slack, and while the UK economy appears to be having a better Q2 than Q1, concerns about rising consumer debt are starting to rise."

SThree looks overseas as UK jobs market slows

Reforms in the public sector and Britain’s decision to leave the European Union resulted in UK companies scaling back their hiring in recent months, according to specialist recruitment agency SThree.

The firm said gross profits for its UK and Ireland arm were down 16pc to £27m in the six months to May 31 because of a “dampened” performance across sectors.

Gross profit fell in all industries apart from engineering, which grew 9pc. However, SThree said it would “cautiously invest” in the UK and Ireland arm “to maximise market opportunity”.

SThree specialises in jobs in science, technology, engineering and mathematics.

However, overall revenues at the firm were up almost 17.5pc to £521m in the period, thanks to a stronger performance in the US, its fastest growing region.

Read Rhiannon Bury's full report here

IMF GDP growth forecast downgrade reaction: Brexit talks still the key to growth

IMF cuts 2017 UK growth forecast to 1.7% from 2%, the biggest downward revision this year of all major economies. pic.twitter.com/48gEFXGwUo

— Jamie McGeever (@ReutersJamie) July 24, 2017

Brexit talks are still the key factor that could weigh on the economy and that has been factored in by the IMF, according to Mihir Kapadia, chief executive at Sun Global Investments.

He added:

“With the IMF’s growth forecast for the UK cut from 2% to 1.7% for the year, this means there is again a focus on the debate about the effect of Brexit on the country’s business. While the IMF’s downgrade has been based on ‘tepid performance’, the ultimate impact of Brexit continues to remain unclear.

"The key factor which threatens to derail the economy and significantly reduce market confidence is the potential for either the Brexit talks collapsing or reaching stalemate. At the moment, there appears to be negligible progress on the talks and the IMF certainly would have factored the risk of talks stalling in reducing their economic growth forecast.”

Spreadex commentator Connor Campbell said on the IMF's impact on the FTSE 100 today:

"The FTSE’s losses really stepped up a gear this morning, the index hurt by the pound’s own growth. With the IMF’s downward revision to the UK’s 2017 growth forecasts already weighing on the FTSE, the improvement in sterling’s fortunes only served to make the index more miserable this Monday, leading to a 1%-plus plunge.

"Those losses forced the FTSE back below 7400, with other issues like easyJet’s 3% fall – caused by news that Ryanair is set to slash its fares after it secured lower fuel prices for the next 2 years – and a dismal showing from the commodity sector also playing their part."

German car makers' shares crash on allegations of collusion

Germany’s biggest car manufacturers shares plunged in early trading as investors digested allegations about decades of collusion between Volkswagen, BMW and Daimler.

Investors dumped the shares after reports, which first appeared in the German press late on Friday afternoon, claiming the companies may have secretly worked together on technology, forming a cartel that could have led to the “dieselgate” emission scandal.

The allegations come just days after Daimler recalled more than 3m of its Mercedes Benz cars for work to lower their emissions. The week before, Audi - which is owned by Volkswagen - recalled 850,000 vehicles.

Read Alan Tovey's full report here

Lunchtime update: FTSE 100 flounders as 'host of drivers' batters sentiment

It's been a dismal start to the week for the equity markets in Europe.

The pound has recovered some of the ground it lost against the euro and dollar last week but that is by no means the only thing weighing on the FTSE 100 today.

Traders woke up to news this morning that the International Monetary Fund has downgraded its GDP growth forecast for the UK and US while upgraded its outlook on the main economies in the Eurozone.

A topsy-turvy day for the oil price has sunk BP and Shell to the bottom of the blue-chip index despite Brent crude recovering to the mid-$48 per barrel mark just before lunchtime after Saudi Arabia indicated that it will undergo further export cuts in August.

A "host of drivers" are weighing on sentiment in Europe today, according to head of research at Accendo Markets Mike Van Dulken:

"The IMF has cut growth forecasts for the UK and US. The EUR remains strong, adding to German auto collusion claims. White House uncertainty persists. An OPEC/NOPEC production cut meeting is underway. A Fed policy update looms large and we are right in the midst of a hitherto mixed earnings season."

Here's the current state of play in Europe:

FTSE 100: -1.01pc

DAX: -0.47pc

CAC 40: -0.08pc

IBEX: -0.30pc

Oil price yo-yos as traders make sense of OPEC meeting

For those who were expecting big news out of the meeting: here it is: Saudi to go it along! #oil#OPEChttps://t.co/LyB2dsrDob

— Anas Alhajji (@anasalhajji) July 24, 2017

RUSSIAN ENERGY MINISTER NOVAK SAYS COMMITTEE HAS RECOMMENDED TO EXTEND CUTS AFTER Q1 IF NEEDED#OOTT

— *Walter Bloomberg (@DeItaOne) July 24, 2017

Oil cartel OPEC has met in St Petersburg today as concerns mount that compliance on output cuts is starting to waver and that OPEC production will increase in July.

In the last half an hour the price has jumped 1.3pc higher to around $49.70 per barrel after Saudi Arabia indicated that it would make deeper cuts to its exports in August and will monitor compliance levels among the other OPEC producers.

Reckitt Benckiser sales take a knock after crippling cyber attack

Consumer goods giant Reckitt Benckiser has said sales will be lower this year as it comes to terms with a cyber attack that ravaged its systems last month.

Reckitt said the fallout from the Petya cyber attack that spread across Europe had been exacerbated by “challenging” trading conditions as it downgraded its full-year revenue growth target from 3pc to 2pc.

Chief executive Rakesh Kapoor said the company was working on securing itself at a “much higher level” following the attack, which halted production, shipping and invoicing at a number of Reckitt sites in Europe.

The FTSE 100 company’s shares dipped more than 2pc in early trading as it published its half-year report, in which it also revealed it had taken a £318m provision to cover the costs of a potential US investigation into the pharmaceuticals business it spun off in 2014.

Read Sam Dean's full report here

Imagination Technologies rises Chinese takeover

Imagination Technologies has risen 6.5pc today as investors digest a report in The Sunday Telegraph that the company has become a takeover target for a private equity fund backed by the Chinese Government.

The company's share price collapsed in April when Apple, which accounts for around 50pc of Imagination's revenue, announced that it will no longer be using its graphics chips.

Imagination put itself up for sale in June and the Beijing-funded Canyon Bridge Capital Partners has since held talks over a potential bid.

Read Christopher Williams' full report here

Miners plummet on FTSE 250

Acacia Mining and Petra Diamonds have plummeted on the mid-cap FTSE 250 index this morning with the former still suffering from its update on the Tanzania dispute from Friday and the latter cutting its production guidance for the year.

Acacia has fallen a further 11pc this morning after brokers gave their take on its Tanzania troubles. The miner told the market on Friday that it has agreed to pay a new royalty rate in the African country, which had banned the export of gold concentrate.

Meanwhile, Petra has fallen 9.6pc as management warned shareholders that its production guidance will be lower and spending and debt has increased at a higher-than-expected rate.

Jon Yeomans' full report on Petra can be read here

Ryanair fares set to fall further as it locks in fuel savings

Ryanair has pledged to cut fares further after it locked in lower prices for its fuel needs for the next two years.

The low-cost carrier said its fuel bill dropped in the past three months even though passenger numbers rose 12pc to 35m. It has also managed to secure further savings that it will pass on to customers.

Chief executive Michael O'Leary said 90pc of its fuel requirements were hedged next year at $49 per barrel and that it had taken advantage of recent price dips to increase its hedging level in the first half of 2019 to 45pc at $48 per barrel, giving it firepower to charge less for its flights. Brent crude, the European benchmark, is currently trading around $48.18 a barrel.

Over in Dublin, the no-frills airline is down 2.3pc to €17.62 this morning.

Read Bradley Gerrard's full report here

Euro comes off highs against the pound and dollar

As traders digest the slight dip shown in the Eurozone PMI data this morning, the pound has advanced on the euro, which has also come off Friday's highs against the dollar as well.

The pound is 0.6pc higher against the euro this morning, trading at €1.1192. Sterling has also made gains on a dollar pushed down by the growing political quagmire across the pond and the IMF's weaker GDP forecast. The internationally-focused FTSE 100 has fallen below 1pc in response to the pound's advances in the last hour.

Much of the pound's movement on the greenback this week is likely to be dictated by events in the US, however, with the Federal Reserve's monetary policy meeting an opportunity for investors to put the central bank's tapering plans in focus.

FTSE 100 has had a 'rude awakening to the new week'

The FTSE 100 has had a "rude awakening to the new week" with last week's gains "clearly left in the rear-view mirror", commented IG market analyst Josh Mahony.

He added on how today's play across the channel is being affected by the fresh Eurozone PMI data:

"Coming off the back of an ECB meeting where the markets failed to believe Draghi’s dovish rhetoric, we are seeing a picture of weakening economic data support the fact that we may actually have longer to wait for the hawks to gain control in Frankfurt.

"With the appreciation of the euro dragging inflation expectations lower, we are also seeing eurozone exporters suffer in an environment of cheaper imports and more expensive exports."

UK airliner shares hit as Ryanair warns of tougher second half

Despite a 13pc increase in its revenue, Ryanair has cautioned that the timing of Easter helped offset the negative effect of sterling and lower bag revenue. The wary trading update from the Irish airliner has hit IAG and easyJet shares already wounded from the latter's interim results last week and a read across from the Lufthansa sell-off in Germany.

Ryanair did say that it expects to step up the price war in the industry as it passes fuel savings onto customers through lower fares.

Neil Wilson, ETX Capital market analyst, commented:

The caution for the rest of the year that we’ve seen from other airlines was replicated by Ryanair. While airlines have had a pretty good start to 2017, they’re pretty downbeat about the second half and this is spooking investors. Ryanair thinks average fares will decline by 8% in the second half.

"It continues to warn over Brexit: warnings about flights between the EU and UK being grounded look a tough overblown but there is just cause for concern in terms of how any post-Brexit settlement for the sector affects its costs and operations. Finally a lot hinges on strikes, the weather and the security situation in Europe.”

FTSE 100 underperforming European peers

European markets are still smarting from last week's surge in the euro but are outperforming the FTSE 100 this morning.

The two oil giants, BP and Shell, are dragging most on the index early on as the price of crude steadies around the $48 per barrel mark. Only a handful of stocks remain in positive territory with GlaxoSmithKline, Astrazeneca and Vodafone also suffering the heaviest losses.

Also, here's Pantheon Macro's take on the Eurozone PMI data:

"Momentum in the Eurozone economy slowed at the start of Q3, but the overall message from the PMI remains one of robust growth in the private sector.

"The key story from PMIs is that the economy remains resilient, but also that the pace of growth slowed significantly at the start of Q3. Growth in new manufacturing orders, for example, rose at its slowest pace since January.

"This supports our suspicion that the consensus notion of EZ GDP growth accelerating to a sustained pace above 2% is too optimistic. That said, the PMIs continue to signal that growth remain strong enough to propel employment growth, indicating that the business cycle upturns remains resilient."

Reckitt Benckiser 'remains in good shape', says Hargreaves Lansdown; shares fall 1.65pc in early trading

Reckitt down 1.6%, not much new in update and nothing to say buy. Profittaking after strong run may continue a little longer.

— Rodney Hobson (@RodneyHobson) July 24, 2017

Reckitt Benckiser is languishing among the sharpest fallers on a stumbling wider market this morning following the release of its second-quarter results.

Shares have dipped 1.65pc to £77.53 but Hargreaves Lansdown manager of select funds believes that the consumer goods giant is still in good shape despite like-for-like growth being hit by June's cyber attack on the company:

"Reckitt has had a lot to contend with lately. In Korea the group’s product liability issues roll on, whilst in India a new Sales Tax is distorting revenue patterns for all major consumer goods players currently. In the US, the group has had to set aside over $300m to cover a dispute with the DoJ relating to their former pharmaceuticals division. Lastly, RB was badly affected by the recent wave of cyber-attacks, leading to production shutdowns, which will take until August to fully rectify.

"Despite all of this, the group remains in strong shape, with margins over 20% and the benefits of integrating Mead Johnson still to come. Growth should pick up in the second half as the group launches a wave of new products, ranging from Probiotic chocolates to disinfectant wipes."

Eurozone PMI 'still points to fairly strong growth'; strong recruitment signals optimism

The slight drop off in the Eurozone PMI figures released today "still points to fairly strong growth", according to Capital Economics.

Its European economist Jack Allen commented:

"In all, the Eurozone PMI suggests that the economy grew at a decent pace at the beginning of Q3, which if sustained should make the ECB more comfortable about tapering its asset purchases in the first half of next year.

"But with inflationary pressure still subdued, as signaled by the PMI input and output price indices, we still think that it will leave interest rates at their current levels until 2019."

Flash #Eurozone#PMI saw one of largest increases in employment in past decade. Factories job gain was 2nd highest on record. pic.twitter.com/OTSouHhLeh

— Chris Williamson (@WilliamsonChris) July 24, 2017

IHS Markit said that strong recruitment in the region signaled that steady order book inflows and continuing optimism over the Eurozone's outlook.

Eurozone PMI reading hits six-month low; 'recent growth spurt lost momentum'

tEconomics: #Euro Markit Composite PMI Flash at 55.8 https://t.co/jq1znrdldSpic.twitter.com/bsq6kl1Tvk

— Value's Vector (@pulpmarkets) July 24, 2017

The Eurozone's recent "growth spurt lost momentum" but "still remained impressive" in July, according to new data released this morning from IHS Markit.

The Eurozone PMI Composite Output Index for July came in at 55.8, a fall from 56.3 in June and a six-month low.

Chris Williamson, chief business economist at IHS Markit, said that the indications are that the region's recovery has merely hit a speed bump, however:

"The July fall in the PMI indicates that the eurozone’s recent growth spurt lost momentum for a second successive month, but still remained impressive.

“The slowing pace of economic growth signalled by the surveys and the accompanying easing of price pressures adds to the belief that ECB policymakers will be in no rush to taper policy, and will leave all options open until the central bank sees a clearer picture of the sustainability of the upturn.

“It’s too early to know for sure whether the economy has merely hit a speed bump or whether the upturn is already starting to fade. The evidence so far points to the former, with the economy hitting bottlenecks due to the speed of the recent upturn."

Brent crude trading below $48 per barrel as OPEC meets on production cuts

Brent crude is trading at below $48 per barrel this morning as concerns grow that oil cartel OPEC's production cuts won't be enough to shift the glut of oil keeping prices low.

The price fell sharply on Friday after a Reuters report revealed that OPEC production will likely increase in July with fears that this could increase as compliance among members begins to ebb.

Michael Hewson, CMC Markets analyst, commented:

"For all recent talk of compliance with production cuts most commentators know that it is Saudi Arabia that is doing all the heavy lifting, and with Libya and Nigeria excluded from the numbers the perception was that the output extension, agreed in May was always a paper tiger.

"With Ecuador breaking ranks last week to increase its production on the grounds it needs the money, today’s meeting in St. Petersburg could open up further splits if bigger OPEC members decide they could do with the extra revenue for higher output."

FTSE 100 'hurt by comments from the IMF'; European markets continue sell-off

IMF says Brexit will have a "mild negative" affect on the UK economy. Not quite as bad as Mme Lagarde spelt out in 2016 (1/2)

— steve hawkes (@steve_hawkes) July 24, 2017

Sterling has given a "more measured" response than the FTSE 100 to the IMF cutting the UK's GDP growth forecast for 2017 to 1.7pc, according to Spreadex analyst Connor Campbell.

He said:

"Of course the FTSE wasn’t best pleased about this news, dropping half a percent to complete the shedding of all of the growth managed in the back half of last week.

"Sterling was more measured in its response to the IMF update, sitting flat (just) above $1.30 against the dollar while pushing 0.2% higher against the euro. However, that still leaves the pound at its worst price since last November against the latter."

IMF’s growth forecast cut underscores need to increase productivity says UK

UK government spokesman replying to IMF's GDP forecast cut 2...— Denis Denisov (@betiforex_com) July 24, 2017

The euro advanced on the pound on Thursday after ECB president Mario Draghi's dovish appearance at the central bank's policy meeting couldn't dissuade investors that it will soon announce the tapering of its bond purchasing programme.

Although the IMF has upgraded its GDP forecasts for several Eurozone countries, European markets have fallen this morning as last week's sell-off inspired by the euro's strength hitting its big exporters continues.

Agenda: Pound shrugs off UK GDP growth downgrade from IMF

Good morning and welcome to our live markets coverage.

This morning sterling has brushed off the International Monetary Fund downgrading the UK's GDP growth forecast for the year from 2pc to 1.7pc due to "weaker-than-expected activity".

While the US also saw its forecast slashed as fears that president Donald Trump will struggle to implement his economic stimulus plan, the IMF said that the outlook in several Eurozone countries was better than initially expected.

IMF downgrades UK growth on #Brexit. scenarios depend on outcome of negotiations. #IMF mildly negative at moment.

— Tony Addison (@TonysAngle) July 24, 2017

Against the euro this morning, the pound is trading slightly higher at €1.1162, a 0.3pc rise, but still remains around the eight-month low it hit at the end of last week. Against the dollar, the pound has pushed back over $1.30 this morning.

Eurozone PMI readings due this morning are likely to dictate some movement later on.

The FTSE 100 has picked up from where it left off at the end of last week, falling another 0.36pc in early trading.

Reckitt Benckiser has kicked off a packed corporate calendar this week with a mixed first-half performance. Although the consumer goods giant reported a rise in profit, like-for-like growth fell 2pc as it deals with the fallout from the cyber attack it faced last month.

Interim result: Reckitt Benckiser Group, Dialight, Ascential

Full result: Tungsten Corporation

AGM: Solo Oil, Specialist Investment Properties

Trading statement: Cranswick

Economics: Existing home sales (US), flash PMIs (EU)

Yahoo Finance

Yahoo Finance