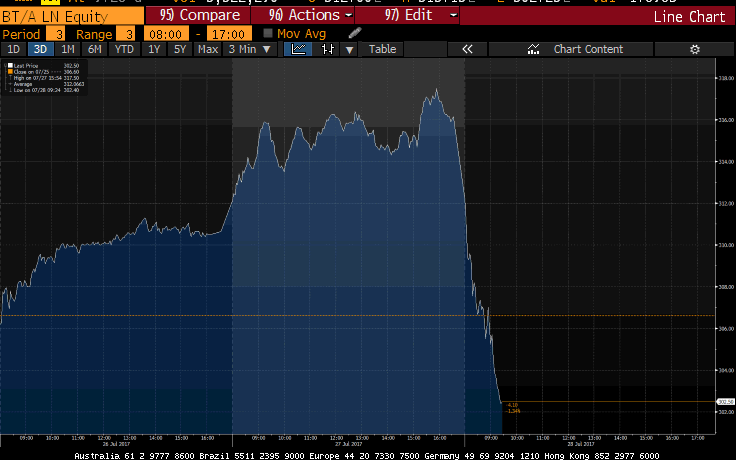

FTSE 100 tobacco giant plunges as FDA announces plan to cut nicotine to non-addictive levels

British American Tobacco plunges following FDA announcement that it will look to reduce nicotine levels to non-addictive levels

Euro advances on the pound as France and Spain post strong GDP figures

Sterling moves higher against the dollar as Trump's healthcare reforms flounder

Markets wrap: Tobacco shares dumped as radical FDA plan looms over industry

Shares in the FTSE 100's two tobacco giants, British American Tobacco and Imperial Brands, have nosedived this afternoon after the FDA in the US proposed reducing nicotine in cigarettes to non-addictive levels.

Heavily-exposed to the US market, BAT plunged as much as 14pc in intraday trading before finishing 6.8pc down as investors pondered the impact of the plan on future earnings. The heavily weighting of the tobacco companies dragged down a FTSE 100 already firmly in the red for the day with pharma giant AstraZeneca rebounding 3.6pc following Thursday's sell-off.

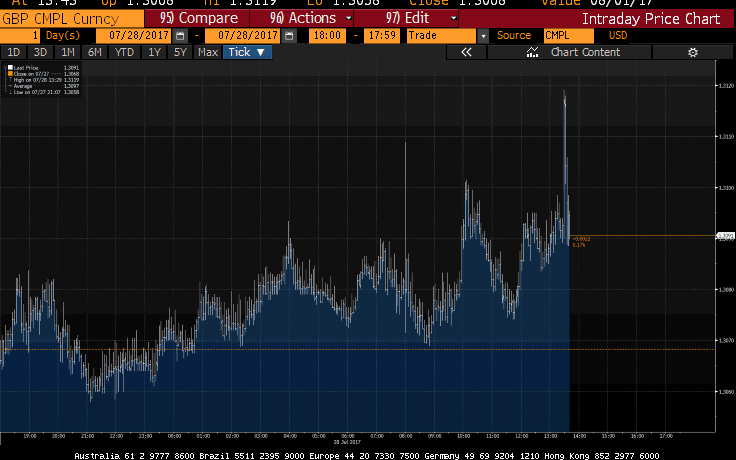

The pound is 0.4pc higher against the dollar this afternoon as US GDP growth figures coming in broadly in line with markets expectations could't help the weakened greenback. It is currently trading at $1.3120.

Finally, if you nodded off this afternoon and couldn't dump your BAT shares quick enough, Mike Van Dulken, head of research at Accendo Markets, has these comforting words:

"This may be an over-reaction, however.

"Firstly, this is a plan to start a public dialogue focused on protecting children and reducing tobacco related disease and death.

"Secondly, the fine print suggests balancing regulation of existing products with encouraging innovation for future less harmful options.

"Thirdly, there may be exemptions and delayed implementation of existing rules that offers some relief.

"Fourthly, it may require input from other bodies.

"Lastly, never underestimate the lobbying power of the might tobacco industry."

That's it for this week's markets coverage, we'll be back bright and early on Monday morning!

Tobacco shares are getting obliterated on this FDA news. https://t.co/Yf8QcNtlbPpic.twitter.com/gscCYkN8cP

— Joe Weisenthal (@TheStalwart) July 28, 2017

Brent crude caps strong week by breaking through $52 per barrel barrier

Brent crude has hit its highest level in two months as it remains on track for its best week this year. It is currently trading at $52.50 per barrel after US stocks data showed a sharper drawdown than expected and OPEC pledged to step-up compliance .

FDA nicotine reduction plan reaction: Hard to overstate what this could mean

Today @US_FDA announced a new regulatory plan to lower the burden of tobacco-related disease & death: https://t.co/vMnl65JIzUpic.twitter.com/ggwcHS9c0R

— FDA Tobacco (@FDATobacco) July 28, 2017

This one's woken up the traders and analysts from their Friday afternoon slumper.

Here's ETX Capital senior market analyst Neil Wilson's take:

It’s hard to overstate what this could mean for the companies affected: non-addictive levels of nicotine would likely mean a lot fewer smokers and of those people who do still light up, smoking a lot less. This will blow a hole in their earnings and forces a fundamental re-evaluation of earnings.

To be honest, I'm not sure the 8pc fall that British American Tobacco has faced today quite does justice to the long-term impact this could have on earnings.

FDA: Tobacco the only legal consumer product that will kill half of users

Nicotine is highly addictive and is most harmful when delivered from combustible cigarettes. pic.twitter.com/8accsdJbVR

— FDA Tobacco (@FDATobacco) July 28, 2017

Here's what the FDA Commissioner Scott Gottlieb said on the FDA's plan:

“The overwhelming amount of death and disease attributable to tobacco is caused by addiction to cigarettes – the only legal consumer product that, when used as intended, will kill half of all long-term users.

“Unless we change course, 5.6 million young people alive today will die prematurely later in life from tobacco use. Envisioning a world where cigarettes would no longer create or sustain addiction, and where adults who still need or want nicotine could get it from alternative and less harmful sources, needs to be the cornerstone of our efforts – and we believe it’s vital that we pursue this common ground.”

A quick sitrep on the tobacco stocks on the FTSE 100: British American Tobacco is now 8pc down while Imperial Brands is 6.5pc lower.

British American Tobacco shares tank 9pc as FDA looks to reduce nicotine to non-addictive levels

The big London-listed tobacco makers are tanking in reaction to the FDA's announcement.

British American Tobacco, with its huge exposure to the North American market, is down over 9pc and Imperial Brands has shed some 6.2pc.

The heavy weighting of BAT in particular will pull down the FTSE 100 even further into the red.

British American Tobacco shares nosedive as FDA signals that it will look to bring nicotine down to non-addictive levels

Well this is quite something.

The FDA in the US has said in the last few moments that it is looking into reducing nicotine in cigarettes to non-addictive levels. If achieved it would be a hammer blow to the tobacco industry. British American Tobacco shares plunge as traders react.

Wow ...#FDA to begin public discussion about lowering nicotine in cigarettes to less than addictive levels https://t.co/83upOlF6Rtpic.twitter.com/HltAGfh25J

— C. Michael Gibson MD (@CMichaelGibson) July 28, 2017

Clipper Logistics warns of staff shortage as revenues and profits jump

Clipper Logistics has warned of a shortage of staff to work in warehouses amid increasing demand for click and collect shopping services.

The company, which works with retailers to deliver goods from warehouses to stores, said after the vote to leave the European Union it had seen a decrease in the number of people available to work.

Tony Mannix, the company’s chief executive, said the company has had “a bit of a challenge with people,” attributing the fall to fewer overseas workers coming to the UK.

“What we’re starting to see is the number of available agency staff is less than it was,” Mr Mannix said.

Read Rhiannon Bury's full report here

US GDP reaction: Economy has improved in spite of lack of fiscal stimulus

The slowing of the rate of acceleration of US GDP on that chart (see pr) means the #Fed may have a bit more time to hike rates.

— David Durand (@SunAndStormInv) July 28, 2017

After an afternoon of choppy trade, the dollar is pretty much back where it started against the pound, 0.1pc down, but its drift lower against the euro is steadily continuing.

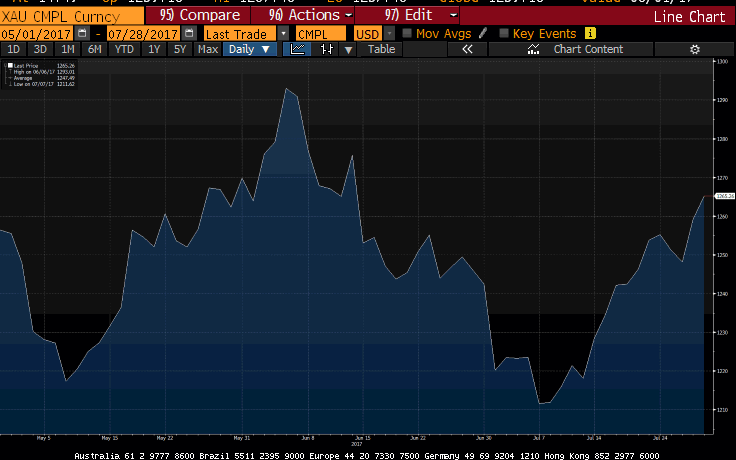

The dollar has now fallen 0.5pc against the euro today while Gold has risen to a six-week high after the GDP release and is trading at $1265 per ounce.

Chief investment officer at Close Brothers Nancy Curtin commented on today's US GDP data:

"The US economy has improved following a slow start to the year, in spite of a lack of fiscal stimulus so far from Trump’s presidency. A strong performance in export and industrial sectors has been buoyed by weaker dollar, and we’ve seen a steady increase in earnings too.

"We’re still some way from the President’s 3%+ growth target, but the good news is this wasn’t priced in by the market, so any additional tax relief or infrastructure spending could support markets into year end.

“Despite improving growth, wage inflation remains somewhat elusive, but the labour market remains reasonably strong, and we anticipate the Fed will proceed as planned with its slow and steady programme of interest rate normalisation.”

Inheritance tax haul hits record high as house prices climb

Families paid the taxman £4.84bn in inheritance tax last year, a record high as house prices and the stock market climbed.

Tax payments increased by 4pc on the year as household wealth increased, HM Revenue and Customs said, but the level at which inheritance tax kicks in held steady at £325,000.

The government had only expected to bring in £4.7bn, so the rising number represents an extra windfall for the Treasury.

The pace of the increase, which does not account for inflation, has slowed - in the previous year an unusually high number of winter deaths helped drive up inheritance tax payments by 22pc - but remains on the upward trajectory the levy has followed since 2009-10.

Read Tim Wallace's full report here

US GDP reaction: Good but not good enough to rescue weak dollar

US GDP growth driven by personal consumption, which increased 4% in Q2. Investment modest rise, inventory build will likely support Q3, Q4

— Daniel Lacalle (@dlacalle_IA) July 28, 2017

Are today's figures enough to prompt the US Federal Reserve to believe that the economy is strong enough to handle monetary policy tightening?

Not according to Ranko Berich, head of market analysis at Monex Europe, and that's why the dollar remains stubbornly weak following today's release.

He added:

"The issue with today’s figures isn’t that they’re particularly bad or even discouraging, but that they just don't provide any justification for a hawkish approach from the Fed.

"The US dollar strength we’ve seen over the last few years has been predicated on expectations of sustained or widening monetary policy divergence. With other G10 economies now performing relatively well, and various central banks edging towards normalisation, the impetus for USD strength is disappearing rapidly.

"It is likely to continue to do so while as the outlook for policy divergence narrow further."

US GDP reaction: This should convince the Fed that the real economy remains in good shape

US #GDP +2.6% Q2: Consumer spend +2.8% & biz invest +5.2%. Inventories +0pp & trade +0.2pp. Solid & compensates weakQ1. Still 2% growth mode pic.twitter.com/zytU1uiQGW

— Gregory Daco (@GregDaco) July 28, 2017

The US' 2.6pc annualised growth in the second quarter driven by a rebound in real consumption growth should convince the Federal Reserve that the real economy remains in good shape even as core inflation remains weak, Capital Economics US economist Andrew Hunter said on this afternoon's figures.

He added:

"Looking ahead, the strengthening labour market should continue to support real consumption growth, while the business surveys remain at a high level and suggest that investment will continue to recover.

"Accordingly, we still expect GDP growth of 2.5%-3.0% over the rest of this year which, along with the declining unemployment rate, should leave the Fed on track to raise interest rates once more before year-end."

US 2Q #GDP miss 2.6% (cons: 2.7%) + downward 1Q revision + softer employment cost index = painful for #USD. Canada on the other hand $CAD...

— Viraj Patel (@VPatelFX) July 28, 2017

Pound and euro retreat on dollar as market settles on GDP figures

For once, what we see with US GDP (+2.6%) is what we get (inventory effect was close to zero, so real final sales also up 2.6%). As expected pic.twitter.com/n5VNr1NyTm

— the belgian dentist (@belgiandentists) July 28, 2017

The currency markets seem a little confused on this one. While the pound and euro spiked against the dollar immediately following the release, they have both retreated to around where they were pre-release after about five minutes or so.

Although Bloomberg's survey estimated growth of 2.8pc on an annualised basis, there was a bit of a spread in terms of estimates. Some are calling it a beat, some a miss. The currency markets seem to have settled on that it was broadly in line with expectations.

Pound spikes as US economy grows 2.6pc in the second quarter

The pound has spiked above $1.31 against the dollar after US GDP growth came in at 2.6pc on an annualised basis, missing Bloomberg's survey of economists' forecast of 2.8pc.

Office provider Workspace raises £200m to fund expansion

Office provider Workspace has raised £200m through a private share placing as it looks to take advantage of changing working habits.

The firm, which has 69 office properties across London, raised the cash through eight UK and US institutional investors, adding to £100m that it raised last month.

Graham Clemett, chief financial officer at Workspace, said changes in the way people want to rent offices meant the firm felt it was “a good time to raise additional money”.

“People often ask about whether the Brexit vote has changed the way companies rent office space, but it is a more fundamental structural change in the market among both smaller and larger businesses,” he said.

He said more firms were looking for flexibility when renting office space, rather than wanting to commit to long-term leases.

While the money has not been allocated to a particular building or project, Mr Clemett said he was confident that the company would be able to use it to add to its portfolio in time.

Read Rhiannon Bury's full report here

Markets reaction: Fresh dollar weakness unwelcome for European equity markets

Sentiment this morning has been dented by fresh dollar weakness "delivering more unwelcome pound and euro strength" to European equity markets, according to Accendo Markets head of research Mike Van Dulken. The pound has nudged up 0.2pc against the dollar today, trading at $1.3090.

Copper coming off this week's highs to hit miners and the banking stocks edging down on Barclays' results have kept the FTSE 100 firmly in the red, Mr Van Dulken added.

It doesn't look like its going to get any better over in the US this afternoon, according to Spreadex commentator Connor Campbell:

"This negativity looks set to infect the US open. The Dow Jones futures are pointing to a 45 point fall after the bell, taking the index away from yesterday’s 21800-tickling levels.

"That admittedly could all change before the session starts, however, since investors are yet to get their first glimpse at the USA’s second quarter GDP reading."

Lunchtime update: FTSE 100 dips below 7400 as BT shares dive

The pound's mid-morning advance on the dollar has tailed off and sterling is now heading towards flat territory against the greenback ahead of the US GDP figures due at 1.30pm (BST) .

The pound received a brief shot in the arm from the European Commission's Economic Sentiment Index, which showed a sharp rise in the UK's July reading.

Strong GDP figures from the eurozone have pushed the pound lower against the euro with France and Spain outstripping the UK's growth in the second quarter, expanding by 0.5pc and 0.9pc, respectively

The FTSE 100 has dipped below 7400 this morning with BT's 3.4pc slide after telling shareholders of a profits hit from the Italian accounting scandal weighing heaviest on the index.

Alcoholic drinks-maker Diageo is the strongest gainer for a second consecutive day with only four companies in positive territory on the blue-chip index. Heavier losses have been sustained on the continent, however, as the strong euro impacts the big European exporters.

Here's the current state of play in Europe:

FTSE 100: -0.72pc

DAX: -0.70pc

CAC 40: -1.32pc

IBEX: -0.85pc

Barclays sinks to a loss after selling chunk of Africa unit and taking £700m PPI hit

Barclays made a loss of £1.2bn in the first half of the year as its withdrawal from Africa and the ongoing payment protection insurance scandal knocked the lender’s balance sheet.

It has set aside an extra £700m to meet compensation claims for mis-selling PPI, while it also reduced its stake in Barclays Africa to around 15pc.

The lender is pulling back from Africa as part of a restructuring plan that will see it focus on operations in the UK and US.

In the six months to the end of June, Barclays made an attributable loss of £1.2bn, compared to a profit of £1.1bn in the same period of the last year.

Not including costs related to the Africa business, the lender made a pre-tax profit of £2.3bn, up 13pc from £2.1bn.

Shares have dipped 0.3pc this morning.

Read our report on Barclays' results here

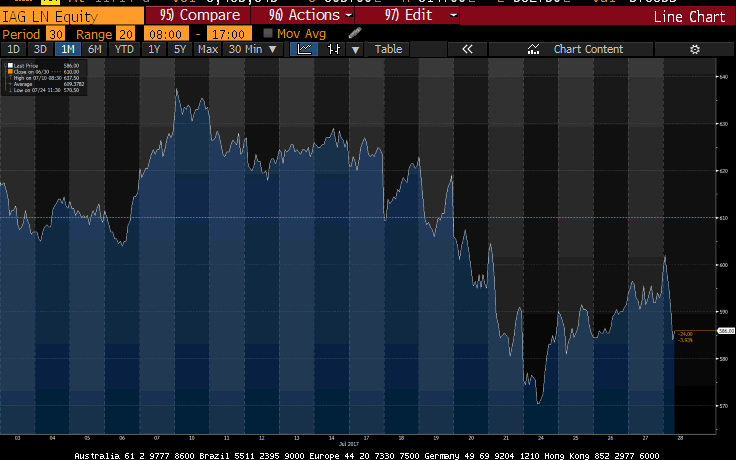

British Airways-owner IAG one of many stocks in the red despite 14pc profits rise

The FTSE 100's deterioration this morning has largely halted but only five stocks have moved higher into positive territory.

One of the many languishing in the red is British Airways-owner IAG, whose shares have shed 1.5pc in today's session despite posting a 14pc increase in profits. The aviation giant said that the IT failure in May which caused travel misery for thousands of passengers cost it £58m.

Shares have taken a hit recently as multiple airlines including easyJet and Ryanair have warned of industry turbulence in the second half of the year.

Hargreaves Lansdown analyst Nicholas Hyett said that the company's focus on long haul flights means it doesn't have to cut prices to keep planes full and its profits should be less squeezed compared to low-cost carriers.

He added:

"The result is that while rivals are seeing the gains from lower fuel prices frittered away in an aggressive price war, at IAG they’re dropping through to the bottom line and profits are taking off.

"However, IAG’s own capacity growth looks cautious rather than jubilant, and combined with a rapidly falling debt pile could suggest the group is buckling in for turbulence ahead."

Rotork shares dive as engineer jettisons long-serving boss

Engineer Rotork's shares dived more than 5pc after the sudden departure of its chief executive following a lacklustre performance from the FTSE 250 business.

The manufacturer, which makes valve systems for companies in the oil, gas and energy industries, revealed that Peter France was leaving after eight years in charge with immediate effect.

In a statement announcing the move, Rotork said that his departure after a career spanning three decades came after “a period of reflection by the board, together with Peter, on the steps required to foster a return to higher growth and margin levels in what is likely to be a generally lower growth macro environment”.

Actions to improve the company’s performance include faster investment in new products and customer service while cutting costs.

Read Alan Tovey's full report here

UK economic sentiment rises sharply in July

Despite bad #UK#consumer#confidence EC UK economic sentiment up to highest since Jan 2015, better than #PMI, inflation #expectations down pic.twitter.com/6Gpe6Fu5PD

— marksastley (@astleyeconomics) July 28, 2017

UK economic sentiment rose sharply in July, according to the latest reading from the European Commission's Economic Sentiment Index.

The UK's rise to 113.2 in July from 109.3 in June (100 represents the 1990-2016 average) helped lift the overall EU figure with sentiment in the eurozone region broadly unchanged.

Capital Economics European economist Jack Allen said that the "small rise in the EC’s measure of eurozone economic sentiment in July left the index pointing to a fairly sharp pick-up in GDP growth".

Pantheon Macro economist Samuel Tombs, however, said that the UK figures are stronger than the reality:

"Business confidence undeniably picked up in July, although the jump in the ESI overstates how much it improved. The sub-component for industry—where confidence has soared due to the weak pound—receives a 40% weight in the index despite only accounting for 15% of the economy.

"Our version of the ESI, which re-weights its components according to the composition of the U.K. economy, also rose in July, but it was only modestly above its long-run average and it has tracked sideways over the last year."

Rightmove profits surge as it attracts record number of customers

Online property portal Rightmove shrugged off concerns over the state of the housing market as customer numbers hit record levels and profits surged by nearly 10pc.

Rightmove said it enjoyed a 1pc jump in customer numbers, to an all-time high of 20,358, in the six months to the end of June.

It said pre-tax profits rose 9pc in the first half of the year, up from £80.6m to £87.5m, while revenues were up 11pc to £120m.

"Home hunters visited Rightmove a record 3,000 times a minute in the first half of 2017, turning to us first to search and research on the only place you can see almost the entire UK residential property market,” said chief executive Peter Brooks-Johnson.

The spike in profits came despite an 8pc drop in housing transactions in the first half, against a tough comparison with 2016, when buyers rushed to move ahead of stamp duty changes.

Read Sam Dean's full report here

US GDP data the focus for investors on the currency markets today

Now the eurozone GDP figures have dropped, the main focus in terms of economics data today for investors will be the US' own growth figures for the second quarter, which will be released at 1.30pm (BST). A strong reading could halt the pound's move higher against the dollar inspired by president Donald Trump's healthcare bill faltering in the Senate.

Growth is expected to come in at 2.5pc on an annualised basis and the US economy will have to pick-up somewhat in the second half of the year if it is going to meet Mr Trump's promise of 3pc growth.

IG market analyst Josh Mahony has provided this preview of the US data:

"Traders will be keeping a close eye on the latest US GDP reading in the afternoon, with markets expecting to see a marked improvement on the disappointing first quarter figure of 1.4%.

"Improvements across a number of recent economic data points are likely to see that figure rise somewhat, with a big jump in personal consumption (2.8% from 1.1%) one of the key drivers of these heightened expectations."

Only a handful of stocks in positive territory this morning; Diageo leads FTSE 100 again

Smirnoff-maker Diageo leads a falling index for a second consecutive day as analysts provide their take on the company's surge in profits and £1.5bn share buyback. Shares are up 1.8pc early on with broker Bernstein upgrading the stock to "outperform" following its strong showing yesterday.

Pharma giant AstraZeneca has recovered 1.1pc following yesterday's huge 15pc plummet after it told shareholders that its flagship drug trial had suffered a setback. Small fry in terms of the £7bn wiped off its value in yesterday's session.

Barclays has nudged up 0.7pc this morning despite the bank setting aside £700m more for PPI compensation claims and swinging to a £1.2bn loss in the first half of the year due to exit from Africa.

However, CMC Markets analyst Michael Hewson said the underlying results were actually slightly better than expected:

"Stripping out the one-off items the results showed that revenues in its investment bank were lower to the tune of 10%, and profits were even lower, however the underlying business numbers were still slightly better than analyst forecasts, once all the incidentals had been stripped out."

Earnings reaction: Gloomy picture for BT unfair

BT shares are 4.4pc down this morning, the worst on the FTSE 100, after the telecom giant told shareholders that pre-tax profit has taken a 40pc hit from the Italian accounting scandal and a £225m settlement to avoid a court battle with two of its biggest investors.

George Salmon, an analyst at Hargreaves Lansdown, commented that its unfair to paint an entirely gloomy picture for the company:

"BT has shaken off demands to fully separate the higher-margin Openreach division, and assuming there aren’t any more skeletons in the closet, the cash flows from EE and the growing Consumer division are potentially attractive.

"Nonetheless, with BT fighting battles on several fronts, one could be forgiven for waiting for the dust to settle.”

ETC Capital market analyst Neil Wilson was also reasonably optimistic on the outlook:

"Despite today’s knock to the share price investors have been warming to BT again following the gigantic selloff in January, which wiped a fifth off its market cap.

"Spectrum position in respect to the forthcoming auction is important and with EE the group can now focus on building its position as a genuine quad-play provider.

"Subscribers are rising and they’re spending more on average. Consumer revenues were up 7%, while those for EE rose 4%. As a quad-play provider it should be able to gain market share over time."

European markets put on the back foot by late US tech sell-off

The FTSE 100 has been spared much of the pain this morning with the CAC and DAX falling harder as a stronger euro weighs on stocks across the channel.

On the mid-cap FTSE 250 index, pub and restaurant operator Mitchell & Butlers has dived nearly 6.4pc to pare some its 21pc gain from yesterday while value manufacturer Rotork has fallen 4.9pc after announcing that its chief executive Peter France has resigned.

A late tech sell-off in the US has also soured investor sentiment in Europe this morning, according to CMC Markets analyst Michael Hewson.

He said on this morning's play:

"European markets look set to end the week on a softer note after a weak Asia session and some late profit taking in the tech sector heading into the US close, which saw both the S&P 500 and Nasdaq close lower on the day.

"We’ve seen a veritable earnings bonanza from the tech sector over the past week or so with Netflix, Alphabet and Facebook surprising to the upside, so hopes were high that Amazon would follow suit."

BT forced to pay £255m to avoid court battle over Italian accounting scandal

BT has been forced to pay £255m to avoid a court battle with Deutsche Telekom and Orange over the accounting scandal in Italy that has battered its finances.

The German and French telecoms giants are among BT’s biggest shareholders, having accepted shares in part exchange for the mobile operator EE last year.

They watched on in January as revelations of complex fraud prompted a plunge in BT’s share price. The fraud blew a £500m hole in BT’s cash flow and caused a £571m write-down, triggering the company’s worst ever day on the stock market.

The disaster could have been a basis for legal action by Deutsche Telekom and Orange under warranties included in the £12.5bn EE takeover agreement.

BT chief executive Gavin Patterson said the settlement with Deutsche Telekom and Orange was “clearly disappointing” but necessary to avoid legal action. Full-year financial guidance was not affected, Mr Patterson added.

Read Christopher Williams' full report here

BT drags on the FTSE 100 early on; US markets lose momentum overnight

The FTSE 100 has opened in the red with BT dragging on the index and Next paring yesterday's gains early on.

BT has sunk almost 3pc this morning on the blue-chip index as it tallied the cost of the Italian accounting scandal that hit the telecommunication company in January. It posted a 42pc drop in first quarter pre-tax profits with a settlement with investors Deutsche Telekom and Orange also hurting figures.

Overnight, US markets couldn't close at the record highs they peaked at in intraday trading as a tech sell-off pulled the Nasdaq and S&P 500 into negative territory.

Amazon founder Jeff Bezos' time as the richest man in the world looks to be short-lived after his company reported that profits were hit by rising spending. Mr Bezos overtook Bill Gates yesterday as Amazon shares rallied ahead of its results but they have fallen 4pc in after-hours trading following the results.

I wouldn't feel too sorry for him.

When the whole world is congratulating Jeff Bezos for becoming the richest man in the world, but you know the situation is temporary. pic.twitter.com/pCh4OHhPpJ

— Chidi Okereke (@Chydee) July 27, 2017

Eurozone recovery continues

#Spain#GDP growth reached 0.9% QoQ in 2Q. Growth is expected to exceed the Eurozone average by more than 1ppt this year.

����↗️↗️— Geoffrey Minne (@gminne) July 28, 2017

Spain's GDP figures, which were released shortly following France's data, adds to the narrative that the eurozone recovery is in full swing. Spain's economy grew by 0.9pc in the second quarter, its fastest growth in almost two years.

Austrian growth also nudged up to 0.8pc in the second quarter, from 0.7pc in the first.

Here's Capital Economics' European economist Jack Allen take on this morning's figures, which make up around a third of the eurozone's economy:

"Looking ahead, we don’t think that quarterly euro-zone GDP growth of 0.7% or 0.8% will be sustained. The surveys for the beginning of Q3 are consistent with growth of about 0.6%.

"But we remain optimistic about the outlook – we think that euro-zone GDP will expand by an above-consensus 2.2% this year and 2.0% in 2018."

Q2 GDP growth. #lagrandenation sets the bar high! 0.5% quarterly growth, 3 quarters in a row. Pas mal #France! pic.twitter.com/WUc979ova4

— Sylvia Walter (@SylviaWalter13) July 28, 2017

Agenda: Pound falls against the euro as France and Spain post stronger GDP growth than UK

Welcome to our live markets coverage.

Sterling is having mixed fortunes this morning with strong French and Spanish GDP figures and political inertia in Washington pulling the pound in different directions against the euro and the dollar.

Data released this morning from Europe showed that France's economy expanded by 0.5pc in the second quarter of the year, beating the UK's 0.3pc growth reported on Wednesday in Emmanuel Macron's first quarter as president. Spain 's economy meanwhile grew by 0.9pc, a nudge up from 0.8pc in the first quarter.

The pound has fallen 0.3pc against the euro this morning and is trading at €1.1172.

The pound has, however, made a small move higher against the dollar as president Donald Trump's healthcare reforms floundered in the Senate with three Republicans voting against the bill. It is trading at $1.3080 against the greenback this morning.

The corporate calendar is looking a little less hectic today following Super Thursday but we still have IAG, BT and Barclays reporting from the FTSE 100. British Airways-owner IAG has jumped to the top of the blue-chip scoreboard after reporting a surge in profits despite the major IT failure that caused travel chaos in May.

Interim results: UBM, International Consolidated Airlines Group, Rightmove, BT Group, Morgan Advanced Materials, UK Commercial Property Trust, IMI, Barclays, Aberforth Smaller Companies Trust

AGM: Amur Minerals Corporation, Red Leopard Holdings, Subex, Boxhill Technologies, Bellzone Mining

Trading statement: Lonmin

Economics: GFK consumer confidence (UK), Employment cost index q/q (US), Advance GDP q/q (US), Advance GDP price index q/q (US), Revised UoM inflation expectations (US), Revised UoM consumer sentiment (US), German preliminary CPI m/m (GER), German import prices (GER)

Yahoo Finance

Yahoo Finance