Potential of Euro Reversal Higher Near Term

The returns of American investors will increase volumes in forex and create the possibility of reversals near term.

Euro Weaker in Early Trading

The short-term range of the Euro has not been for the faint of heart. This morning the Euro is near 1.2360 versus the U.S Dollar, after coming off of highs seen last Wednesday and Thursday.

German Producer Price Index numbers showed more inflation than expected from the nation this morning with a gain of 0.5%, but the Euro has actually been weaker. Support for the Euro near term may be around the 1.2300 level.

Euro Sustaining its Values

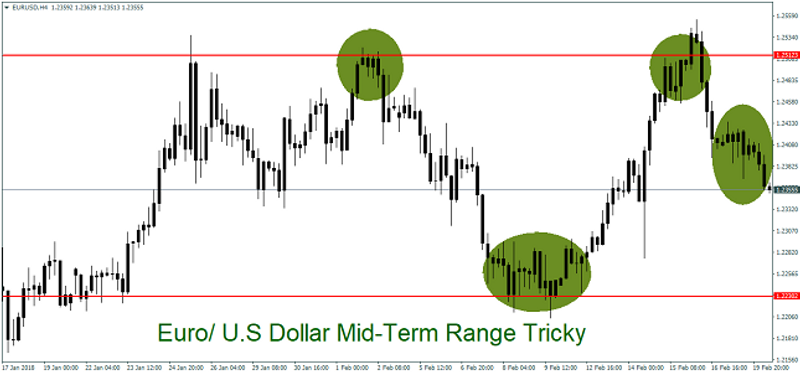

The return of the Americans to the broad markets after their holiday will supply impact today. A look at a mid-term chart of the Euro shows there have been plenty of fireworks. Resistance may be around 1.2450 for the European currency if it reverses higher.

A test of the range is likely today, but a potential move higher again could take place in the coming days which would sustain the Euro’s better values.

In the short term, we believe the Euro may be positive. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

More From FXEMPIRE:

Technical Overview of EUR/USD, GBP/USD, USD/CAD & USD/CHF: 20.02.2018

Crude Oil Price Update – In Position to Form Bearish Closing Price Reversal Top

Oil Price Fundamental Daily Forecast – Pressured by Stronger Dollar, Weaker Stocks

Gold Price Futures (GC) Technical Analysis – Heading into Retracement Zone at $1336.70 to $1330.20

E-mini Dow Jones Industrial Average (YM) Futures Analysis – February 20, 2018 Forecast

Yahoo Finance

Yahoo Finance