PNC Financial (PNC) Q2 Earnings Beat Estimates, Revenues Up

PNC Financial PNC reported positive earnings surprise of 1.8% in second-quarter 2019. Earnings per share of $2.88 surpassed the Zacks Consensus Estimate of $2.83. Further, the bottom line reflects a 5.9% jump from the prior-year quarter’s reported figure.

Higher revenues, driven by higher net interest income and escalating fee income, aided the company’s results. However, rise in costs and provisions were headwinds.

The company’s net income for the quarter came in at $1.37 billion compared with the prior-year quarter’s $1.36 billion.

Segment wise, on a year-over-year basis, quarterly net income at the Corporate & Institutional Banking and Other, including the BlackRock, declined 7.7% and 5.2%, respectively. However, the Retail Banking and Asset Management Group segments reported 18.6% and 86% rise in net income, respectively.

High Revenues Recorded, Partly Muted by Elevated Costs

Total revenues for the reported quarter came in at $4.44 billion, climbing 3% year over year. Additionally, the top-line figure surpassed the Zacks Consensus Estimate of $4.41 billion.

Net interest income jumped 4% from the year-ago quarter to $2.5 billion. Elevated loan and securities yields, and balances were partly mitigated by growth in deposit and borrowing costs. Further, net interest margin contracted 5 basis points to 2.91%.

Non-interest income was up 2% year over year to $1.94 billion owing to higher consumer services income, service charges on deposits and other income, partially offset by lower income from corporate services, asset management and residential mortgage.

PNC Financial’s non-interest expenses totaled $2.61 billion, flaring up 1% from the year-ago figure. This surge primarily stemmed from rise in almost all components of expenses, partly offset by lower other costs.

As of Jun 30, 2019, total loans were up 2% sequentially to $237.2 billion. Also, total deposits improved 1% to $273.3 billion.

Credit Quality: A Mixed Bag

Non-performing assets declined slightly to $1.85 billion, year over year. Yet, net charge-offs increased 30% to $142 million.

Provision for credit losses more than doubled from the prior-year quarter to $180 million. In addition, allowance for loan and lease losses was up 5% to $2.7 billion.

Steady Capital Position

As of Jun 30, 2019, the Basel III common equity Tier 1 capital ratio, effective Jan 1, 2018, was 9.7% compared with 9.5% as of Jun 30, 2018.

Share Repurchase

During the April-June quarter, PNC Financial repurchased 6 million common shares for $802 million. Furthermore, dividends of $431 million were distributed.

Our Viewpoint

PNC Financial displayed an impressive performance during the June-end quarter. Improving lending scenario is likely to support its top line in the upcoming period. Moreover, the company is well poised to grow on the back of its diverse revenue mix. It remains on track to execute its strategic goals, including technology initiatives, which bodes well for the long term. Rise in expenses and provisions, nevertheless, remain concerns.

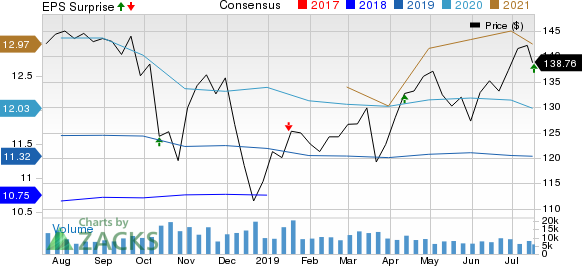

The PNC Financial Services Group, Inc Price, Consensus and EPS Surprise

The PNC Financial Services Group, Inc price-consensus-eps-surprise-chart | The PNC Financial Services Group, Inc Quote

Currently, PNC Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Goldman Sachs’ GS second-quarter results recorded a positive earnings surprise of 22.8%. The company reported earnings per share of $5.81, comfortably beating the Zacks Consensus Estimate of $4.73. Nevertheless, the bottom-line figure compared unfavorably with earnings of $5.98 per share recorded in the year-earlier quarter.

Citigroup C delivered a positive earnings surprise of 2.8% in the second quarter, backed by expense control. Adjusted earnings per share of $1.83 for the quarter handily outpaced the Zacks Consensus Estimate of $1.78. Also, earnings climbed 12% year over year.

Driven by prudent expense management, Wells Fargo WFC posted a positive earnings surprise of 12.1% in second-quarter 2019. Earnings of $1.30 per share surpassed the Zacks Consensus Estimate of $1.16. Results also came in higher than the prior-year quarter adjusted earnings of $1.08 per share.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance