Play The Malaysian Mid Caps For 1H18

After a dip in form in 2016, Malaysia’s economy rebounded strongly in 2017. Stabilisation in the commodities sector, a strong turnaround in external demand for manufactured goods, a rebound in spending by consumers and recovery in tourist arrivals propelled the economy to meet consensus economic growth forecast for 2017.

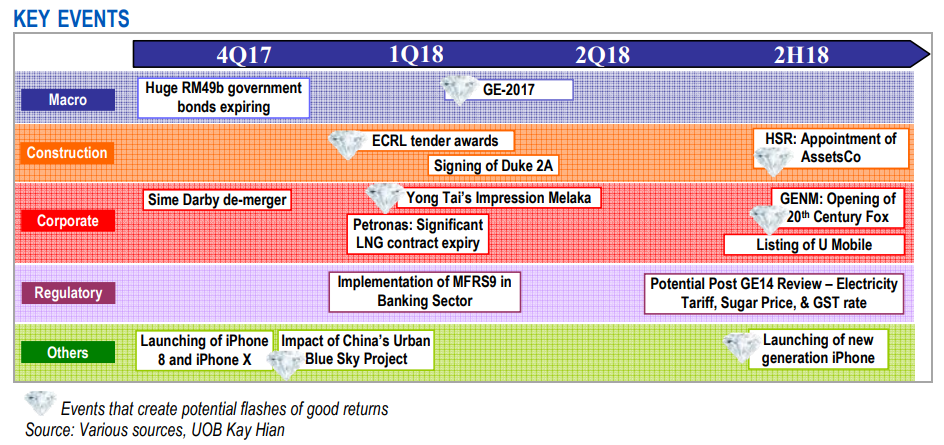

The Malaysian market should continue to trend upwards towards UOB-Kay Hian’s (UOBKH) Kuala Lumpur Composite Index (KLCI) target of 1,860. UOBKH highlights that the 14th General Election (GE14), firm domestic economic indicators, and ample global and domestic trading liquidity are all potential tailwinds that will support KLCI’s uptrend.

UOBKH’s Malaysia Investment Strategy: Beta Mid-Caps In 1Q18, Defensive Mid-Caps In 2Q18

UOBKH recommends investors to focus on beta stocks in 1Q18. UOBKH notes that market conditions still generally favour mid-caps, given the ability of mid-caps to continue to sustain superior earnings growth. Following 1Q18, UOBKH advocates investors to turn to defensive stocks in 2Q18.

Investors Takeaway: 4 Investment Themes For MY Investors To Follow

Some multi-year investment themes that UOBKH recommends include:

⦁ Mega Infrastructure

The construction and building material sectors will be supported by contract awards and implementation of mega projects. Construction activities will continue to pick up until they reach a peak in 2019, according to UOBKH. Large-cap construction companies will also claw back 2017’s losses as they ride on the infrastructure megatrend.

Ann Joo Resources has shown significantly stronger 4Q17 earnings. UOBKH also notes that the latest published domestic steel price has been rising. On top of that, there will be significant rollout of mega projects by mid-2018, which should give Ann Joo Resources share price a boost in 2018.

Another stock that UOBKH recommends is Gabungan AQRS. Gabungan AQRS is in a good position for contract wins in 1Q18 from Malaysia’s East Coast Rail Link and Sabah Pan Borneo Highway projects which combine to be worth more than RM1 billion.

Ann Joo Resources: BUY, TP RM4.25; Gabungan AQRS: BUY, TP MYR2.47

⦁ Electronics And Electrical (E&E) Trend

UOBKH highlights three companies that will ride on the E&E megatrend: Globetronics, Inari Amertron and VS Industry.

UOBKH foresees Globetronics’s earnings to double in 2018 with upside on potential commercialisation of sensors under development. On the other hand, Inari Amertron is also in good position to double its revenue in the next three years from its Radio Frequency packaging segment and Broadcom’s clientele.

Last but not least. UOBKH also recommends VS Industry for its high growth visibility that it exhibits, just like Globetronics and Inari Amerton, further pointing out that potential contract wins could help VS Industry to fill up and utilise capacities at its new plant.

Globetronics: BUY, TP RM7.50; VS Industry: BUY, TP RM3.50

⦁ Situational GE14

Historically, KLCI has yielded positive returns in the three-month periods up to the election polling dates. Moreover, with robust headline economic indicators, the Malaysian Ringgit and investment sentiments should be buoyed. In addition, there are minimal risks in a portfolio sell-down of Malaysian bonds in 2018, given the moderate maturity schedule. UOBKH underlines that defensive and high-yielding utilities should outperform post GE14.

MRCB has historically traded up to 2 standard deviations during GE periods. It looks set to continue that trend, according to UOBKH. The potential sale of EDL by MRCB will significantly strengthen its balance sheet and potentially lift earnings outlook for MRCB.

⦁ Tourism-related picks

With the 20th Century Fox theme park slated to open by end 2018, Genting Malaysia could lead its peers in the tourism recovery. The theme park is the world’s first 20th Century Fox theme park, which should generate strong interest. Tune Protect is another tourism play that UOBKH recommends for its strong turnaround story and relatively attractive valuations.

Genting Malaysia: BUY, TP RM6.28; Tune Protect: BUY, TP RM1.40

Yahoo Finance

Yahoo Finance