Plains All American (PAA) Q4 Earnings Miss Mark, Revenues Lag

Plains All American Pipeline, L.P. PAA reported fourth-quarter 2020 adjusted net income of 29 cents per unit, which missed the Zacks Consensus Estimate of 31 cents by 6.5%. Also, the bottom line declined 54% from the year-ago quarter’s figure.

In the quarter under review, the partnership reported GAAP net loss of 11 cents per unit against the earnings of 35 cents in the year-ago quarter.

Total Revenues

Total revenues of $5.96 billion missed the Zacks Consensus Estimate of $6.71 billion by 11.2%. Further, the top line dropped 34.9% from $9.2 billion reported a year ago.

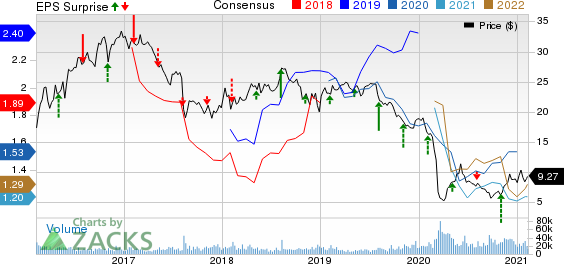

Plains All American Pipeline, L.P. Price, Consensus and EPS Surprise

Plains All American Pipeline, L.P. price-consensus-eps-surprise-chart | Plains All American Pipeline, L.P. Quote

Highlights of the Release

In the quarter under review, Plains All American’s total costs and expenses were $6,028 million, down 31.7% year over year. This reduction was owing to lower purchases and related costs, field operating costs as well as general and administrative expenses. The firm incurred an operating loss of $65 million against the operating income of $331 million in the prior-year quarter.

Total adjusted EBTIDA for the quarter was $559 million, down 35% from the year-ago quarter.

Net interest expenses decreased 5.3% year over year to $108 million.

Segmental Performance

In the Transportation segment, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $383 million decreased 15% from the year-ago quarter’s figure, primarily due to reduction in contracted tariff volumes in multiple regions caused by soft crude oil prices, reduced drilling and completion activity and compressed regional basis differentials.

In the Facilities segment, adjusted EBITDA summed $172 million, down 2% from the year-ago quarter’s figure. This fall was primarily due to the impact of asset sales and ramped-down activity at some rail terminals caused by less favorable market conditions. However, this was partly offset by operational cost savings and an expanded capacity at the Mid-Continent and Gulf Coast crude oil storage terminals.

The Supply and Logistics segment reported adjusted EBITDA of $4 million, which tumbled 98% from the year-ago quarter’s figure. This downtrend was primarily caused by less favorable crude oil differentials in both Permian Basin and Canada.

Financial Update

As of Dec 31, 2020, current assets were $3,665 million compared with $4,612 million at 2019 end.

As of Dec 31, 2020, Plains All American had a long-term debt of $9,382 million compared with $9,187 million on Dec 31, 2019.

As of the same date, its long-term debt-to-total book capitalization was 49%, up from 41% at the end of 2019.

Guidance

Plains All American expects its 2021 adjusted net income to be 95 cents per unit. The partnership retained its 2021 adjusted EBITDA expectation of $2,150 million.

Plains All American expects its 2021 capital spending to be $425 million.

Zacks Rank

Plains All American currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Murphy Oil Corporation MUR incurred fourth-quarter 2020 adjusted net loss of 9 cents per share, narrower than the Zacks Consensus Estimate of a loss of 10 cents.

CNX Resources Corporation CNX reported fourth-quarter 2020 adjusted earnings of 21 cents per share, which surpassed the Zacks Consensus Estimate of 18 cents by 16.7%.

National Fuel Gas Company NFG posted first-quarter fiscal 2021 operating earnings of $1.06 per share, which beat the Zacks Consensus Estimate of $1.03 by 2.9%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance