Photronics Q3 Preview: Can Shares Stay Hot?

The Zacks Computer and Technology Sector has tumbled year-to-date amid a hawkish Fed, declining more than 20% in value and widely lagging the S&P 500. Over the last month, however, the sector has tacked on a strong 7% in value.

One company residing in the sector, Photronics PLAB, is on deck to unveil Q3 earnings on August 30th before market open.

Photronics is a leading worldwide manufacturer of photomasks. Photomasks are high-precision quartz plates that contain microscopic images of electronic circuits, a key element in the manufacturing process of semiconductors and flat panel displays.

How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, the price action of Photronics shares has been remarkable, tacking on nearly 20% in value and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Over the last month, however, PLAB shares have lagged behind the S&P 500’s 3% gain, declining nearly 4% in value.

Image Source: Zacks Investment Research

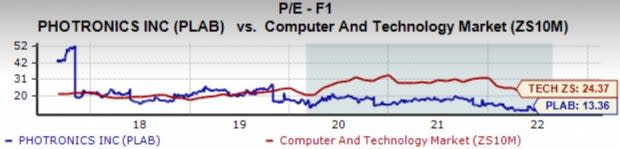

In addition, Photronics shares trade at attractive valuation multiples – the company’s 13.4X forward earnings multiple is well beneath its five-year median of 17.6X and represents a steep 30% discount relative to its Zacks Sector.

PLAB carries a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been quiet for the quarter to be reported over the last 60 days, with zero estimate revisions coming in. Still, the Zacks Consensus EPS Estimate of $0.50 pencils in a substantial 130% triple-digit Y/Y uptick in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line is also in great shape – the Zacks Consensus Sales Estimate of $210 million reflects a sizable 23% year-over-year uptick in revenue.

Quarterly Performance & Market Reactions

PLAB has been on a solid earnings streak, exceeding the Zacks Consensus EPS Estimate in each of its previous three quarters. Just in its latest print, the company penciled in a substantial 40% bottom-line beat.

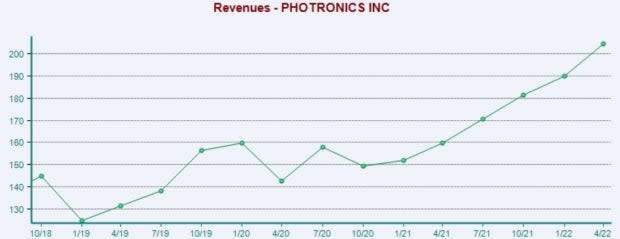

Top-line results have also been rock-solid – Photronics has chained together six consecutive revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has liked the company’s quarterly results; shares have moved upwards following each of its previous five quarterly reports.

Putting Everything Together

PLAB shares have been remarkably strong year-to-date, easily crushing the S&P 500’s performance. Still, shares have slightly lagged behind the general market over the last month.

The company carries solid valuation multiples, with its forward P/E ratio well beneath its five-year median and Zacks Sector average.

Analysts haven’t moved their earnings outlook over the last 60 days, but estimates reflect serious earnings and revenue growth.

Furthermore, the company has consistently exceeded quarterly estimates, and the market has reacted favorably following each of Photronics’ previous five reports.

Heading into the print, Photronics PLAB carries a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Photronics, Inc. (PLAB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance