PetroChina's (PTR) Blowout H1 Earnings Signal Turnaround

PetroChina Company Limited PTR announced first-half 2021 profit of RMB 53 billion or RMB 0.290 per diluted share against loss of RMB 30 billion or RMB 0.164 per diluted share a year earlier. Moreover, China’s dominant oil and gas producer’s total revenues for the first six months of the year rose 28.8% from the year-ago period to RMB 1,196.6 billion.

Results of PetroChina, one of China’s big three oil giants, the other two being Sinopec SNP and CNOOC Limited CEO, were aided by higher oil prices and a rebound in fuel demand.

The Chinese energy giant will shift a third of its capital to low-carbon energy projects by 2035, highlighting its green push. It’s seen as part of PetroChina’s efforts toward its goal of cutting net carbon emissions to zero by 2060.

The company is also targeting to improve its natural gas contribution in total output to 55% by 2025 from 43% in 2020. As far as annual production is concerned, PetroChina expects 1.5% growth this year.

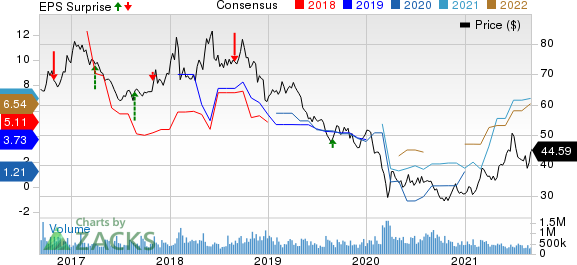

PetroChina Company Limited Price, Consensus and EPS Surprise

PetroChina Company Limited price-consensus-eps-surprise-chart | PetroChina Company Limited Quote

Segment Performance

Upstream: PetroChina posted lower upstream output during the six months ended Jun 30, 2021. Crude oil output — accounting for 54% of the total — fell 6.8% from the year-ago period to 443.1 million barrels. Meanwhile, marketable natural gas output was up by 5.1% to 2,258.5 billion cubic feet. As a result, PetroChina’s total production of oil and natural gas decreased 1.7% year over year to 819.6 million barrels of oil equivalent. Besides, the company’s oil and gas lifting cost rose 9.9% on a per unit basis compared with the same period of last year.

Notwithstanding the drop in production and higher costs, the upstream (or exploration & production) segment posted an operating income of RMB 30.9 billion, nearly trebling from the year-ago profit of RMB 10.4 billion. This was primarily on account of sharply higher crude price. In fact, average realized oil price during the first half of 2021 was $59.45 per barrel, surging 52.4% from the year-ago period.

Downstream: The Beijing-based company’s Refining and Chemicals business recorded an operating income of RMB 22.2 billion against the year-earlier period’s loss of RMB 10.5 billion. The turnaround in the downstream division result was due to rising prices and impressive sales volumes of refined and chemical products.

PetroChina’s refinery division processed 606.1 million barrels of crude oil during the six-month period, up 6.7% from 2020. The company produced 5,073 thousand tons of synthetic resin in the period (up 1% year over year), besides manufacturing 3,043 thousand tons of ethylene (down 1.9%). It also produced 54,906 thousand tons of gasoline, diesel and kerosene during the period against 52,085 thousand tons a year earlier.

Natural Gas and Pipeline: Higher sales volume and price of natural gas, a dip in gas purchasing costs and rebounding market demand buoyed the Chinese behemoth’s segment earnings. As a result of these factors, the group’s natural gas business earned RMB 36.9 billion in the period under review, soaring from the year-earlier profit of RMB 14.4 billion.

Marketing: In marketing operations, the state-owned group sold 80,339 thousand tons of gasoline, diesel and kerosene during the half-year period, up 4.9% year over year. The effects of higher volumes were magnified by incremental refined products prices and recovery in the domestic market demand. Consequently, PetroChina posted a profit of RMB 6.6 billion compared to a loss of RMB 12.9 billion recorded in the same period last year.

Liquidity & Capital Expenditure

As of Jun 30, the group’s cash balance was RMB 154.4 billion, while cash flow from operating activities for the first half of 2021 was RMB 116 billion. Capital expenditure for the first six months reached RMB 73.9 billion.

Zacks Rank & Stock Pick

PetroChina currently carries a Zacks Rank #3 (Hold).

A better-ranked player in the energy space is Continental Resources CLR, which presently flaunts a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Continental Resources has an expected earnings growth rate of 428.21% for the current year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNOOC Limited (CEO): Free Stock Analysis Report

PetroChina Company Limited (PTR) : Free Stock Analysis Report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance