Persol HoldingsLtd And Two More Japanese Exchange Growth Companies With Significant Insider Ownership

As Japan's stock markets recently hit all-time highs, fueled by a weakening yen and significant wage increases, the investment landscape appears increasingly favorable for growth-oriented companies. In this context, examining growth companies with high insider ownership can provide valuable insights into firms that potentially have aligned interests between management and shareholders, fostering robust corporate governance and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.9% |

Hottolink (TSE:3680) | 27% | 59.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Astroscale Holdings (TSE:186A) | 20.9% | 90% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Here's a peek at a few of the choices from the screener.

Persol HoldingsLtd

Simply Wall St Growth Rating: ★★★★☆☆

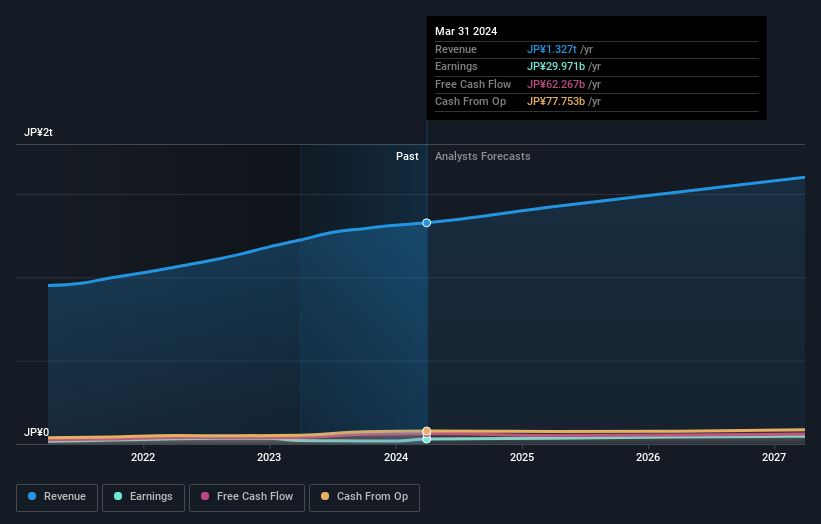

Overview: Persol Holdings Ltd. (TSE:2181) operates globally, offering human resource services under the PERSOL brand, with a market capitalization of approximately ¥582.94 billion.

Operations: Persol Holdings' revenue is segmented into BPO (¥110.80 billion), Career (¥128.28 billion), Technology (¥102.38 billion), Asia Pacific (¥412.77 billion), and Staffing excluding BPO (¥575.80 billion).

Insider Ownership: 11.8%

Persol Holdings Ltd. has demonstrated robust earnings growth, with a 45.6% increase over the past year and forecasts suggesting a 12% annual growth rate, outpacing the Japanese market's 9%. Despite slower revenue growth projections at 5.3%, this still exceeds the market average of 4.4%. The company's recent share buyback, repurchasing shares worth ¥3.59 billion, underscores a commitment to shareholder returns but also reflects substantial insider confidence in its valuation, trading significantly below estimated fair value.

PeptiDream

Simply Wall St Growth Rating: ★★★★★☆

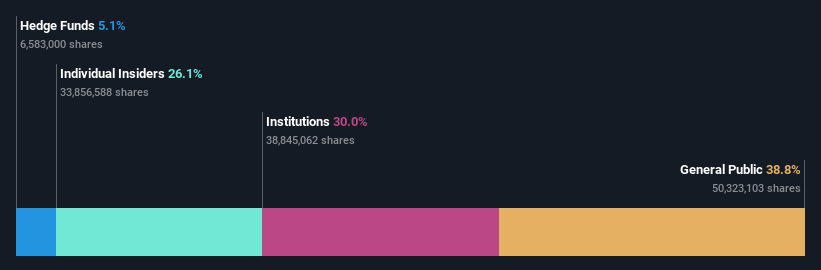

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥355.64 billion.

Operations: The company generates revenue primarily through the development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Insider Ownership: 26.1%

PeptiDream Inc., a Japanese biotech firm, is expected to see its earnings grow by 22.3% annually, outpacing the broader market's 9%. Despite a drop in profit margins from last year, the company's revenue growth forecast of 10.5% also exceeds the market average. Recent strategic expansions with Novartis and advancements in clinical studies underscore its innovative edge and potential for significant future revenues, though it faces challenges from highly volatile share prices and lower current profit margins.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

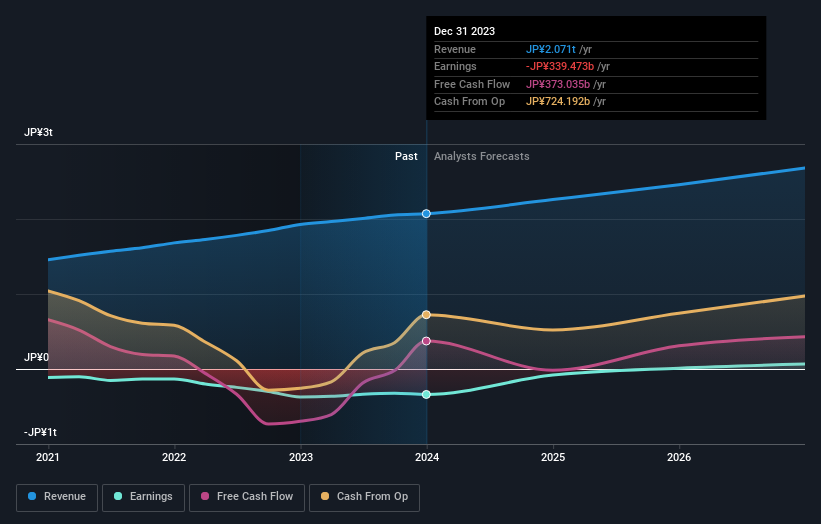

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally and has a market capitalization of approximately ¥1.95 trillion.

Operations: The company generates revenue through sectors including e-commerce (¥1.13 trillion), fintech (¥0.45 trillion), digital content (¥0.21 trillion), and communications (¥0.36 trillion).

Insider Ownership: 17.3%

Rakuten Group, a prominent Japanese e-commerce and internet company, is poised for significant growth with an anticipated profitability within the next three years. Despite trading at 78.1% below its estimated fair value, challenges such as a low forecasted return on equity at 8.9% in three years persist. Insider ownership remains stable with no significant buying or selling in the past three months, supporting a steady governance outlook amidst plans for robust double-digit revenue growth excluding its securities segment.

Delve into the full analysis future growth report here for a deeper understanding of Rakuten Group.

Our valuation report here indicates Rakuten Group may be undervalued.

Make It Happen

Delve into our full catalog of 98 Fast Growing Japanese Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2181TSE:4587TSE:4755.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com