PepsiCo (PEP) to Report Q4 Earnings: What's in the Offing?

PepsiCo, Inc. PEP is set to report fourth-quarter 2019 results on Feb 13, before market open. In the last reported quarter, the company delivered a positive earnings surprise of 4%. Moreover, its bottom line beat the Zacks Consensus Estimate over the trailing four quarters, delivering average surprise of 3.2%.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.43, implying a 4% decline from the year-earlier quarter's reported figure. Notably, the consensus mark has been unchanged over the past 30 days. For quarterly revenues, the Zacks Consensus Estimate stands at $20.38 billion, suggesting 4.4% growth from the prior-year quarter’s reported figure.

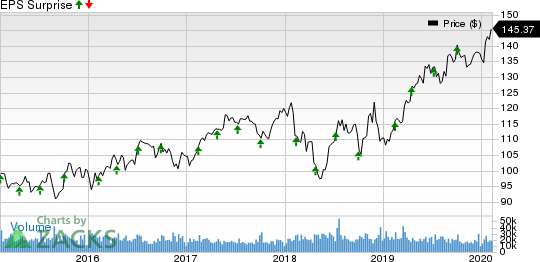

PepsiCo, Inc. Price and EPS Surprise

PepsiCo, Inc. price-eps-surprise | PepsiCo, Inc. Quote

Key Factors to Note

Robust gains across all operating segments as well as strength in product and geographic portfolios, and progress on productivity targets have been driving the company’s earnings and sales performance. Notably, the effects of cost savings from its productivity and restructuring plans are likely to get reflected in its margins for the to-be-reported quarter.

Moreover, PepsiCo has the competitive advantage of selling complementary food categories — snacks and beverages. The company’s complementary snacks portfolio has been resulting in cost leverage, capability sharing, cross-category promotions and other commercial benefits. The Snacking segment is expected to continue delivering strong sales and profits, owing to the rising demand for savory items.

Furthermore, PepsiCo generates significant part of its revenues outside the United States. Continued growth in the developing/emerging markets is expected to have contributed meaningfully to its top-line growth in the fourth quarter.

However, unfavorable impacts of ongoing investments to strengthen business, higher tax rate, and the absence of asset sale and refranchising gains that occurred in 2018 are expected to have hurt PepsiCo’s earnings. Its results are also likely to reflect the impacts of adverse currency rates.

Zacks Model

Our proven model does not conclusively predict an earnings beat for PepsiCo this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although PepsiCo carries a Zacks Rank #3 but an Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Coca Cola Femsa S.A.B. de C.V. KOF has an Earnings ESP of +5.47% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Monster Beverage Corporation MNST has an Earnings ESP of +3.38% and a Zacks Rank #2.

Molson Coors Brewing Company TAP has an Earnings ESP of +5.03% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Brewing Company (TAP) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance