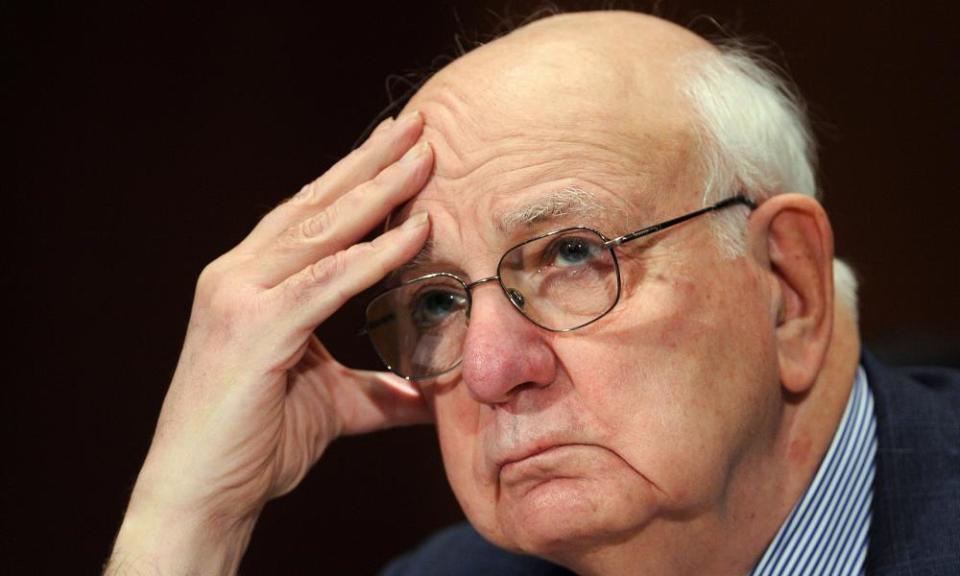

Paul Volcker, US Fed chief under Carter and Reagan, dies at 92

Paul Volcker, the former US central bank chief renowned for taming rampant inflation after the oil price rises of the 1970s, has died aged 92.

Volcker’s daughter Janice Zima said the former head of the Federal Reserve died at his home in New York on Sunday.

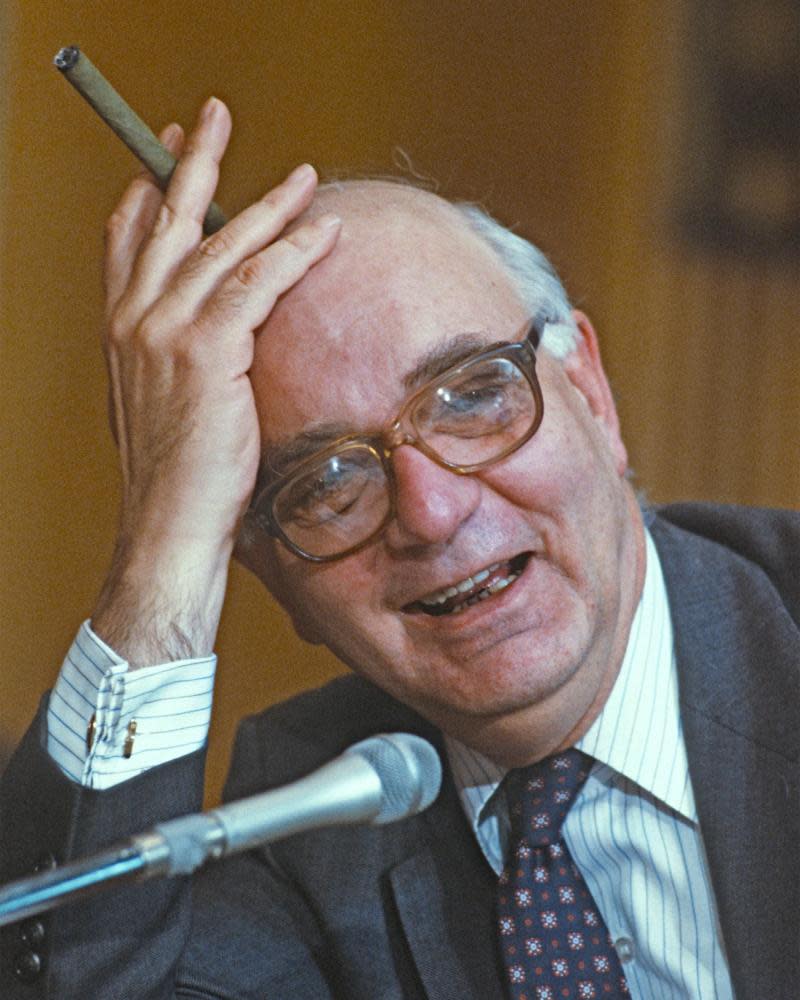

An imposing figure at 2 metres (6ft 7in), Volcker, who had been suffering from prostate cancer, was notoriously independent both in the way he conducted himself – smoking cheap cigars and wearing crumpled suits – and in his views, which often clashed with the short-term considerations of legislators on Capitol Hill.

In 2018, he published a memoir, Keeping at It: The Quest for Sound Money and Good Government, and expressed concern about the direction of the federal government and the loss of respect for it.

“The central issue is we’re developing into a plutocracy,” he told the New York Times. “We’ve got an enormous number of enormously rich people that have convinced themselves that they’re rich because they’re smart and constructive. And they don’t like government and they don’t like to pay taxes.”

From the moment he was appointed Federal Reserve chairman in 1979 by Jimmy Carter with a mission to support the president’s war on inflation, Volcker was in the public eye.

While Carter embarked on bruising battles to end industry cartels that kept prices artificially high, Volcker sought to restrict consumer spending, pushing interest rates up to the previously unheard of level of 20%.

Under Carter’s successor, Ronald Reagan, inflation began to fall from a high of 13% and interest rates followed the downward trend, leaving the Republican president to take the plaudits.

But Volcker kept monetary policy tight and Reagan resorted to huge budget deficits to fund tax cuts, driving up the US debt-to-GDP ratio to record highs.

Jerome Powell, the current chairman of the Federal Reserve, paid tribute to Volcker, saying he was “deeply saddened” by his death and that his work had left “a lasting legacy” for the country.

Powell, who has been heavily criticised by President Donald Trump for keeping monetary policy tight and restricting growth, was last year advised by Volcker to ignore brickbats from the White House.

The Bank of England governor, Mark Carney, said Volcker was “a towering figure among the central bankers of his generation”.

Carney added: “The integrity and independence he showed in his battle against inflation helped lead the United States – and with it, the world – through some of the most testing times of the modern era. He was also an inspiration for generations of public servants who all aspired to his examples of intellectual rigour, determination and integrity.”

Born the son of German immigrants in New Jersey, Volcker started his career on Wall Street as a financial analyst before moving into the Treasury and implementing Richard Nixon’s decision to make the dollar a floating currency, in effect ending the post-war era of fixed foreign exchange rates.

After serving two four-year terms at the Fed, he moved back to Wall Street and took up advisory posts on various international bodies, ending an illustrious career as a stinging critic of the banking industry following the 2008 crash.

As President Barack Obama’s special adviser, he said: “I wish someone would give me one shred of neutral evidence that financial innovation has led to economic growth – one shred of evidence.”

Yahoo Finance

Yahoo Finance