Paul Tudor Jones Boosts Legg Mason and Slashes S&P 500 ETF Position in 1st Quarter

Paul Tudor Jones (Trades, Portfolio), president and founder of Tudor Investment Corp., disclosed last week that the firm's top four trades for the first quarter featured sells in the SPDR S&P 500 exchange-traded fund (SPY) and Caesars Entertainment Corp. (NASDAQ:CZR). With the proceeds from these transactions, the firm expanded its holdings in Legg Mason Inc. (NYSE:LM). The firm also gained shares of Raytheon Technologies Corp. (NYSE:RTX) following Raytheon's merger with United Technologies.

According to the firm's website, Stamford, Connecticut-based Tudor Investment seeks to generate consistent returns through the use of research, trading and investment techniques. Tudor believes that companies must "continuously innovate in order to compete in rapidly-evolving markets."

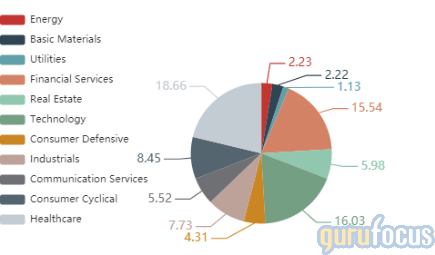

As of the quarter's end, the firm's $1.11 billion equity portfolio contains 1,015 stocks, with 385 new positions and a turnover ratio of 38%. Tudor Investment's top three sectors in terms of weight are health care, technology and financial services, representing 26.62%, 16.03% and 15.54% of the equity portfolio.

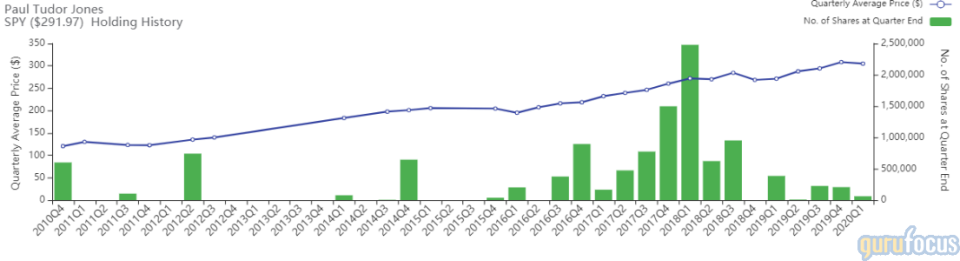

SPDR S&P 500

Tudor Investment sold 145,977 shares of SPDR S&P 500 ETF, knocking off 70.53% of the holding and 2.11% of the equity portfolio. Shares averaged $305.03 during the first quarter.

According to the State Street Global Advisors website, the SPDR S&P 500 ETF seeks to track the performance of the Standard & Poor's 500 index. On Wednesday, the S&P 500 increased approximately 2% from Tuesday's close of 2,922.94 as investors continue monitoring how the reopening of states is going. Stocks soared as retailers like Lowe's Companies Inc. (NYSE:LOW) and Target Corp. (NYSE:TGT) reported same-store sales growth of approximately 10% during the first quarter, mitigating fears that the coronavirus might significantly shut down retail.

GuruFocus offers several Premium features involving the S&P 500, including the S&P 500 Grid. Although most Manual of Stocks downloads require a Premium Plus membership, Premium members can download the Manual of Stocks containing all stocks in the S&P 500.

Ray Dalio (Trades, Portfolio)'s Bridgewater owns 3,564,043 shares of SPDR S&P 500 as of March, down 49.01% from the 6,989,665 shares owned as of December 2019.

Caesars Entertainment

Tudor Investment sold 2,400,433 shares of Caesars Entertainment, eliminating 99.35% of the holding and reducing the equity portfolio 1.46%. Shares averaged $11.86 during the first quarter.

The Las Vegas-based company operates several casino properties, including the Caesars Palace, Flamingo, Paris, Bally's, Rio and Planet Hollywood casinos on the Strip. GuruFocus ranks Caesars' financial strength 3 out of 10 on several warning signs, which include interest coverage and debt ratios that underperform over 92% of global competitors.

David Tepper (Trades, Portfolio)'s Appaloosa Management sold 100% of its Caesars holding during the quarter. Gurus that have large positions in Caesars include Carl Icahn (Trades, Portfolio)'s Icahn Enterprises and Howard Marks (Trades, Portfolio)' Oaktree.

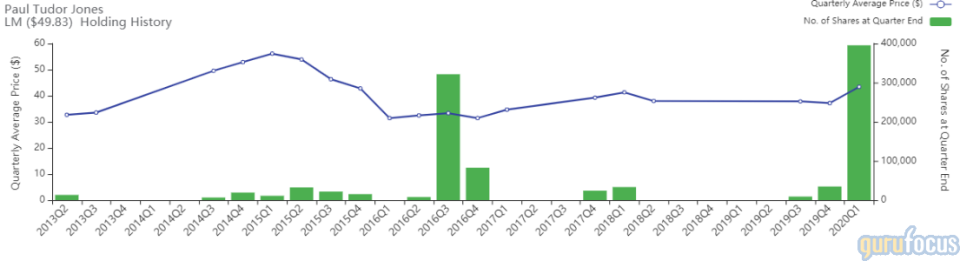

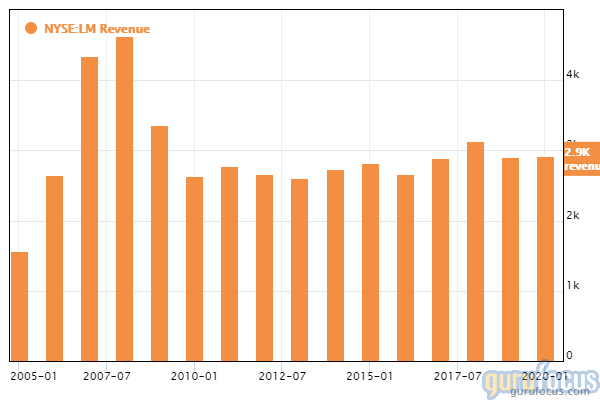

Legg Mason

Tudor Investment purchased 395,437 shares of Legg Mason, increasing the position 1,039.63% and the equity portfolio 1.59%. Shares averaged $43.38 during the first quarter.

The Baltimore-based company provides investment management services for institutional and individual investors. Legg Mason's affiliates include Chuck Royce (Trades, Portfolio)'s Royce Investment Partners.

GuruFocus ranks Legg Mason's profitability 7 out of 10: Operating margins outperform just over 51% of global competitors despite three-year revenue and Ebitda growth rates outperforming as much as 88% of global asset managers.

Raytheon Technologies

Tudor Investment gained 255,925 shares of Raytheon as a result of its merger with United Technologies. The shares, which boosted the position 15,279.10% and the equity portfolio 1.22%, averaged $85.15 during the first quarter.

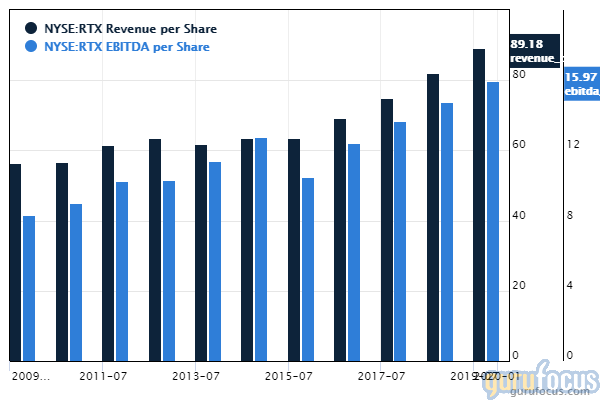

Raytheon and United Technologies completed its merger on April 3, with each share of RTN converted to 2.3348 shares of the new company. According to GuruFocus, Raytheon Technologies' profitability ranks 9 out of 10 on the back of a high Piotroski F-score of 7, a three-star business predictability rank and a Joel Greenblatt (Trades, Portfolio) return on capital that outperforms 91.46% of global aerospace and defense competitors.

Disclosure: No positions.

Read more here:

Jeff Ubben's ValueAct Sells FedEx, Buys 2 New Positions in the 1st Quarter

Bruce Berkowitz Buys Buffett's Berkshire and Kraft Heinz in the 1st Quarter

Daniel Loeb Exits Campbell Soup and Trims Baxter in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance