Patterson Companies (PDCO) Q3 Earnings Top Estimates, Up Y/Y

Patterson Companies, Inc. PDCO reported adjusted earnings per share (EPS) of 47 cents in third-quarter fiscal 2020, which beat the Zacks Consensus Estimate by 27%. Moreover, the bottom line improved 23.7% from the prior-year quarter.

Net sales in the quarter were $1.46 billion, outpacing the Zacks Consensus Estimate by 2.8%. The top line also rose 4.3% year over year.

Segmental Analysis

The company currently distributes products through subsidiaries Patterson Dental and Patterson Animal Health.

Dental Segment

This segment provides a complete range of consumable dental products, equipment, software, turnkey digital solutions and value-added services to dentists, and laboratories throughout North America.

In the fiscal third quarter, dental sales improved 8.1% year over year to approximately $626.6 million.

Dental Consumable

Sales in the sub-segment totaled $300.4 million, up 1.9% year over year.

Dental Equipment & Software

Sales in the segment improved 16.2% on a year-over-year basis to $252.9 million.

Other

This segment comprises technical service, parts and labor, software support services and office supplies. Sales at the segment improved 8.8% on a year-over-year basis to $73.3 million.

Animal Health Segment

This segment is a leading distributor of veterinary supplies to clinics, public and private institutions and shelters across the United States.

In the fiscal third quarter, the segment sales improved 1.2% on a year-over-year basis to $817.3 million.

Corporate

Sales at the segment were $12.3 million, up 29% from $9.5 million reported in the year-ago quarter.

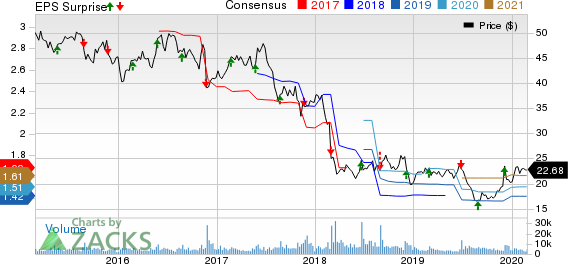

Patterson Companies, Inc. Price, Consensus and EPS Surprise

Patterson Companies, Inc. price-consensus-eps-surprise-chart | Patterson Companies, Inc. Quote

Gross Margin Analysis

Gross profit in the reported quarter was $311.8 million, up 4.1% year over year. As a percentage of revenues, gross margin of 21.4%, remaining flat on year-over-year basis.

Operating expenses in the reported quarter totaled $268 million, up 5.5% on a year-over-year basis.

Operating income was $43.8 million, down 3.4% from the year-ago quarter.

Fiscal 2020 Guidance Raised

For fiscal 2020, Patterson Companies now expects adjusted earnings per share in the range of $1.50 to $1.55 (up from the prior range of $1.36-$1.46). The mid-point of the guidance of $1.53 is above the Zacks Consensus Estimate of $1.42 per share.

Our Take

Patterson Companies ended third-quarter fiscal 2020 on a strong note, wherein both earnings and revenues beat the consensus mark. The company’s Dental segment performed impressively. With respect to Animal Health, the company displayed sustained growth in its companion business and improved trends in production business despite challenges faced in the end market. On the back of strong performance, the company raised outlook for fiscal 2020, thereby instilling investor optimism in the stock.

A broad spectrum of products cushions the company against economic downturns in the MedTech space. We believe that a diverse product portfolio, strong veterinary business prospects, accretive acquisitions and strategic partnerships are key catalysts.

Meanwhile, the company witnessed a decline in operating income in the quarter under review, while gross margin remained flat.

Zacks Rank

Patterson Companies carries a Zacks Rank #2 (Buy).

Earnings of Other MedTech Majors at a Glance

Some other top-ranked stocks that reported solid results this earning season are Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2.

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, beating the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance