Partnering Google, internet provider MyRepublic takes battle with telcos to enterprise sector

Upstart internet service provider MyRepublic has been on a crusade to end the dominance of Singapore’s incumbent telcos — SingTel, StarHub, and M1.

While battling mainly in the consumer space, the company has today announced a serious foray to win the hearts and minds of the country’s Small and Medium Enterprises (SMEs), which make up about 50 percent of Singapore’s GDP.

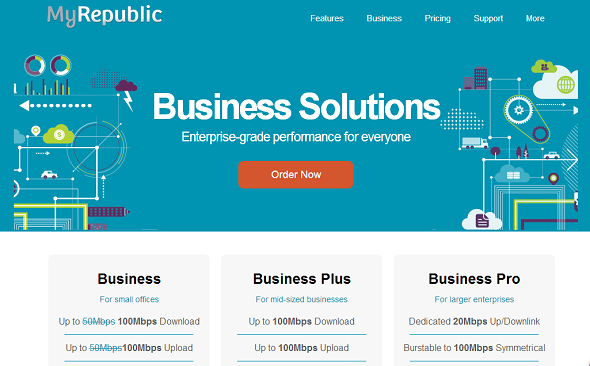

It has rolled out three enterprise plans catering to businesses, priced at SGD186 (USD146), SGD499 (USD391), and SGD999 (USD783) per month before the seven percent goods and services tax. The contracts carry a two-year commitment.

The download and upload speed of 100Mbps is roughly equivalent to SingNet’s top-tier eVolve Fibre Broadband plan, tagged at SGD238. StarHub’s 12Mbps business fiber broadband costs SGD209 monthly.

MyRepublic has also teamed with Google Apps, Mako Networks, and Singapore-based OSINet to bundle additional services into its business products.

Through Google Apps, SMEs can create their own web domains and company email addresses, as well as use tools like Gmail, Calender, Hangouts, Docs, and Drive. Mako Networks enables business owners to monitor and restrict office internet usage to prevent “cyber-slacking”.

Finally, OSINet would grant businesses the ability to replicate features of a large IT department without the costs of hosting their own web server infrastructure.

Every user will get a private System Integrator through the MyRepublic Partner Program. These are essentially part-timers who are engaged and trained to sell the company’s products to the community. They are now also equipped to set up the company’s internet service and cloud offerings for customers.

The new plans are in part a response to customer demand: For a while, the company has been receiving requests from consumers for a business product. And until recently, it has been offering its consumer plans to SMEs, chalking up 300 sign-ups.

Despite being a young company with a smaller footprint compared to its rivals, MyRepublic has managed to keep its prices competitive through several means.

It’s all in the cloud

First, it holds no servers in its office. Everything is hosted on the cloud, including its entire billing and CRM systems. Typically, software required for a telco to operate would cost about SGD300k to SGD500k to implement, says KC Lai, co-founder of MyRepublic. But it has been able to bring costs down to SGD 80k with a monthly running cost of about SGD 2k.

Its Partner Program, which functions in a similar manner to the commission-based insurance industry, keeps upfront costs low by paying partners only upon customer acquisition. About 22 percent of its sales are generated through this channel.

Partners can only remain on the program if they meet a minimum quota, ensuring that sales support expenses are not wasted. As a marketing channel, KC contends that they’re more effective than ads, which the telcos tend to use, because they’re more targeted, personal, and are situated right where customers are.

“We don’t resort to giving out coffee machines to new sign-ups,” he said.

An intangible benefit that the company offers is its thorough customer support, says Malcolm Rodrigues, CEO and co-founder. He adds that enterprise customers at other telcos are often kept unaware about its cloud services simply because the sales team isn’t diligent enough in their follow-up. MyRepublic’s Partner Program is designed to apprise customers to what the company has to offer.

So far, the company has 12k consumers and SMEs as paying customers, up from 10,000 in March. It is generating SGD 700k in billings monthly, and has 53 employees on its payroll. It has also raised SGD 10M (USD 7.83M) in funding from forty angel investors.

By the end of the year, it aims to expand to New Zealand, Australia, Malaysia, and several other countries. It selects countries that have something similar to Singapore’s National Broadband Network (NBN) model, which ensures a level playing field by removing any party’s stranglehold on the supply of fiber broadband lines.

The battle gets thicker

Since Singapore has only introduced the model only recently, the internet provider landscape is less competitive than it seems. SingTel still owns the copper network in the majority of the 23k commercial buildings in Singapore.

The push towards fiber adoption among SMEs has been slow. While there are now some 400k consumer fiber subscribers, the take-up rate among SMEs in Singapore, which number at 220k, stands at only 20 percent. The rest are still on ADSL. That’s a huge opportunity for MyRepublic.

Singapore’s telco landscape has been shaken up for a variety of reasons. The NBN is nudging the industry towards greater diversity, and MyRepublic has been setting itself apart with products like Gamer, a internet service plan targeted at those seeking a low-latency experience. Customers who prefer not to be tied down by two-year commitments have the option of selecting a no contract plan.

It also has Teleport, essentially a private VPN that enables access to geo-restricted content on the likes of Netflix, Hulu, BBC iPlayer, and Pandora internet radio.

The telco industry has also been irreversibly altered by popular internet services and communication apps like WhatsApp, Skype, and Facebook. These services are undercutting the traditional revenue streams of carriers, resulting in a push to evolve into a provider, distributor and supplier of over-the-top services.

SingTel, for instance, has teamed up with Shopify to resell the online store builder in Singapore through myBusiness, its SaaS marketplace. StarHub, meanwhile, has just announced a deal to offer free Evernote subscriptions to new and recontracting post-paid customers.

The rules are changing, and while incumbents hold numerous advantages, the global and open nature of the internet has forced the market open, giving new players like MyRepublic a shot at building a sustainable business in a tough industry with high cost outlays.

At the press conference, the company conveyed a tone that was both light-hearted and combative, projecting confidence in its ability to punch above its weight.

When asked about ViewQwest, another upstart internet service provider benefitting from the NBN, KC Lai dismissed it.

“They’re not a competitor…they’re nowhere near us,” he said.

The post Partnering Google, internet provider MyRepublic takes battle with telcos to enterprise sector appeared first on SGE.

Yahoo Finance

Yahoo Finance