Paris is closing in on London as Europe’s startup capital

Jacques Brinon/AP

French unicorn BlaBlaCar raised a $24 million private equity round in Q3 2016.

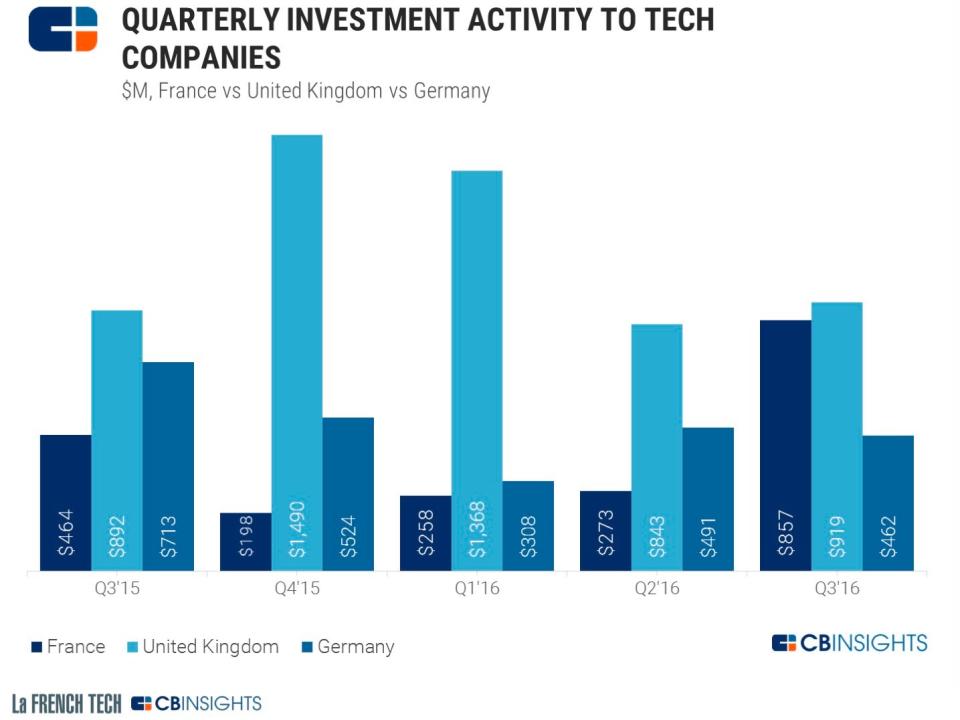

Paris could be closing in on London as Europe’s startup capital, with research from CB Insights suggesting investments in France-based startups in the third quarter of 2016 almost reached the value of investments in tech firms based in the UK.

French startup investments between Q2 and Q3 2016 rose by over 200% to $857 million in deal flow, according to the report.

French investment deal values trailed UK by just $62 million in the third quarter of 2016.

All 65 investments in French companies in Q3 were concentrated on Paris-based companies.

Early-stage startups made up over 60% of France-based investment deals in 2016 to date, the report said.

The value of third-quarter French startup investments was largely driven by a $279 million private equity round in the cloud computing company OVH.com.

Other notable investments in the period included Blablacar’s $24 million private equity round and Zenly’s second funding round of $23 million.

Total investments in French startups for the first three quarters of 2016 reached $1.5 billion, helping the country reach a new high mark before the year had even finished. The amount to beat was $1.4 billion, which was reached in 2014, when BlaBlaCar raised a $100 million round.

The UK’s Q3 2016 was boosted by a $275 Series E funding round in Deliveroo. According to Tech City News’ investment tracker the British capital saw 61 investments in the third quarter, four fewer than Paris in the same time period. Ten of those investments were made in cities other than London.

While Paris lagged behind Berlin in the first two quarters of 2016 it nearly doubled the German capital’s deal value in Q3.

French Tech investments in 2016 spiked in Q3, nearly reaching the level of London startup investments.

Bpifrance, the French public investment bank, made the largest number of deals in 2016 to date.

The investment bank expects the growth in investments in France-based companies to continue. “The number of funding rounds will continue to increase and average deal value will rise,” a Bpifrance spokesperson said. “France is bound to sustainably become the leader of venture capital in Europe.”

The most active private investor in 2016 to date was Kima Ventures. The investment fund — launched by telecoms entrepreneur Xavier Niel — invested in location-sharing social app Zenly and the ride-sharing service Heetch.

The telecoms billionaire is also behind Paris-based Station F, which is set to be the biggest early stage startup incubator in the world. It was recently chosen by Facebook as the location for its first incubator.

NOW WATCH: 9 iPhone tricks that will make your life easier in 2017

The post Paris is closing in on London as Europe’s startup capital appeared first on Business Insider.

Yahoo Finance

Yahoo Finance