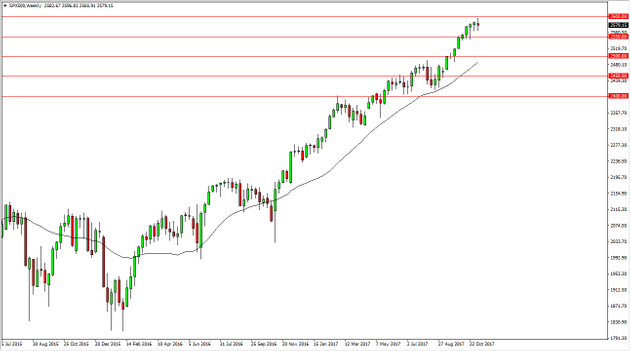

S&P 500 Price Forecast for the Week of November 13, 2017, Technical Analysis

The S&P 500 went back and forth during the week, forming a neutral candle. The 2600 level above is massive resistance, and I think that it makes sense that we continue to pull back, perhaps even grind sideways to build up enough momentum to continue going higher. If we break down below the 2550 handle, I am not willing to sell this market, but would simply wait for a buying opportunity at lower levels, namely the 2500 level. Longer-term, I think that the market continues to show plenty of bullish pressure, and with the earnings season, we have seen good gains.

S&P 500 Video 13.11.17

Ultimately, this is a market that should continue to be positive, but is obviously much more volatile as of late, as we are a bit overextended, so any type a pullback at this point should be a nice opportunity to pick up value. I don’t have any interest in shorting, but if we were to break down below the 2400 level, it’s likely that the entire uptrend is over with, and we would enter some type of negative trend. In general, though, I believe that if Congress can get together with some type of tax package, that might be the next reason to continue to go higher, as it should help the corporate earnings. Right now, though, the market looks very tired, so therefore the longer-term trader is probably best to sit on the sidelines and wait for a better risk to reward ratio to present itself. Right now, it’s likely that we see volatility dry up yet again, or perhaps even a pullback, but rallying from here seems to be a bit of a stretch of the imagination according to what I see on the charts.

This article was originally posted on FX Empire

More From FXEMPIRE:

FTSE 100 Index Price forecast for the week of November 13, 2017, Technical Analysis

Silver Price forecast for the week of November 13, 2017, Technical Analysis

Major US Indices, Forecast for The Week of November 13, 2017, Technical Analysis

Dow Jones 30 and NASDAQ 100 Price Forecast for the Week of November 13, 2017, Technical Analysis

Yahoo Finance

Yahoo Finance