Overstock.com (OSTK) Q2 Earnings & Revenues Beat Estimates

Overstock.com OSTK reported second-quarter 2021 earnings of $1.72 per share, which beat the Zacks Consensus Estimate by 104.7% and increased 55% from the year-ago quarter.

Revenues of $794.8 million increased 3.6% year over year. The top line also beat the consensus mark by 3.61%.

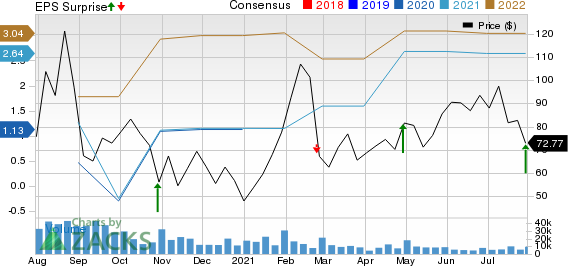

Overstock.com, Inc. Price, Consensus and EPS Surprise

Overstock.com, Inc. price-consensus-eps-surprise-chart | Overstock.com, Inc. Quote

Top-Line Details

Active customers reached 9.2 million as of Jun 30, 2021, an increase of 31% year over year.

Orders placed on a mobile device were 49.9% of gross merchandise sales in the second quarter compared to 52.7% in the year-ago quarter.

Average order value was $213 in the quarter, an increase of 33% year over year. However, orders delivered were 3.7 million, a decrease of 22%.

Operating Details

Gross margin contracted 120 basis points (bps) to 22% in the reported quarter.

Sales & marketing (S&M) expenses increased 7.6% year over year to $85.3 million. As a percentage of revenues, S&M expenses expanded 40 bps to10.7%.

Technology expenses were $30.4 million, up 4.5% year over year. As a percentage of revenues, technology expenses remained flat year over year.

General & administrative (G&A) expenses increased 8.7% year over year to $22.7 million. As a percentage of revenues, G&A increased 10 bps to 2.9%.

Adjusted EBITDA was $44.4 million, which declined 9.3% from the year-ago quarter.

Operating income was $36.5 million compared with $48.8 million a year ago.

Balance Sheet

As of Jun 30, 2021, Overstock.com had cash and cash equivalents worth $536 million compared with $535 million as of Mar 31, 2021.

Long-term debt as of Jun 30, 2021, was $39.6 million compared with $40.5 million as of Mar 31, 2021.

Key Q2 Development

On Apr 23, 2021, the company entered into a limited partnership agreement with Pelion MV GP, L.L.C., to oversee Medici Ventures’ blockchain assets. Per the agreement, Pelion became the sole general partner, holding a 1% equity interest in the partnership, and Overstock became a limited partner, holding a 99% equity interest in the partnership.

Per the agreement, MediciVentures, Overstock.com’s wholly owned blockchain-focused subsidiary, will be converted to a limited partnership (the Fund), which will have an eight-year life and a total capital commitment of $45 million.

Overstock.com will be a limited partner in the Fund while Pelion will act as general partner. The Fund will return invested capital to Overstock.com first and then split profits on successful exits as outlined in its Limited Partnership Agreement.

Zacks Rank & Stocks to Consider

Overstock.com currently carries a Zacks Rank #3 (Hold).

Booking Holdings Inc. BKNG, Boot Barn Holdings, Inc. BOOT and Ruths Hospitality Group, Inc. RUTH are some better-ranked stocks in the broader Retail-wholesale sector. While Ruths Hospitality Group and Boot Barn Holdings sport a Zacks Rank #1 (Strong Buy), Booking Holdings carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Booking Holdings and Boot Bran Holdings are set to release quarterly earnings on Aug 4 and Ruths Hospitality is set to report the same on Aug 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ruths Hospitality Group, Inc. (RUTH) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Overstock.com, Inc. (OSTK) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance