Outlook for Oil & Gas Canadian E&P Industry Remains Bright

The Zacks Oil and Gas - Canadian E&P industry consists of Canada-based companies focused on exploration and production (E&P) of oil and natural gas. These firms are engaged in finding hydrocarbon reservoirs, drilling oil and gas wells, and producing and selling these materials to be refined later into products such as gasoline.

Let’s take a look at the industry’s three major themes:

While oil production is surging in Canada, the country's exploration and production sector has remained out of favor, primarily due to the scarcity of pipelines. In short, pipeline construction in Canada has failed to keep pace with rising domestic crude volumes – the heavier sour variety churned out of the oil sands – resulting in infrastructural bottleneck. This has forced producers to give away their products in the United States – Canada’s major market – at a discounted rate. As it is, Canadian heavy crude is inferior to the higher-quality oil extracted from shale formations in the United States and is also more expensive to transport and refine.

The macro situation is expected to improve once TC Energy’s (TRP) flagship infrastructure project – Keystone XL – comes online. The long-delayed pipeline, which has encountered significant regulatory, legal and environmental setbacks over the years, finally looks to be moving forward. Designed to carry 830,000 barrels of crude a day from Alberta’s oil sands to U.S. Gulf Coast refineries, construction of the 1,900-kilometer conduit is slated to begin shortly. Post completion (expected by the end of 2022), the $8-billion mega-project will considerably ease the pipeline shortage plaguing Canada’s oil industry. Importantly, TC Energy has been able to secure long-term volume contracts for more than 90% of the pipeline’s capacity, indicating widespread commercial support for the development.

The positive final investment decision for Royal Dutch Shell’s (RDS.A) LNG Canada project (in October 2018) is seen as a significant turning point for the country’s energy industry. The initiative, located in Kitimat, British Columbia, is estimated to cost C$40 billion and marks the nation’s largest infrastructure project ever. While the production of gas is soaring in Canada, lack of pipeline construction and export facilities are forcing producers to sell their products at a discounted rate (just like oil). The LNG Canada project is expected to start exporting the super-cooled fuel to Asia by 2024 and will likely provide a fresh lease of life to Canada’s gas industry. The additional export facility (with a 40-year license) will certainly help mitigate the oversupplied gas market of Canada, which has debilitated the commodity’s price in the country for the past few years.

Zacks Industry Rank Indicates Favorable Outlook

The Zacks Oil and Gas - Canadian E&P is a 7-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #113, which places it in the top 44% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Taking into consideration the increasingly bullish outlook of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s recent stock-market performance and valuation picture first.

Industry Outperforms Sector & S&P 500

The Zacks Oil and Gas - Canadian E&P has surpassed the broader Zacks Oil - Energy Sector as well as the Zacks S&P 500 composite over the past year.

The industry has gained 21% over this period compared to the S&P 500’s rally of 20.1% and broader sector’s decrease of 14.3%.

One-Year Price Performance

Industry’s Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month EV/EBITDA ratio, the industry is currently trading at 4.91X, significantly lower than the S&P 500’s 12.25X. It, however, mirrors the sector’s trailing-12-month EV/EBITDA of 4.9X.

Over the past five years, the industry has traded as high as 20.46X, as low as 3.65X, with a median of 7.82X, as the chart below shows.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Bottom Line

Agreed, Canadian crude prices are most likely to trade at a discount to WTI because of quality and pipeline issues. However, a string of positive updates associated with the industry have been warmly received by investors.

As discussed above, the first piece of encouraging news pertains to the contentious Keystone XL pipeline, work on whose construction is likely to commence shortly – a much needed step to move oil from Alberta to the refineries in the United States. Meanwhile, a corporate tax cut by Alberta’s provincial government and easing of the state-mandated production curtailments should lead to increased oil sands investment this year for the first time since 2014.

Meanwhile, the official go-ahead for the much-awaited Kitimat mega LNG export facility is expected to be a game changer for the Canadian energy sector. The project will help ease the nation's gas oversupply while tapping into the growing demand for the commodity in Asia. Due to Canada’s proximity with the Asian markets along with robust natural gas production in British Columbia and Alberta, the nation is a much-preferred destination for the LNG export facilities. The startup of the Kitimat project is likely to unleash a new LNG wave in Canada.

With the abovementioned catalysts set to provide near-term upside, we are presenting two stocks with a Zacks Rank #2 (Buy) that are well positioned to gain amid the prevailing challenges. There are also two stocks with a Zacks Rank #3 (Hold) that investors may currently retain in their portfolio.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Crescent Point Energy Corp. (CPG): Crescent Point Energy’s operations are primarily concentrated in southwest and southeast Saskatchewan and Utah. The Calgary-based company carries a Zacks Rank #2 and has an attractive expected earnings growth of 344.5% for this year.

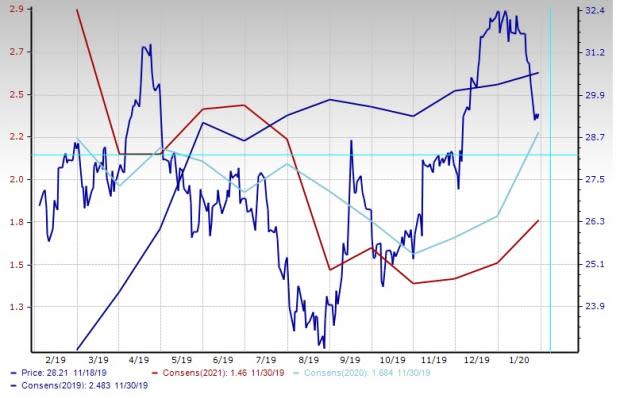

Price and Consensus: CPG

Canadian Natural Resources Limited (CNQ): This Calgary-based operator is one of the largest independent energy companies in Canada engaged in the exploration, development and production of oil and natural gas. Canadian Natural Resources, whose core operations are focused in Western Canada, the United Kingdom sector of the North Sea and offshore Africa, carries a Zacks Rank #2. Over 30 days, the company has seen the Zacks Consensus Estimate for 2020 increase 25.6%.

Price and Consensus: CNQ

Baytex Energy Corp. (BTE): Baytex Energy is an intermediate explorer and producer with primary focus on the Western Canadian Sedimentary Basin and in the Eagle Ford in the United States. Over 30 days, the Calgary-headquartered company – carrying a Zacks Rank #3 – has seen the Zacks Consensus Estimate for 2020 surge 25%.

Price and Consensus: BTE

Enerplus Corporation (ERF): Enerplus focuses on Bakken and Three Forks formations in the Williston Basin in North Dakota, together with interests in the Marcellus Basin in and waterflood projects in Canada. The Calgary-based company carries a Zacks Rank #3 and has an expected earnings growth of 15.6% for this year.

Price and Consensus: ERF

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TC Energy Corporation (TRP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Crescent Point Energy Corporation (CPG) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Baytex Energy Corp (BTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance