Oracle (ORCL) Teams Up With Airtel to Drive Cloud Market Push

Oracle ORCL teamed up with India-based Bharti Airtel to extend its cloud offerings to more than a million Airtel enterprise clients, which includes start-ups, big corporations and small and medium enterprises (SMEs) in the country. Airtel is one of the leading telecommunications services’ company in the country.

Oracle and Airtel Business will together market Oracle Cloud Infrastructure (OCI) services to Airtel’s enterprise customers in the private and public sectors in India. Oracle’s cloud offerings will be available to clients as part of Airtel Business integrated portfolio, noted the tech giant.

Oracle is also looking to collaborate with Nxtra by Airtel (Airtel’s data centre subsidiary) to expand the capacity of its India West (Mumbai) cloud region. The company expects the expanded cloud region to be available in 2022 and the region will add to the company’s MeitY-empanelled cloud regions located in Mumbai and Hyderabad.

Further, Oracle in association with Airtel is planning to build a Cloud Centre of Excellence in Gurgaon to revamp Airtel’s internal workloads and help customers in implementing cloud solutions.

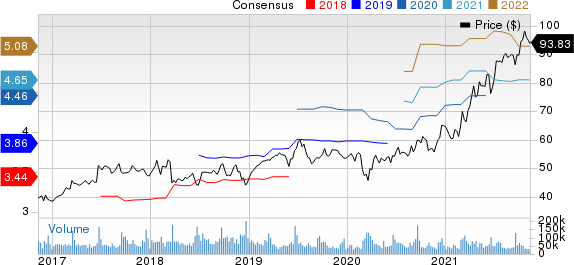

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Both the companies are planning to develop a joint Intellectual Property (IP) solution, which will support advancement of innovative technology growth areas, added Oracle.

Oracle’s Global Cloud Push

Despite its late entry in the cloud market, Oracle is striving hard to capture a large share of this profitable market.

Accelerated workload migration to cloud, owing to the remote/hybrid work, is driving the cloud market. Migration to cloud offers benefits like improved scalability, easy deployment of applications and faster disaster-recovery management.

Spurt in e-commerce and a high demand for cloud-native applications like streaming services are also driving the market. The adoption of pioneering technologies like machine learning, Artificial Intelligence (AI) and Big Data is another driving factor for the cloud market.

According to Fortune Business Insights report, the global cloud computing market is expected to witness a CAGR of 17.9% between 2021 and 2028 and reach $791.48 billion.

Alliance with Airtel bodes well for Oracle, as it strives to increase its presence in the global cloud market.

Higher availability of Oracle cloud regions globally is consolidating its competitive position in the cloud computing market. In October 2021, the company announced that it was working toward opening 14 new cloud regions across Europe, the Middle East, Asia Pacific and Latin America to support its cloud services platform. Oracle expects to have 44 cloud regions by the end of 2022.

Recently, Oracle unveiled its first cloud region in France followed by the opening of cloud regions in United Arab Emirates and Singapore. At present, the company operates 34 cloud regions in the world.

A higher spend on product enhancements, especially toward cloud platform, amid increasing competition in the cloud domain from established players Amazon’s AMZN Amazon Web Services, Microsoft’s MSFT Azure and Alphabet’s GOOGL Google Cloud as well as other medium- and small-sized cloud service providers is likely to limit margin expansion in the near term for Oracle which carries a Zacks Rank #3 (Hold).

Per a Statista report, Amazon accounted for 32% of the global cloud infrastructure services market followed by Microsoft (21%) and Alphabet’s Google Cloud (8%) in the third quarter of 2021.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Price Movement

In the past year, shares of Oracle have increased 66.2% compared with Zacks Computer Software industry’s growth of 50.5%.

Shares of Amazon have returned 11.9% in the past year compared with Zacks Internet Commerce industry’s decline of 29.6%.

Microsoft, buoyed by strength in Azure adoption, has witnessed a 53.5% increase in share price over the last year compared with Zacks Computer Software industry’s surge of 50.5%.

Alphabet’s shares have gained 67.4% compared with Zacks Internet Services industry’s rally of 54.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance