Optimistic FOMC Minutes to Fuel Bullish USD Outlook

DailyFX.com -

- Federal Open Market Committee (FOMC) Minutes to Highlight Wait-and-See Approach.

- Will a Greater Number of Fed Officials Show a Growing Concern USD Strength?

Trading the News: Federal Open Market Committee (FOMC) Minutes

The Federal Open Market Committee (FOMC) meeting minutes may largely mimic the statement following the April 29 interest rate decision and continue to highlight a wait-and-see approach as the central bank remains ‘data dependent.’

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:Despite fears of a slowing recovery, the Fed may continue to relay an optimistic outlook as it looks past the temporary/transitory factors dragging on the real economy, and the central bank may stay on course to normalize monetary policy in 2015 as it anticipates a stronger expansion in the coming months.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Pending Home Sales (MoM) (MAR) | 1.0% | 1.1% |

Existing Home Sales (MoM) (MAR) | 0.5% | 0.7% |

Factory Orders (FEB) | -0.4% | 0.2% |

The FOMC may continue to strike an upbeat outlook for the region as Chair Janet Yellen remains confident in achieving the dual mandate, and fresh batch of central bank rhetoric may instill a more bullish outlook for the greenback as the committee prepares to remove the zero-interest rate policy (ZIRP).

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Gross Domestic Product (QoQ) (Annualized) (1Q A) | 1.0% | 0.2% |

Core Personal Consumption Expenditure (QoQ) (1Q A) | 1.0% | 0.9% |

Advance Retail Sales (MoM) (MAR) | 1.1% | 0.9% |

Nevertheless, the slowdown in growth and inflation may become a growing concern for the central bank, and we may see a growing number of Fed officials favor a further delay in the normalization cycle as committee struggles to achieve its 2% target for price growth.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

How To Trade This Event Risk(Video)

Bullish USD Trade: Fed Officials Show Greater Willingness to Normalize

Need red, five-minute candle following the policy statement to consider a short EUR/USD position.

If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Majority of FOMC Retains Support for ZIRP

Need green, five-minute candle to favor a long EUR/USD trade.

Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

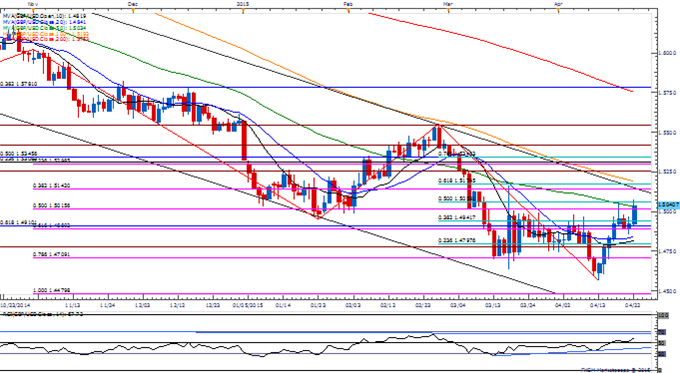

EUR/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

Ongoing series of lower highs & lows in EUR/USD favors the downside targets as price & RSI fail to retain the bullish formations from earlier this year.

DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, but seeing a narrowing ratio as it currently sits at -1.42.

Interim Resistance: 1.1520 (61.8% expansion) to 1.1532 (February high)

Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

Read More:

EUR/USD, GBP/USD into Trend Support with FOMC Minutes DueEURCAD Pullback Stalls at Support- Sub 1.3538 to Negate Bullish Bias

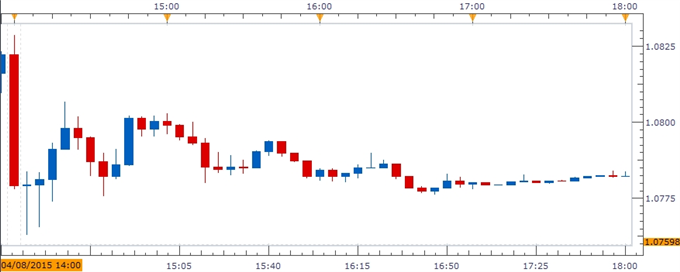

Impact that the FOMC minutes has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

MAR 2015 | 04/08/2015 18:00 GMT | - | - | -22 | -42 |

March 2015 Federal Open Market Committee (FOMC) Minutes

The Federal Open Market Committee (FOMC) meeting minutes showed another unanimous vote to retain the current policy, but revealed signs of a split over the timing for liftoff. While several officials saw scope for a mid-2015 rate hike, other favored a further delay in the normalization cycle, with a few members even preferring to remove the zero-interest rate policy (ZIRP) in 2016. Despite the mixed outlook, it seems as though the Fed remains on course to normalize monetary policy ahead of its major counterparts as the central bank remains confident in achieving its 2% inflation target over the policy horizon. The greenback strengthened following the upbeat statement, with EURUSD dipping below the 1.0800 handle to end the day at 1.0779.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance