onsemi's (ON) New Lighting Solutions to Augment Top Line

onsemi ON recently announced that it will showcase its latest lighting solutions at the Light+ Building autumn edition from Oct 2- 6.

The latest launch reflects the company’s strategy to invest heavily in building its intelligent power and sensing products to help address key high-growth megatrends in automotive, industrial and plug power.

In the second quarter, despite ongoing market volatility, onsemi’s automotive and industrial revenues accounted for 66% of its overall business and combined grew 38% year over year. This was driven by the adoption of intelligent power and sensing solutions in the markets like automotive due to the electric vehicle (EV) megatrend.

Due to rising inflation, industrial and residential buildings will be looking for lighting solutions that provide high efficiency with higher power savings to lower operations cost. Launching its latest lighting solutions will aid onsemi in attracting new clients from industrial and aid in its top-line growth.

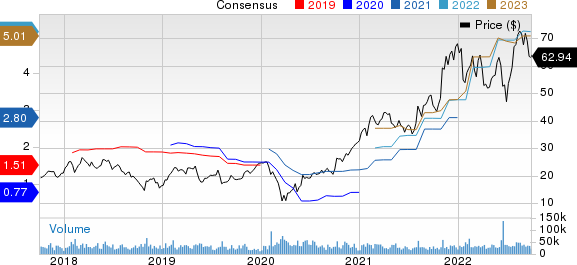

ON Semiconductor Corporation Price and Consensus

ON Semiconductor Corporation price-consensus-chart | ON Semiconductor Corporation Quote

onsemi Investing in Industrial Sensing to Boost Share Price

ON's shares, which currently carries Zacks Rank #3 (Hold), have fallen 7.3% in the year-to-date period, narrower than the Zacks Semiconductor - Analog and Mixed industry’s and Zacks Computer and Technology sector’s decline of 24% and 33.8%, respectively. The entire Semiconductor - Analog and Mixed industry is reeling under various operational challenges due to the macro-economic turmoil and geopolitical tensions. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

onsemi has been able to beat the cyclical downtrend by investing in strategic areas like intelligent power and sensing, which helps it to grow its gross and operating margin.

The launch of onsemi’s latest lighting solutions comes right after the company approved an exit plan to close one of its divisions in the advanced solutions group segment to further enable the company to direct its investments to high-growth margin business segments.

In the second quarter of 2022, advanced solutions group or ASG revenues of $716.7 million (34.4% of revenues) increased 4% on a year-over-year basis.

onsemi is also expanding its silicon carbide (SiC) facility in Hudson, NH. The new hub will increase ON’s SiC boule production capacity by five times year over year and address certain supply-chain bottlenecks. Per onsemi, the SiC total addressable market is projected to grow from $2 billion in 2021 to $6.5 billion in 2026, at a CAGR of 33%.

Further, positively impacting onsemi’s decision to expand operations in high-growth markets is President Biden's decision to sign the CHIPS and Science Act, supporting investments in domestic semiconductor manufacturing and reducing dependence on foreign markets like China. Onsemi peer Microchip Technology MCHP is also looking to benefit from the recent declaration of the act by the government.

The declaration will help Microchip to diversify income from its microcontroller business, which is riddled with supply-chain disturbances. Microchip continues developing and introducing a wide range of innovative and proprietary new linear, mixed-signal, power, interface and timing products to spur growth in the analog business.

However, ON is facing stiff competition from Texas Instruments TXN and STMicroelectronics STM.

STMicroelectronics’ third-generation STPOWER SiC MOSFETs help meet the energy-saving efficiency requirements in EVs and are a chief competitor of onsemi in the EV market. STMicroelectronics’ solutions will help EV makers achieve faster charging and reduce EV weight. This helps STM win a significant market share in the industry.

Texas Instruments is also seeing success in certain fast-growing automotive market segments. TXN is focused on infotainment, safety and ADAS, body electronics (including lighting), hybrid electric vehicle and powertrain segments of the automotive market. It also experiences significant traction from the EV megatrend.

However, onsemi expects demand to continue outpacing supply throughout 2022. With the recent focus on high-growth margin business segments, onsemi can address the rising supply-chain issues, distinguishing its services from its competitors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance