Online Strength, GenNext Plan to Aid Aaron's (AAN) Amid Inflation

Aaron’s AAN has been gaining from reduced write-offs and fewer customers opting for early purchase options. Also, cost-reduction initiatives, a solid online show and strength in the GenNext program bode well.

This led to impressive first-quarter 2023 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Consolidated revenues grew 21.5% to $554.4 million, driven by gains from the BrandsMart buyout, somewhat offset by weak lease revenues and fees, and drab retail sales at the Aaron's Business.

The company has continued to witness strength in its e-commerce platform. In first-quarter 2023, e-commerce lease revenues were up 12.3%, accounting for 17.9% of the total revenues. The uptick can be attributable to increased website traffic and a higher conversion rate. Some other notable efforts include increased investments in digital marketing, improved shopping experience, same-day and next-day delivery services, the personalization of products, and a broader assortment, including the latest product categories. Its express delivery program also bodes well.

Aaron’s latest acquisition of appliance and electronics retailer, BrandsMart, is expected to strengthen AAN’s market position and help expand the customer base. The deal is also likely to generate significant cost synergies and aid Aaron’s top line. Notably, revenues were $144.2 million in the first quarter of 2023, driven by strength in small appliances and housewares, and e-commerce strength. The company has been optimistic about its performance in the near future. It announced the opening of its first BrandsMart store in 2023.

A sturdy performance in GenNext stores bodes well. Notably, the company had 222 GenNext locations at the end of the first quarter. This accounted for more than 27% of lease and retail revenues, up from 15% in the first quarter of 2022.

Hurdles to Overcome

However, Aaron's has been reeling under dismal margins, lower lease revenues and reduced lease portfolio size. This led adjusted EBITDA to decline 20.7% year over year to $45.9 million. Meanwhile, the EBITDA margin contracted 210 bps to 13.2%. Consequently, the bottom line declined 24.1% year over year from the 87 cents per share reported in the prior-year quarter. On a GAAP basis, AAN reported earnings of 41 cents per share versus 68 cents in the year-ago quarter.

The company continues to witness sluggishness in its Aaron’s Business segment. In first-quarter 2023, revenues declined 9.6% year over year to $412.1 million due to lower average lease portfolio size and lease renewal rate, coupled with fewer exercises of early purchase options and weak retail sales. Also, lower customer traffic led to delayed deliveries and lower lease revenues.

For the Aaron’s Business, revenues are expected to be $1.50-$1.57 billion, down from the prior stated $1.53-$1.60. Adjusted EBITDA is likely to be $170-$185 million, down from the earlier mentioned $165-$180 million. For 2023, the company anticipates revenues of $2.15-$2.25 billion compared with the earlier guided $2.20-$2.30 billion. The lowered revenue outlook is mainly due to lower early purchased options and drab retail sales at the Aaron's Business in the said quarter and the remainder of the year.

High inflation and other challenging economic conditions have been concerning. The company’s segments are expected to continue experiencing softness in customer demand in its core product categories, including appliances, furniture and electronics, in the first half of the year.

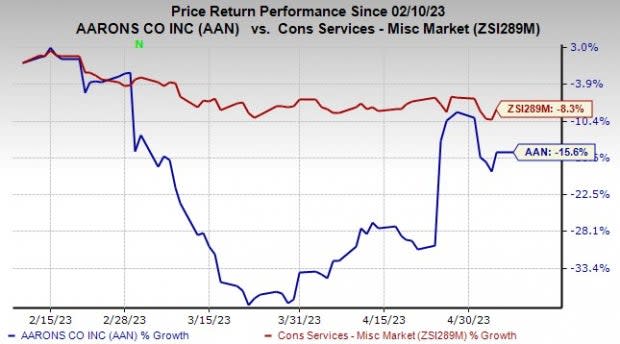

Image Source: Zacks Investment Research

As a result, AAN shares have lost 15.6% in the past three months compared with the industry’s decline of 8.3%.

Bottom Line

Although lower lease revenues, drab Aaron’s Business segment and inflation remain headwinds, solid online show, gains from the BrandsMart buyout and strength in the GenNext program are likely to aid Aaron’s performance in the near future. A VGM Score of A raises optimism in this Zacks Rank #3 (Hold) stock. Topping it, the company’s earnings estimates for 2023 have moved up 5.4% in the past seven days.

Stocks to Consider

Some better-ranked companies are Crocs CROX, PVH Corp PVH and H&R Block HRB.

Crocs, which offers casual lifestyle footwear and accessories, carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 15%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 13.1% and 2.8% from the year-ago period’s actuals. CROX has a trailing four-quarter earnings surprise of 21.8%, on average.

PVH Corp currently carries a Zacks Rank #2. PVH has a trailing four-quarter earnings surprise of 23.4%, on average. PVH has a long-term earnings growth rate of 16.1%.

The Zacks Consensus Estimate for PVH Corp’s current financial year’s sales and EPS indicates declines of 3.8% and 9.8%, respectively, from the year-ago period’s reported levels.

H&R Block provides assisted income tax return preparation and do-it-yourself tax return preparation services. HRB currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for H&R Block’s current financial year’s EPS suggests growth of 9.4% from the year-ago reported figure. H&R Block has a trailing four-quarter earnings surprise of 10.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Aaron's Company, Inc. (AAN) : Free Stock Analysis Report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance