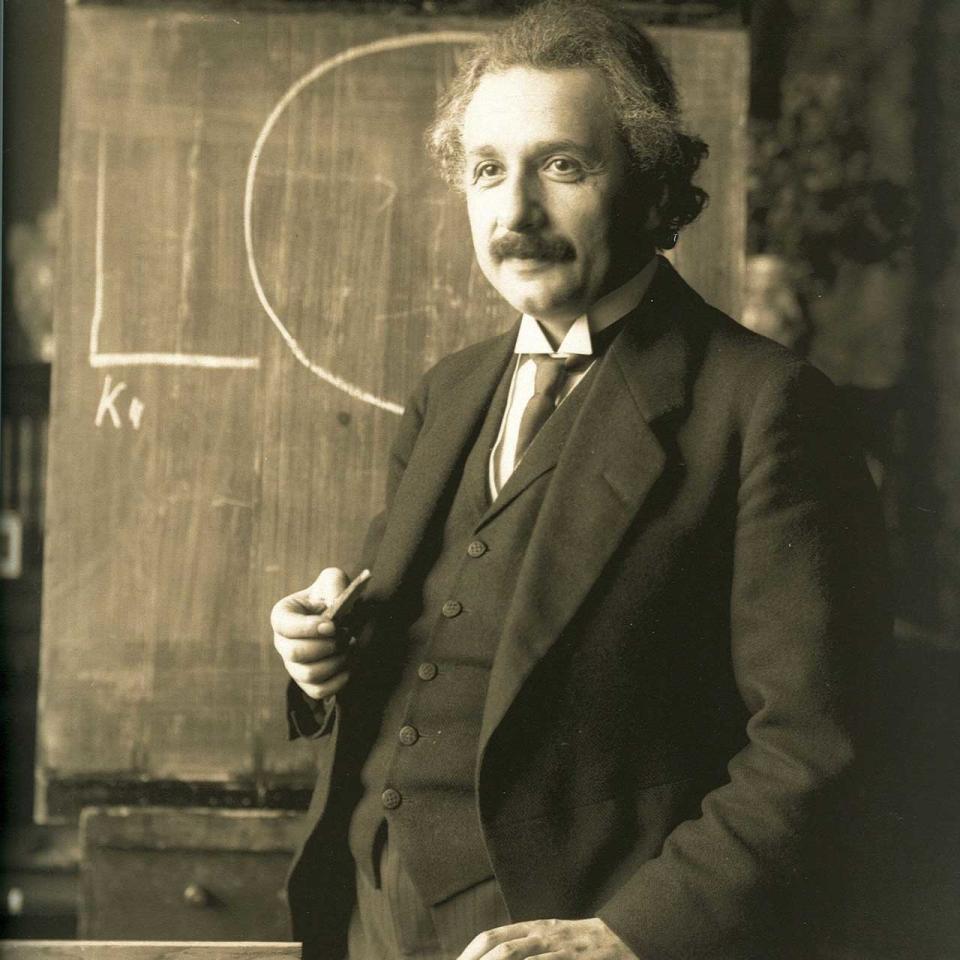

The one thing Albert Einstein would say about investing

By James Yeo

Not many people know this, but Albert Einstein, the guy behind the general theory of relativity and the famous equation E = mc2, invested most of his Nobel Prize money in the stock market. He ended up losing most of it when the market crashed in 1929 during the Great Depression phase.

While he is not known for his investing acumen, he discovered the greatest mathematical discovery of all time – compound interest. In fact, he calls it the eighth wonder of the world.

So what exactly is compound interest?

Before diving deep into the benefits and the mechanism of compound interest, it is important to know what it really is.

It is basically the interest calculated on the initial investment and also on the accumulated interest income of previous years. Simply put, it is a case of interest on interest, which makes your investment grow faster compared to simple interest.

How does compound interest work?

Here comes the sexy part.

Let’s take a look at an example to get a better idea of its mechanism.

Suppose you invest $10,000 at 5% and withdraw the interest income every year. At the end of five years, you will have $12,500.

But if you let the interest compound, you would have around $12,762.82 – an extra $262.82.

It may not seem a lot initially but you can tweak the different factors involved, such as the number of years or the interest rate applied, to get a clearer picture.

For example, by increasing the number of years to 30 years, the original $10,000 with simple interest will amount to $25,000. Not bad.

That said, the one with compound interest will nett you $43,219.42, 72% more than the former just because you changed simple interest to compound interest.

Patience is key

Patience is the key to success when it comes to investments, too. A consistent 10% absolute return on your investments will triumph the latter strategy where the returns fluctuate from +20% to -20% due to the huge risks involved.

One should understand that stellar results don’t come overnight and the concept of compounding takes time. In fact, by making little small investments on a regular basis, you can multiply your savings over time. Time is of the essence here; given enough time, you can plan and reach your goals successfully.

Conclusion

Last but not least, you should also remember this saying from Albert Einstein: “He who understands it, earns it … he who doesn’t … pays it.”

Inflation is always eroding your money and if you are parking your money in low interest-bearing savings accounts, you are at the brunt of inflation. As such, we hope that understanding compound interest gives you the motivation to put your money better at work.

Related stories:

Yahoo Finance

Yahoo Finance