One Year Later: What Have Tariffs Meant for America's Steelmakers?

On March 23, 2018, a 25% tariff was implemented on a substantial portion of steel imported to the U.S. Economists roundly decried the tariffs as bad for American consumers, manufacturers, and the economy; after all, higher steel prices would get passed along to consumers, whether the steel was for a beam in a skyscraper or a can of a favorite soda. And one of the best ways to potentially weaken a healthy economy is to make steel -- so critical to U.S. manufacturing and the consumer economy -- more expensive.

Yet American steel-industry leaders applauded the move; they said it was an overdue and necessary action to establish a level playing field against foreign producers whose steel was being illegally subsidized by governments in its countries of origin.

Image source: Getty Images.

With tariffs in place for over a year at this point, who's been "right" so far? In short, the answer is...complicated.

Tariffs are profitable for American steelmakers

One metric we can look at to determine the impact of tariffs on the steel industry is gross profit margin, which measures the raw profitability of manufacturing. Here's how America's biggest steelmakers, Nucor (NYSE: NUE), U.S. Steel (NYSE: X), AK Steel (NYSE: AKS) and Steel Dynamics (NASDAQ: STLD), did last year:

NUE Gross Profit Margin (TTM) data by YCharts.

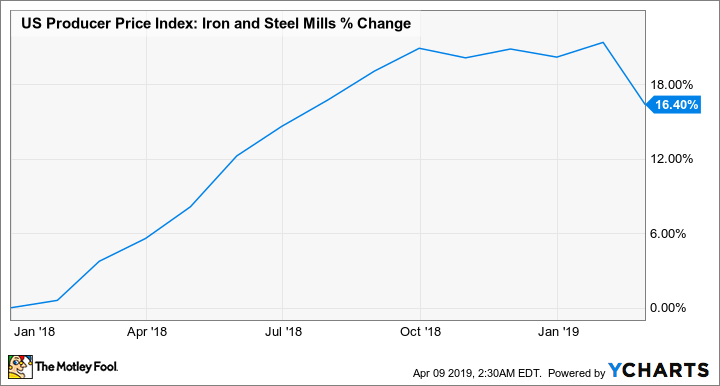

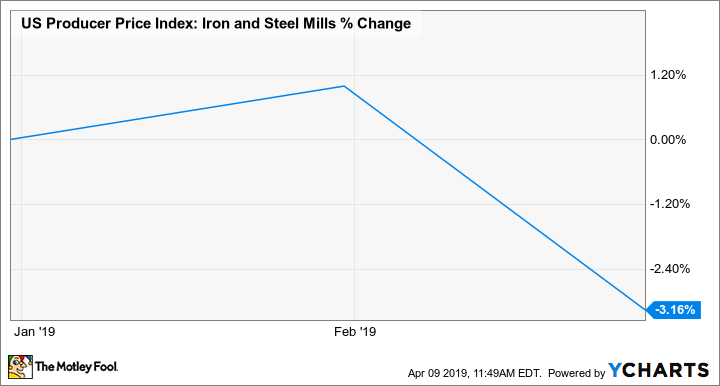

These big gains in gross margin were a direct result of the tariffs. Here's a look at the Producer Price Index for U.S. iron and steel mills since the start of 2018:

US Producer Price Index: Iron and Steel Mills data by YCharts.

But there's more to the story than just higher prices. The main goal of the steel tariffs -- as far as American steelmakers are concerned -- is to reduce how much foreign steel enters the American market, so that American steelmakers can make and sell more steel.

That happened in 2018. The American Iron and Steel Institute reported that total steel imports declined 11.5% in 2018, and imported steel made up 23% of U.S. steel consumption, down from 27% in 2017. That small 400-basis-point gain in market share really added up for the U.S. steel industry. According to Nucor CEO John Ferriola, the U.S. steel industry produced approximately 6 million tons more steel in 2018 than 2017, helping American steel mills operate at their highest rate of capacity utilization in a decade.

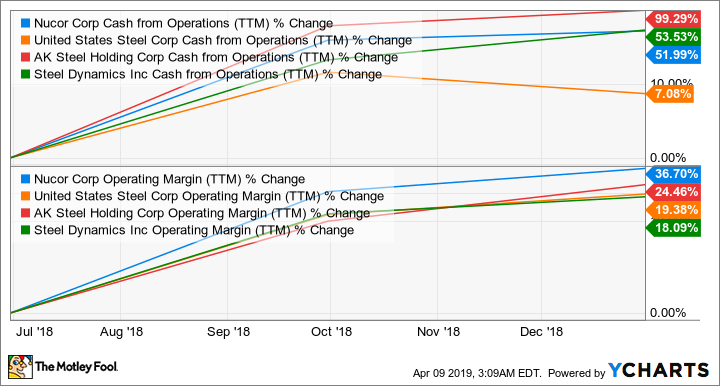

That combination of higher prices and higher volume generated a substantial amount of operating leverage. Both cash from operations, a cash flow measure which focuses on a company's core business, and operating margin, a profitability metric that includes operating expenses excluded from gross margin, increased across the board:

NUE Cash from Operations (TTM) data by YCharts.

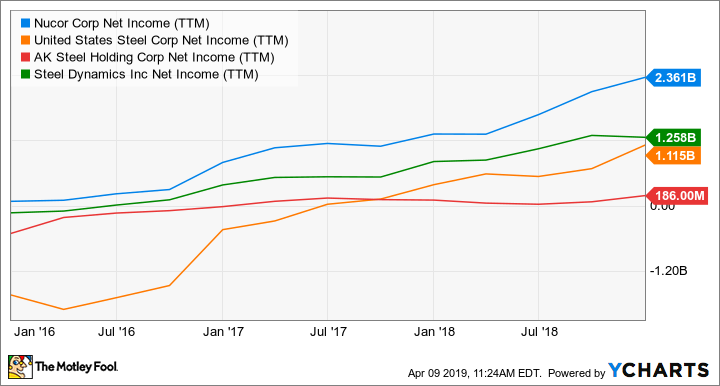

The combination of 6 million tons of extra steel and much higher prices proved very profitable. Here's a look at how the bottom line improved for these four since the beginning of 2016, when steel imports were much higher and steel prices were lower:

NUE Net Income (TTM) data by YCharts.

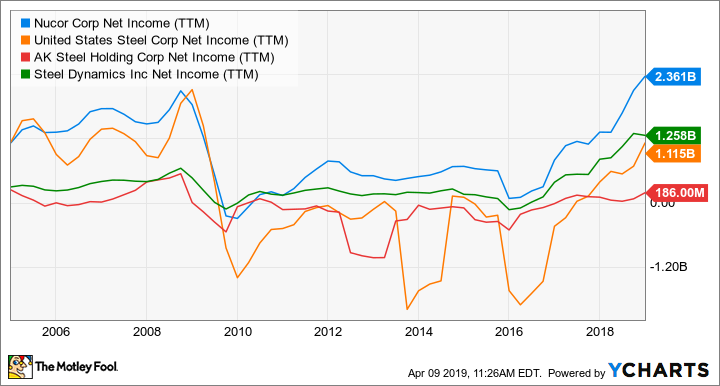

Let's look at another chart for some context as to just how good 2018 was for the steel industry:

NUE Net Income (TTM) data by YCharts.

2018 was the most profitable year for the American steel industry in the past decade. For Nucor and Steel Dynamics, it was the most profitable year they've ever had.

The market isn't optimistic

Based on stock prices, one would hardly believe the American steel industry just had its best year in a decade:

So what gives? It seems investors were never really optimistic that steel tariffs would generate lasting gains for the American steel industry -- for a litany of reasons, including the tailwind of higher steel prices for American consumers and manufacturers. For instance, Ford (NYSE: F) reported that higher commodity costs -- almost entirely steel and aluminum prices -- cost it $439 million last quarter alone.

It's not just the impact of tariffs directly on steel users and consumers that's worrying investors; a swath of retaliatory tariffs have been implemented against a range of American goods by U.S. trading partners. For example, Brown-Forman (NYSE: BF-A) (NYSE: BF-B), the maker of Jack Daniel's whiskey, reported that retaliatory tariffs are expected to cost it $125 million per year so long as steel tariffs stay in place.

Ford and Brown-Forman are just two examples of the ripple effects the Trump tariffs on steel are having, and economists and investors alike are concerned that the end result will be a weaker economy. That would slow demand for steel.

And while it's a bit early to call a "top" for the steel cycle, there are already some signs that the benefit of tariffs is waning. Steel prices have fallen 3.2% since the beginning of the year, and are down 4% from their peak in late January:

US Producer Price Index: Iron and Steel Mills data by YCharts

All good things come to an end (especially steel cycles)

There are additional indicators that should give investors pause about going all in on steel today, despite record profits, and steel stocks looking cheap.

Nucor's capital allocation strategy is one barometer, and its shift from acquisitions to internal projects indicates that prices for acquisitions are too high to generate acceptable return. That's a positive for the industry's current financial health, but also says investors should be cautious about what they buy.

U.S. Steel is ramping up its capacity as well; it recently announced it was restarting construction on a steel mill in Alabama that's been on hold since 2015, and reopening a tube steel plant it closed in 2016, after having restarted two blast furnaces in Illinois. The company also says it will invest $2 billion to modernize many of its U.S. facilities.

On one hand, it's exciting to see U.S. steelmakers investing money to modernize and grow American steel capacity. On the other hand, the global steel market is already massively oversupplied; the potential repercussions of bringing on more capacity over the next few years are a real reason to be concerned.

The steel industry has proven notoriously terrible at predicting the steel demand cycle; one only has to look at the "boom, bust, boom" nature of the industry for proof. My biggest concern is that the short-term boost from tariffs has emboldened industry executives, and the next swath of expansion will play a role in the next cyclical downturn.

Be patient and buy only the best-run steelmakers

Between the cyclical nature of the steel industry and the risk that the (somewhat artificial) boost created by steel tariffs isn't likely to prove durable, I'm reluctant to call now a good time to buy steel stocks. That's even with most trading at single-digit multiples of both last year's and expected 2019 profits, and the potential for landmark infrastructure-investment legislation to be enacted this year, which would be a massive catalyst for the steel industry.

But with that caveat, I think investors who buy the two clearly best steelmakers, Nucor and Steel Dynamics, should do well -- so long as they buy to hold for the long term, and look at the eventual next steel downturn as an opportunity to buy more. Nucor and Steel Dynamics both have operating structures built to ride out the ups and downs of steel, and management teams with proven capital-allocation chops. While I can't promise you'll make money in the short term, I'm confident that investors in these two companies who buy to hold will make money.

More From The Motley Fool

Jason Hall owns shares of Ford and Nucor. The Motley Fool recommends Ford and Nucor. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance