Omnicom's (OMC) Credera Announces Acquisition of BrightGen

Omnicom Group Inc.’s OMC Credera yesterday announced its acquisition of BrightGen for an undisclosed amount.

Credera is a boutique consulting firm and part of Omnicom Precision Marketing Group, the digital and customer relationship management specialist practice area within Omnicom. BrightGen is a UK-based Salesforce Summit Partner that engages in designing, delivery, and implementation of solutions for companies in financial services, travel and transport, and education industries.

The acquisition is aimed at expanding Credera’s global Salesforce capabilities and geographic reach, and increasing its expertise in digital transformation, marketing technology and customer experience capabilities. BrightGen will continue with its current management team post the acquisition.

Justin Bell, president and CEO of Credera, stated, "We remain committed to prioritizing investment in organizations that create remarkable customer experiences with meaningful outcomes for our diverse client base, and we have tremendous confidence that BrightGen's depth of expertise will better enable us to do just that."

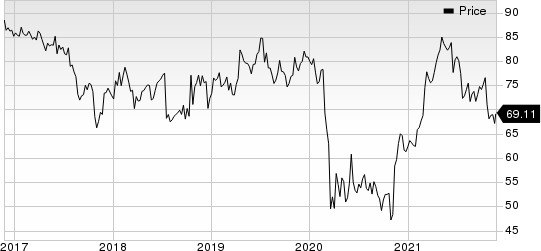

Omnicom’s shares have gained 7.7% over the past year, underperforming the 16.9% rise of the industry it belongs to and 29.9% growth of the Zacks S&P 500 composite.

Omnicom Group Inc. Price

Omnicom Group Inc. price | Omnicom Group Inc. Quote

Zacks Rank and Stocks to Consider

Omnicom currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the broader Business Services sector are Avis Budget CAR and Cross Country Healthcare CCRN, both sporting a Zacks Rank #1, and Charles River Associates CRAI, carrying a Zacks Rank #2 (Buy).

Avis Budget has an expected earnings growth rate of 420.6% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 719.1% in the past year. The company has a long-term earnings growth of 18.8%.

Cross Country Healthcare has an expected earnings growth rate of 447.8% for the current year. The company has a trailing four-quarter earnings surprise of 75%, on average.

Cross Country Healthcare’s shares have surged 201.2% in the past year. The company has a long-term earnings growth of 21.5%.

Charles River Associates has an expected earnings growth rate of 61.2% for the current year. The company has a trailing four-quarter earnings surprise of 51%, on average.

Charles River’s shares have surged 120.2% in the past year. The company has a long-term earnings growth of 15.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance