Oil & Gas US Integrated Industry Outlook: Prospects Bright

The Zacks Oil & Gas US Integrated industry comprises companies that are mostly involved in upstream and midstream energy businesses. The upstream operations entail oil and natural gas exploration and production in the prolific shale plays of the United States.

The integrated energy companies are also engaged in midstream businesses through their gathering and processing facilities along with transportation pipelines networks and storage sites.

Overall, the upstream business is positively correlated to oil and natural gas prices. The produced commodity volumes are then transported through midstream assets, generating stable fee-based revenues.

Here are the three major themes in the industry:

West Texas Intermediate (WTI) crude has recovered significantly and is now heading toward the $65-a-barrel mark, thanks to tightening global oil supply owing to the production cut by OPEC, Libya unrest and sanctions by the United States on crude exporters Iran and Venezuela. WTI oil price is likely to remain firm this year since Saudi Arabia is reportedly trying to extend the production cut, yet to be decided at the Vienna meet in June, through the second half of 2019. The positive crude pricing scenario is highly favorable for oil exploration and production businesses.

Rising demand for cleaner energy has been backing export volumes of natural gas from the United States. Moreover, since it will take time to replace oil by alternative sources of energy, export volumes of the commodity are likely to rise steadily in the coming years. Thus, oil and gas explorers and producers should continue to support domestic and global demand.

To support such production volumes in the United States, there is heightened demand for fresh midstream infrastructure to gather, store, process and transport the commodities. Notably, Permian, which is the most prolific basin in the United States, is still facing a pipeline bottleneck problem. To solve the shortage in transportation capacities, major energy players have started bringing fresh pipeline networks online. Thus, integrated energy firms are also poised to gain from the existing and fresh pipeline networks through their midstream operations.

Zacks Industry Rank Indicates Positive Outlook

The Zacks Oil & Gas US Integrated industry is an 11-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #38, which places it in the top 15% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bullish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts have faith in this group’s earnings growth potential. In the past year, the industry’s earnings estimates for 2019 have risen 1.4%.

Before we present a few stocks that you may want to consider, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags Sector and S&P 500

The Zacks Oil & Gas US Integrated industry has lagged the broader Zacks Oil - Energy sector as well as the Zacks S&P 500 composite over the past year.

The industry has lost 6.1% over this period against the S&P 500’s rise of 8.4% and the broader sector’s decline of 5.7%.

One-Year Price Performance

Industry’s Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 4.66X, lower than the S&P 500’s 11.1X. It is also well below the sector’s trailing-12-month EV/EBITDA of 5.11X.

Over the past five years, the industry has traded as high as 21.33X, as low as 4.29X, with a median of 7.92X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Bottom Line

Although the composite free cashflow of the stocks belonging to the industry declined 51.2% through 2018, positive factors are likely to drive the industry this year. WTI crude has recovered almost 30% through the March quarter of 2019 and the momentum is likely to continue. The midstream business front looks attractive as well, backing the bullish outlook for the industry.

We are presenting one stock with a Zacks Rank #1 (Strong Buy) and one with a Zacks Rank #2 (Buy) that are well positioned to grow. There are also three stocks with a Zacks Rank #3 (Hold) that investors may retain in their portfolio.

You can see the complete list of today’s Zacks #1 Rank stocks here.

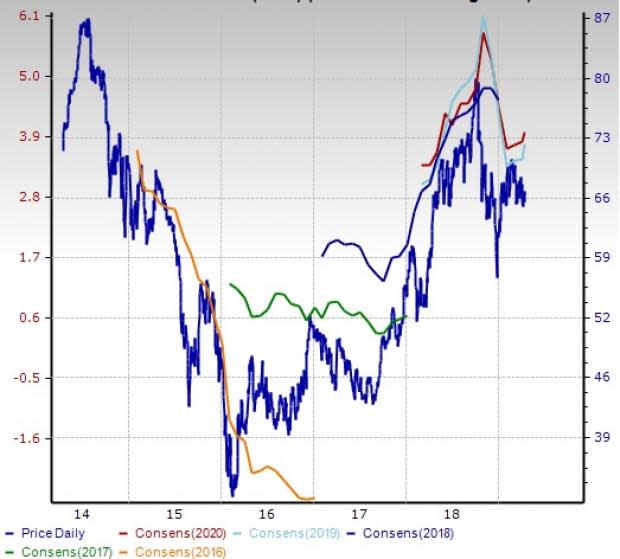

ConocoPhillips (COP): Based on production and proved reserves, the #1 Ranked stock is the largest explorer and producer in the world. In the past 60 days, the Houston, TX-based company has seen the Zacks Consensus Estimate for 2019 earnings per share rise almost 11% to $3.71.

Price and Consensus: COP

Cactus, Inc. (WHD): Headquartered in Houston, TX, the company is a leading manufacturer of wellhead and pressure control equipment. Since the favorable crude pricing environment is likely to boost drilling activities, Cactus is expected to generate cashflow from renting or selling the equipment used for drilling and completing wells. Over the past 60 days, the Zacks #2 Ranked stock has witnessed positive earnings estimate revision of 23.4% for 2019.

Price and Consensus: WHD

Hess Corporation (HES): Headquartered in New York, Hess is also a leading explorer and producer of oil and natural gas. The company also has midstream presence through a master limited partnership. Over the past 60 days, the company with a Zacks Rank of 3 has witnessed positive estimate revision for its bottom line.

Price and Consensus: HES

Marathon Oil Corporation (MRO): Headquartered in Houston, TX, Marathon Oil is an explorer and producer with strong focus on the United States. Over the past 60 days, the Zacks #3 Ranked stock has seen positive earnings estimate revisions of more than 135% for 2019 to 50 cents.

Price and Consensus: MRO

Occidental Petroleum Corporation (OXY): Headquartered in Houston, TX, Occidental Petroleum is an oil and natural gas explorer with presence in the midstream energy business. The #3 Ranked stock has seen positive earnings estimate revisions of almost 10% for 2019 over the past 30 days.

Price and Consensus: OXY

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cactus, Inc. (WHD) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance