If October Is A Smooth Ride, Enter The Market With Courage!

We’re already almost halfway through October. Are you getting more nervous or calmer?

Before we were hit by the Global Financial Crisis back in 2008, the US S&P 500 index last climbed to a record high on 9th October 2007. After which, it wasn’t until March 2013 did it pass its previous record high again.

Goh Mou Lih, one of the speakers of our upcoming Shares Investment Conference 2H2017 “股林大会”, previously discussed the “October effect” and said that the market commonly talks about it.

It’s a pattern that economists and market analysts have noticed over the years – stocks tend to underperform or even fall in the months of October.

As such, retail investors tend to be more cautious and worried whenever October arrives. The “October effect” is similar to “Sell in May and go away’ saying.

The US stock market performance in October has been not bad

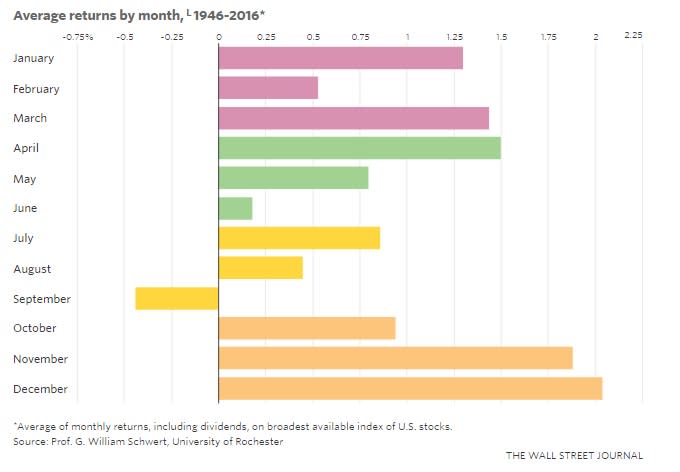

However, an article posted by The Wall Street Journal on 7 October 2017 presented an interesting insight.

The average returns by month from the US stock market in the span of 70 years from 1946 to 2016, October ranks sixth while September is typically the worst month.

The top two performing months were November and December!

UBS Research’s Chief Investment Officer: Economic data can continue to push the stock market higher

UBS Research released a report on 9 October 2017 detailing its global economic outlook for the next few months.

The Chief Investment Officer (CIO) of UBS Research Mark Haefele thinks that even if the US can’t implement the tax reform policy within 2017, the economic data alone is sufficient for investors to stay optimistic about the US stock market.

The possibility of the US being able to implement the tax reform policy within this year is only 55%, according to UBS Research.

However, the US unemployment rate is at the lowest in 16 years while the non-manufacturing (ISM NMI) and purchasing managers’ indices (PMI) are at 12-year and 13-year highs.

Moreover, according to the historical data for the US S&P 500, the fourth-quarter has always outperformed the previous quarters. As such, the outlook for the stock market is still looking good.

Since Donald Trump became president, the stock market has been climbing every month

According to UBS Research’s analysis of the US, Japan and the eurozone in September, their respective business manufacturing confidence indices have been at their highest in many years and might continue to climb in the coming months.

The global economic growth for this year and next year is expected to be about 3.7% and 3.8% respectively, a slight increase from 2016’s 3.1%.

Corporate earnings and profits in the US and eurozone will undoubtedly expand, giving a reason for forecasts to increase by 10-15%, giving the stock market confidence to climb higher.

Since Trump became the US President, the US S&P 500 has brought positive returns every month. If October ends on a positive note too, this will be on par with the previous longest winning streak.

Mark Haefele estimates that the stock markets will post positive returns for the next few months too.

Upcoming Event

Dr Chan Yan Chong will be speaking at Shares Investment’s upcoming Chinese conference, 《股林大会》SIC2H2017 on 4 November 2017 (Saturday), sharing the stage with three other local investment experts who all happen to be regular speakers at 958fm among other local media platforms.

Here are the five key topics we’ll talk about:

US Federal Reserve’s plan to raise rates and shrink its balance sheet and how the stock market will be impacted

Who will take over the chair of the US Federal Reserve?

China’s market outlook after the 19th National Congress of the Communist Party of China

The Singapore property sector outlook

Which stocks to consider and which stocks to avoid?

Click on the image above or the button below to learn more and grab your tickets before the early bird discount ends next Wednesday, 18 October 2017 at 11:59 pm.

P.S. Go along with some friends and you’ll receive buddy discounts!

Yahoo Finance

Yahoo Finance