NZD/USD Forex Technical Analysis – Strengthens Over .6357, Weakens Under .6327

The New Zealand Dollar is trading at its highest level since September 18 late Friday as optimism over a possible trade deal between the United States and China is encouraging short-sellers to cover positions while attracting some light speculative buying.

The catalyst behind the rally is a positive comment from President Trump, which suggested the 15-month-long-trade war may be moving closer to an end.

“Good things are happening at China Trade Talk Meeting,” Trump said in a tweet. “Warmer feelings than in recent past, more like the Old Days. I will be meeting with the Vice Premier today. All would like to see something significant today!”

Trump’s meeting with Chinese Vice Premier Liu He is scheduled for 18:45 GMT. Traders should prepare for volatility at that time in case there is an official announcement on what transpired at the meeting.

At 17:31 GMT, the NZD/USD is trading .6342, up 0.0022 or +0.34%.

Daily Technical Analysis

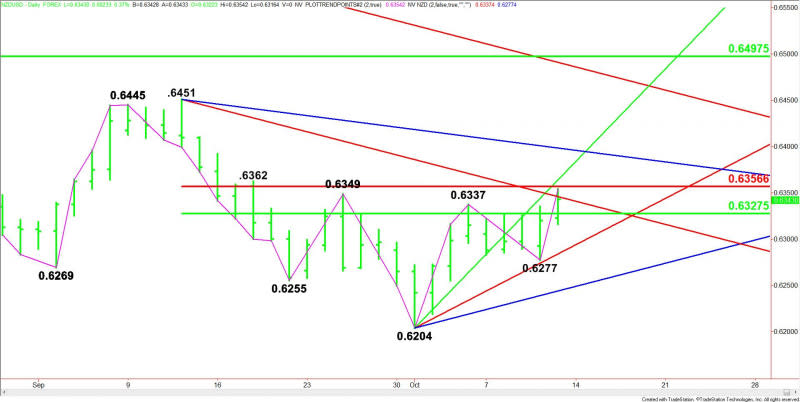

The main trend is up according to the daily swing chart. The main trend changed to up earlier today on a trade through .6337. The main trend will change to down on a move through .6277.

The short-term range is .6451 to .6204. The market is currently trading inside its retracement zone at .6327 to .6357. This zone is controlling the near-term direction of the Forex pair.

Daily Technical Forecast

Based on the early price action and the current price at .6342, the direction of the NZD/USD the rest of the session on Friday is likely to be determined by trader reaction to the downtrending Gann angle at .6346.

Bearish Scenario

A sustained move under .6346 will indicate the presence of sellers. The first target is the short-term 50% level at .6327. This is a potential trigger point for an acceleration into the uptrending Gann angle at .6284. This is followed by the main bottom at .6277.

Bullish Scenario

A sustained move over .6346 will signal the presence of buyers. The first two targets are the short-term Fibonacci level at .6357 and the uptrending Gann angle at .6364.

Crossing to the strong side of the angle at .6364 will indicate the buying is getting stronger. This could trigger a rally into the downtrending Gann angle at .6399.

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas Weekly Price Forecast – Natural Gas Markets Testing Support

AUD/USD Forex Technical Analysis – News Driven Aussie Strengthens Over .6811, Weakens Under .6783

Natural Gas Price Prediction – Prices Rise, but Trend Remains Down

Crude Oil Price Update – Traders Not Too Impressed with Partial Trade Deal

Yahoo Finance

Yahoo Finance