NZD/USD Forex Technical Analysis – Taking Out .7194 Confirms Minor Reversal Bottom, Strengthens Over .7204

The New Zealand Dollar is trading lower early Friday after posting a minor reversal bottom the previous session. The Kiwi traded lower early in the session on Thursday as the U.S. Dollar held on to gains following a surprisingly strong rise in U.S. consumer prices. After finding support, the Kiwi Dollar was driven higher by strong demand for higher risk assets, led by a massive rebound in U.S. equity markets.

At 04:12 GMT, the NZD/USD is trading .7178, down 0.0009 or -0.13%.

The New Zealand Dollar was also underpinned after Prime Minister Jacinda Ardern said she is exploring quarantine-free travel with other countries, but the Kiwi gradually gave up those gains amid reluctance to sell the greenback.

Daily Swing Chart Technical Analysis

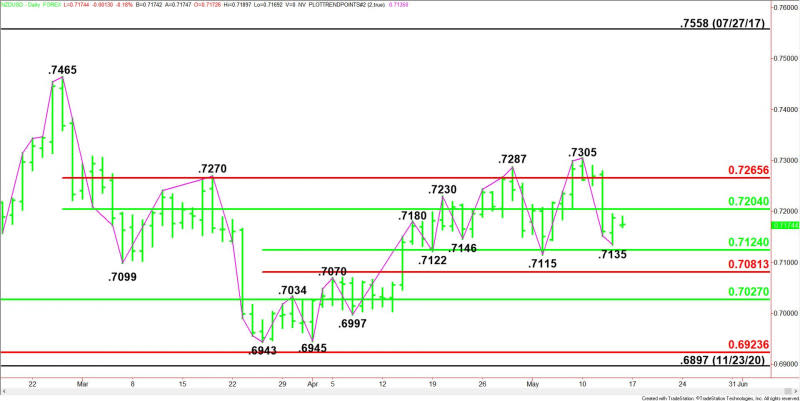

The main trend is up according to the daily swing chart, however, momentum has been trending lower since the formation of the closing price reversal top on May 10.

A trade through .7115 will change the main trend to down. A move through .7305 will negate the closing price reversal top and signal a resumption of the uptrend.

The minor trend is also up. A trade through .7194 will turn .7135 into a new minor bottom.

The short-term range is .6943 to .7305. Its retracement zone at .7124 to .7081 is potential support.

The main range is .7465 to .6943. Its retracement zone at .7204 to .7266 is potential resistance. This zone is controlling the near-term direction of the NZD/USD.

Daily Swing Chart Technical Forecast

The NZD/USD is currently trading inside yesterday’s range and a pair of 50% levels. This indicates investor indecision and impending volatility.

A bullish tone could redevelop on a sustained move over .7204. A bearish bias is likely to begin on a sustained move under .7124.

Bullish Scenario

A sustained move over .7204 will indicate the presence of buyers. If this move is able to create enough upside momentum then look for the rally to possibly extend into the minor pivot at .7220.

Bearish Scenario

The inability to overcome .7204 will indicate the presence of sellers. This could lead to a labored break with potential downside targets coming in at .7135, .7124 and .7115.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Prediction – Prices Rise Rebounding from Support Following Robust Producer Inflation

Natural Gas Price Prediction – Prices Rally Following Inventory Report

European Equities: Another Quiet Economic Calendar Leaves U.S Stats In Focus Once More

Ethereum, Litecoin, and Ripple’s XRP – Daily Tech Analysis – May 14th, 2021

Yahoo Finance

Yahoo Finance