NZD/USD Bearish Formation at Risk on Upbeat RBNZ- 0.7300 in Focus

DailyFX.com -

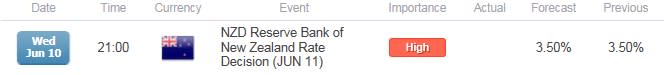

- Reserve Bank of New Zealand to Keep Cash Rate on Hold for Seventh Consecutive Meetings.

- Will Fresh Comments from Governor Graeme Wheeler Heighten Bets for Lower Borrowing-Costs?

For more updates, sign up for David's e-mail distribution list.

Trading the News: Reserve Bank of New Zealand Interest Rate Decision

A Bloomberg News survey shows 10 of the 16 economists polls forecast the Reserve Bank of New Zealand (RBNZ) to keep the cash rate on hold at 3.50%, but a meaningful shift in the forward-guidance for monetary policy may instill a more bearish outlook for NZD/USD should the central bank show a greater willingness to revert back to its easing cycle.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Fears of a slower global recovery may encourage the RBNZ to strike a more cautious tone this time around, and the New Zealand dollar remains at risk of facing additional headwinds over the near to medium-term should Governor Graeme Wheeler boost market expectations for a rate cut.

Expectations: Bearish Argument/Scenario

Release | Expected | Actual |

ANZ Consumer Confidence (MoM) (MAY) | -- | -3.8% |

Employment Change (QoQ) (1Q) | 0.8% | 0.7% |

Consumer Price Index (YoY) (1Q) | 0.2% | 0.1% |

Waning confidence paired with the weakening outlook for the inflation may prompt the RBNZ to further support the real economy, and the bearish sentiment surrounding the kiwi may gather pace over the near-term should the central bank reverse the rate hikes from back in 2014.

Risk: Bullish Argument/Scenario

Release | Expected | Actual |

Trade Balance (APR) | 98M | 123M |

Retail Sales ex Inflation (QoQ) (1Q) | 1.6% | 2.7% |

Building Permits (MoM) (MAR) | -- | 11.0% |

However, the RBNZ may largely retain a wait-and-see approach throughout 2015 amid increased demand from home and abroad, and the New Zealand dollar may face a near-term rebound should Governor Wheeler talk down bets for lower borrowing-costs.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bearish NZD Trade: RBNZ Shows Greater Willingness to Cut Cash Rate

Need red, five-minute candle following the rate decision for a potential short NZD/USD trade.

If market reaction favors a bearish aussie trade, sell NZD/USD with two separate position.

Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish NZD Trade: Governor Wheeler Endorses Wait-and-See Approach

Need green, five-minute candle to consider a long NZD/USD position.

Carry out the same setup as the bearish aussie trade, just in the opposite direction.

Read More:

EURNZD Threatens Key Resistance Ahead of RBNZ- Longs at Risk Sub 1.59

Price & Time: Kiwi Trades at Near 5-Year Low

Potential Price Targets For The Release

NZD/USD Daily

Chart - Created Using FXCM Marketscope 2.0

Failure to retain the bearish RSI momentum raises the risk for a more meaningful correction in NZD/USD; looking for a break of the descending channel in price for confirmation/conviction.

DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long NZD/USD since May 19, with the ratio coming off of recent extremes to hold at +1.85.

Interim Resistance: 0.7300 (38.2% retracement) to 0.7330 (38.2% retracement)

Interim Support: 0.7023 (June low) to 0.7050 (78.6% retracement)

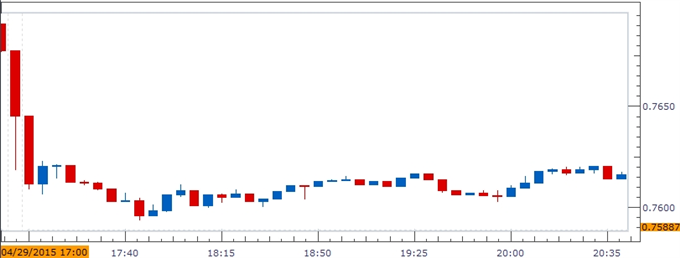

Impact that the RBNZ Interest Rate decision has had on NZD during the last meeting

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

APR 2015 | 04/29/2014 21:00 GMT | 3.50% | 3.50% | -72 | -78 |

April 2015 Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

As expected, the Reserve Bank of New Zealand (RBNZ) kept the Official Cash Rate (OCR) unchanged at 3.50%, but Governor Graeme Wheeler struck a rather cautious outlook for the region, with the central bank head highlighting a risk for lower borrowing-costs should the outlook for growth and inflation deteriorate. The dovish twist to the forward-guidance for monetary policy dragged on the New Zealand dollar, with NZD/USD dipping below the 0.7650 region to end the Asia/Pacific trade at 0.7599.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance