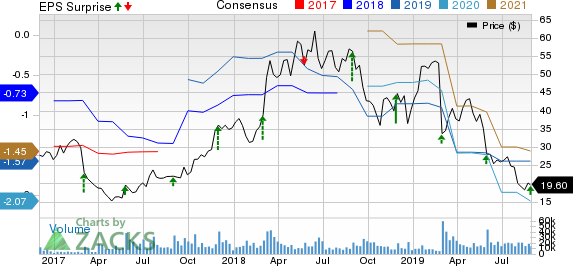

Nutanix's (NTNX) Earnings and Revenues Beat Estimates in Q4

Nutanix NTNX incurred fourth-quarter fiscal 2019 loss of 57 cents per share, narrower than the Zacks Consensus Estimate of a loss of 64 cents. However, the figure was wider than the year-ago quarter’s loss of 11 cents.

Revenues decreased 1.3% year over year to $299.9 million but beat the consensus mark of $293 million.

Product revenues (62.1% of revenues) fell 17.1% year over year to $186.3 million, primarily due to 63.7% decline in hardware revenues and 8.2% in software revenues.

Support, entitlements & other services revenues (37.9% of revenues) soared 43.5% to $113.5 million.

Top-Line Details

Subscription revenues (65.2% of revenues) jumped 71.6% from the year-ago quarter to $195.6 million. Professional services revenues (3% of revenues) grew 29.8% to $9 million.

Non-Portable Software revenues (27.4% of revenues) plunged 44.1% year over year to $82.2 million. Moreover, hardware revenues (4.3% of revenues) were $13 million.

Billings were down 5.9% year over year to $371.7 million. Software and Support billings were flat at $358.7 million.

Subscription billings accounted for 71% of total billings, up from 65% in the previous quarter.

The bill to revenue ratio was 1.24 compared with 1.2 in the previous quarter.

At the end of the quarter, Nutanix had 14,180 customers. The company added 990 customers (including 31 new Global 2000) in the reported quarter.

Nutanix now has 16 customers, with a lifetime spend of more than $20 million. Of these, six have more than $30 million in lifetime bookings.

The company’s hypervisor, AHV, experienced a 47% increase in adoption on a rolling four-quarter basis.

Margin

In the fiscal fourth quarter, the company delivered a non-GAAP gross profit of $239.9 million, up 1.6% year over year. Non-GAAP gross margin expanded 230 basis points (bps) on a year-over-year basis to 80%.

Operating expenses on a non-GAAP basis jumped 34.1% year over year to $377.1 million. Sales & marketing, research & development and general & administrative expenses increased 36.9%, 34.7% and 13.9% on a year-over-year basis, respectively.

Operating loss on a non-GAAP basis widened to $104.6 million from a loss of $19.7 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Jul 31, 2019, cash and cash equivalents plus short-term investments were $934.3 million compared with $941 million as of Apr 30.

Cash outflow from operations was $9.7 million compared with an outflow of $36 million in the previous quarter.

Free cash outflow was $33.3 million compared with an outflow of $33 million in the prior quarter.

Deferred revenues surged 44% year over year to $910 million at the end of the reported quarter.

Guidance

For the first quarter of fiscal 2020, software and support revenues are projected between $290 million and $300 million. Nutanix anticipates software and support billings of $360-$370 million.

Hardware revenues are expected to be 3% or less of total bookings.

Non-GAAP gross margin is anticipated to be around 80%. Moreover, management forecasts operating expenses of $385-$390 million.

Nutanix estimates non-GAAP loss per share to be 75 cents, wider than the Zacks Consensus Estimate of a loss of 64 cents.

Zacks Rank & Key Picks

Nutanix currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Computer Technology sector are Anixter International AXE, LogMeIn LOGM and Perficient PRFT, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Anixter, LogMeIn and Perficient is currently pegged at 8%, 5% and 10.8%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Click to get this free report Nutanix Inc. (NTNX) : Free Stock Analysis Report Perficient, Inc. (PRFT) : Free Stock Analysis Report LogMein, Inc. (LOGM) : Free Stock Analysis Report Anixter International Inc. (AXE) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance