Nucor's (NUE) Q3 Earnings Miss, Revenues Surpass Estimates

Nucor Corporation NUE reported higher profits in third-quarter 2018. The steel giant logged net earnings of $676.7 million or $2.13 per share, up nearly three-fold from $254.9 million or 79 cents registered a year ago.

Barring one-time items, earnings per share came in at $2.33, which missed the Zacks Consensus Estimate of $2.35.

Nucor’s net sales totaled $6,742.2 million, up roughly 30.4% year over year from $5,170.1 million. The reported figure outpaced the Zacks Consensus Estimate of $6,518.5 million.

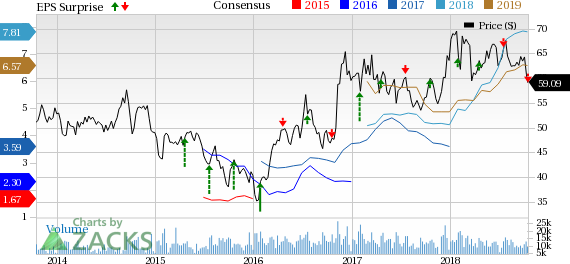

Nucor Corporation Price, Consensus and EPS Surprise

Nucor Corporation Price, Consensus and EPS Surprise | Nucor Corporation Quote

Operating Stats

Total steel mills shipments in the quarter were 6,293,000 tons, up 7% year over year. Total tons shipped to outside customers were up 6% year over year to 7,048,000 tons. Average sales price improved 23% year over year.

Steel mill operating rates increased to 92% in the third quarter from 84% a year ago.

Segment Highlights

Performance in the steel mills segment improved sequentially. This was mainly owing to higher earnings at plate mills and sheet mills despite the impact of both weather-related and planned outages at certain mills in the third quarter.

Performance of steel products and raw materials unit decreased sequentially. Per the company, the decline in the raw materials unit can be attributed to the earlier mentioned impairment charges related to the company’s natural gas well assets along with dismal performance of scrap brokerage and processing operations. Moreover, the decreased performance of Nucor’s DRI facilities also dented the performance as the company’s Louisiana DRI facility experienced unplanned and planned outages in the quarter.

Financial Position

As of Sep 29, 2018, Nucor had cash and cash equivalents of around $1.9 billion compared with $1.6 billion a year ago. Long-term debt was $4,232.8 million, up roughly 30.6% year over year.

Outlook

Nucor expects fourth-quarter earnings to decrease across all three operating segments compared with the third quarter, barring the impairment charge. Per the company, the expected decline in performance in the fourth quarter is due to typical seasonality factors.

However, the company anticipates the fourth quarter to demonstrate strong performance as it believes earnings will be noticeably higher year over year. Moreover, it continues to believe there is sustainable strength in steel end use markets.

Price Performance

Shares of Nucor have inched up 0.8% in the past year, against the industry’s decline of 4.7%.

Zacks Rank & Other Stocks to Consider

Nucor currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Methanex Corporation MEOH, KMG Chemicals, Inc. KMG and CF Industries Holdings, Inc. CF, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Methanex has expected long-term earnings growth rate of 15%. Its shares have surged 50.2% in the past year.

KMG Chemicals has expected long-term earnings growth rate of 28.5%. Its shares have gained 35.2% in the past year.

CF Industries has expected long-term earnings growth rate of 6%. Its shares have rallied 41.7% in a year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance