How to (not) blow yourself up with a “weapon of mass destruction” ETF

If it sounds too good to be true, it probably is. For example: Exchange traded funds (ETFs) that say they return double or triple the return of a stock index. For most investors, these are the financial equivalent of a box of dynamite with a very short fuse. ETFs are one of the best ways to own a basket of stocks, bonds or commodities. They were originally produced to track a stock index, like the STI, the Hang Seng or the S&P 500. The popularity of ETFs has exploded over the past decade – from about 450 ETFs worldwide in 2005, to over 4600 today. Assets in ETFs worldwide have increased from US$416 billion in 2005 to nearly US$3 trillion today, according to research firm ETFGI. One of the excesses of this growth, though, has been leveraged and inverse ETFs. What are leveraged and inverse ETFs? Leveraged ETFs attempt to track 2 or 3 times the performance of an index. They try to amplify how the underlying index performs. For example, SSO (the New York Stock Exchange-traded Ultra S&P 500 ETF) says that it returns 2X the S&P 500 Index. So if the S&P 500 Index rises 1 percent in a day, SSO returns 2 percent. (And if the S&P 500 falls 1 percent, SSO falls 2 percent.) Inverse ETFs do the opposite of what an index does – so if the S&P 500 falls 1 percent, SH (the Short S&P 500 ETF) rises 1 percent (and if the S&P 500 rises 1 percent, SH falls 1 percent). Inverse ETFs can also use leverage – for instance, SPXU (the UltraPro Short S&P 500 ETF) tries to track 3X the opposite of the S&P 500 Index change on a given day.

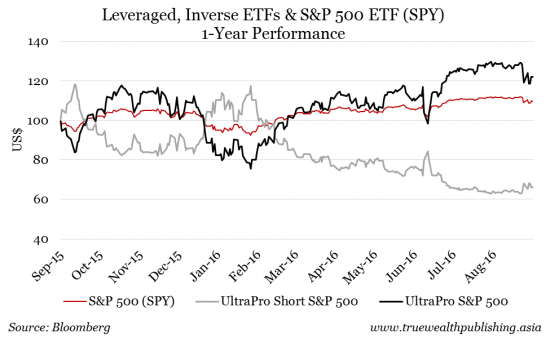

Leveraged and inverse ETFs do this by using financial products called derivatives. These are instruments that “derive” their value from an underlying asset. For instance, you can buy a derivative that will be valued based on how the price of gold or a stock index performs. (Warren Buffett once referred to derivatives as “financial weapons of mass destruction.”) The first problem with leveraged ETFs But these types of ETFs don’t work like you might think. For example, consider the UltraPro S&P 500 ETF (UPRO). It’s designed to provide three times the returns of the S&P 500 Index using derivatives and debt, or leverage. So, in theory, you could invest $100 into UPRO and get $300 worth of exposure to the S&P 500. This also means, though, that UPRO also has three times the volatility of the S&P 500. So, you can earn, or lose, three times as much as what the S&P 500 earns – making UPRO a very risky investment. The bigger problem with leveraged ETFs But there is an additional, misunderstood problem with these types of ETFs – they track daily returns. The UPRO prospectus explains it this way: “ProShares UltraPro S&P 500 (the “Fund”) seeks investment results for a single day only, not for longer periods… The return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from three times (3x) the return of the S&P 500® (the “Index”) for that period. For periods longer than a single day, the Fund will lose money when the level of the Index is flat, and it is possible that the Fund will lose money even if the level of the Index rises.” In other words, if the S&P 500 is up 2 percent for the month, there is no guarantee that UPRO will gain 6 percent (3 x 2%) over the same time period. In fact, it could lose money – even if the underlying index has made money. How is this possible? Here’s an example to illustrate: Let’s say you buy a 2X leveraged ETF that tracks the return of ABC index. You buy 1 share of the ETF for $100, and the underlying index is at 10,000. If ABC jumps 10 percent the next day to 11,000, your 2X leveraged ETF would increase 20 percent, to $120. But say the next day the index drops from 11,000 back down to 10,000. That’s a 9.09 percent decline for the index. But your 2X leveraged ETF would go down twice this amount, or 18.18 percent. Losing 18.18 percent means the value of the leveraged ETF would drop from $120 to $98.18. So, over the two-day period the underlying ABC index is unchanged – it started at 10,000 and is back at 10,000. But the value of your 2X ETF is down 1.82 percent! Now, if the underlying index rises every single day for an extended period, you will earn great returns. But any down days will hurt a leveraged ETFs performance (relative to the underlying index) by more than you’d expect. Even a single bad day will have an outsized effect. Time is death for leveraged and inverse ETFs In fact, the more volatile the underlying index, the bigger the variation from the returns you’d expect to earn. And the longer the time period, the wider the spread between the index’s return, and the leveraged or inverse ETF’s performance. Below are the one-month and one-year returns (as of September 16) for three ETFs based on each of the S&P 500 and the MSCI Emerging Markets indexes – a regular, non-leveraged ETF (SPY for the S&P 500 index; EEM for the emerging markets index – there is very little difference between the performance of a regular ETF and its underlying index), a 3X leveraged ETF and -3X inverse leveraged ETF.

For the S&P 500, the regular SPY ETF had a one-month return of negative 1.6 percent. This was tracked fairly well by the 3X and -3X ETFs, which returned -5.3 percent and 4.5 percent, respectively. However, over the past year, SPY returned 9.5 percent, but UPRO only returned 20.6 percent – which is over 7 percentage points less than what you’d expect a 3X leveraged ETF to return. And the inverse SPXU ETF actually did almost 5 percentage points worse than what you’d expect. The more volatile MSCI Emerging Markets Index did even worse. EDC, the 3X leveraged ETF made to track the index, wasn’t even close. An investor who bought EDC for 3X exposure to EEM would be disappointed to see only a 5.4 percent return over the last 12 months, instead of the expected 3X return of 24 percent. Likewise, EDZ – the -3X inverse ETF – tracked poorly over the 1 and 12-month time frames. Again, the more volatile the underlying index, the worse leveraged and inverse ETFs perform.

So, unless you’re a day or short-term trader, leveraged ETFs are not worth the added risk and volatility. When it comes to owning these ETFs, it’s buyer beware. (There are currently no leveraged or inverse ETFs available on the Singapore Exchange. Investors who want to invest in them on the New York Stock Exchange must pass a quiz administered by the stock market regulator.) If you’re concerned about falling stock prices, a better, easier to understand and potentially less volatile strategy is to own gold and cash. Gold performs well when stocks are falling and cash won’t change in value even when stock markets crash. Both will ensure you have some money to invest to take advantage of now lower stock prices.

Kim Iskyan

Yahoo Finance

Yahoo Finance